Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samuel Aalto is 63 years old and retired from his employment with Duplex Ltd. a Canadian public corporation, on September 30, 2020. Samuel has

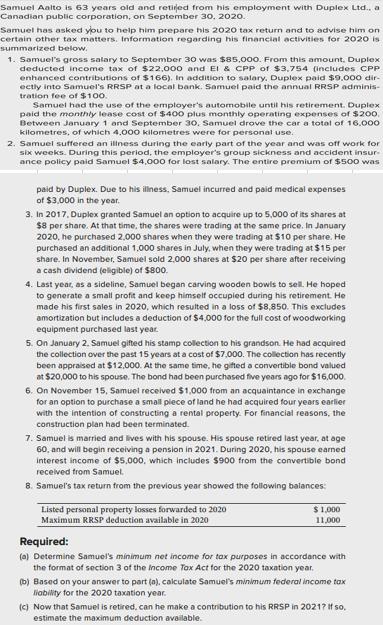

Samuel Aalto is 63 years old and retired from his employment with Duplex Ltd. a Canadian public corporation, on September 30, 2020. Samuel has asked you to help him prepare his 2020 tax return and to advise him on certain other tax matters. Information regarding his financial activities for 2020 is summarized below. 1. Samuel's gross salary to September 30 was $85,00O. From this amount. Duplex deducted income tax of $22,000 and El & CPP of $3,754 (includes CPP enhanced contributions of $166). In addition ectly into Samuel's RRSP at a local bank. Samuel paid the annual RRSP adminis- tration fee of $100. Samuel had the use of the employer's automobile until his retirement. Duplex paid the monthly lease cost of $400 plus monthly operating expenses of $200, Between January 1 and September 30. Samuel drove the car a total of 16.000 kilometres, of which 4.000 kilometres were for personal use. 2. Samuel suffered an iliness during the early part of the year and was off work for six weeks. During this period, the employer's group sickness and accident insur- ance policy paid Samuel $4,000 for lost salary. The entire premium of $500 was salary. Duplex paid $9.o00 dir- paid by Duplex. Due to his iliness, Samuel incurred and paid medical expenses of $3,000 in the year. 3. In 2017. Duplex granted Samuel an option to acquire up to 5,000 of its shares at $8 per share. At that time, the shares were trading at the same price. In January 2020, he purchased 2.000 shares when they were trading at $10 per share. He purchased an additional 1,000 shares in July, when they were trading at $15 per share. In November, Samuel sold 2,000 shares at $20 per share after receiving a cash dividend (eligible) of $800. 4. Last year, as a sideline, Samuel began carving wooden bowls to sel. He hoped to generate a small profit and keep himself occupied during his retirement. He made his first sales in 2020, which resulted in a loss of $8,850. This excludes amortization but includes a deduction of $4,000 for the full cost of woodworking equipment purchased last year. 5. On January 2. Samuel gifted his stamp collection to his grandson. He had acquired the collection over the past 15 years at a cost of $7,000. The collection has recently been appraised at $12,000. At the same time, he gifted a convertible bond valued at $20,000 to his spouse. The bond had been purchased five years ago tor $16,000. 6. On November 15, Samuel received $1,000 from an acquaintance in exchange for an option to purchase a small plece of land he had acquired four years earlier with the intention of constructing a rental property. For financial reasons, the construction plan had been terminated. 7. Samuel is married and lives with his spouse. His spouse retired last year, at age 60, and will begin receiving a pension in 2021. During 2020, his spouse earned interest income of $5,000, which includes $900 from the convertible bond received from Samuel. 8. Samuel's tax return trom the previous year showed the following balances: Listed personal property losses forwarded to 2020 Maximum RRSP deduction available in 2020 $1,000 11,000 Required: (a) Determine Samuel's minimum net income for tax purposes in accordance with the format of section 3 of the Income Tox Act tor the 2020 taxation year. (b) Based on your answer to part (a), calculate Samuel's minimum federal income tax liability for the 2020 taxation year. (c) Now that Samuel is retired, can he make a contribution to his RRSP in 20217 It so, estimate the maximum deduction available.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Taxable income is the part of an characters or a companys earnings used to calculate how tons tax they owe the authorities in a given tax 12 months It may be defined extensively as adjusted gross ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started