Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samsung and LG produce Liquid Crystal Display (LCD) panels for television sets. Suppose (for now) the panels they produce are identical and Samsung and

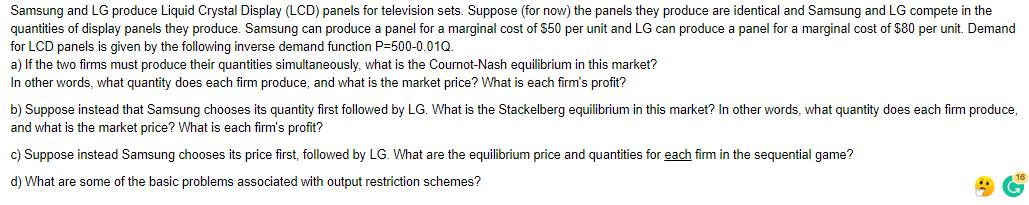

Samsung and LG produce Liquid Crystal Display (LCD) panels for television sets. Suppose (for now) the panels they produce are identical and Samsung and LG compete in the quantities of display panels they produce. Samsung can produce a panel for a marginal cost of $50 per unit and LG can produce a panel for a marginal cost of $80 per unit. Demand for LCD panels is given by the following inverse demand function P-500-0.010. a) If the two firms must produce their quantities simultaneously, what is the Cournot-Nash equilibrium in this market? In other words, what quantity does each firm produce, and what is the market price? What is each firm's profit? b) Suppose instead that Samsung chooses its quantity first followed by LG. What is the Stackelberg equilibrium in this market? In other words, what quantity does each firm produce, and what is the market price? What is each firm's profit? c) Suppose instead Samsung chooses its price first, followed by LG. What are the equilibrium price and quantities for each firm in the sequential game? d) What are some of the basic problems associated with output restriction schemes?

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

C Since Samsung chooses its price first it is actually following the Bertrand Model of Duopoly It ha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started