Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samuel and Amy formed the Sam, Amy & Co partnership on 1 January 2021 as interior designers, having both worked for Disegno UK Ltd

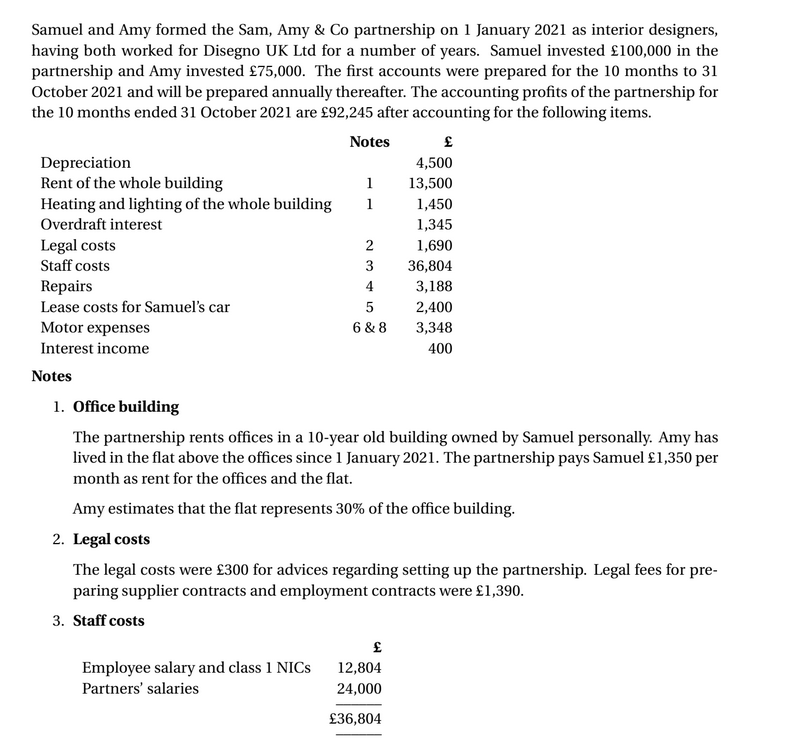

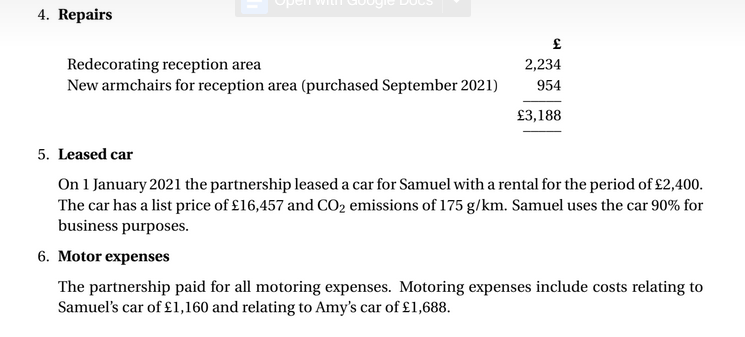

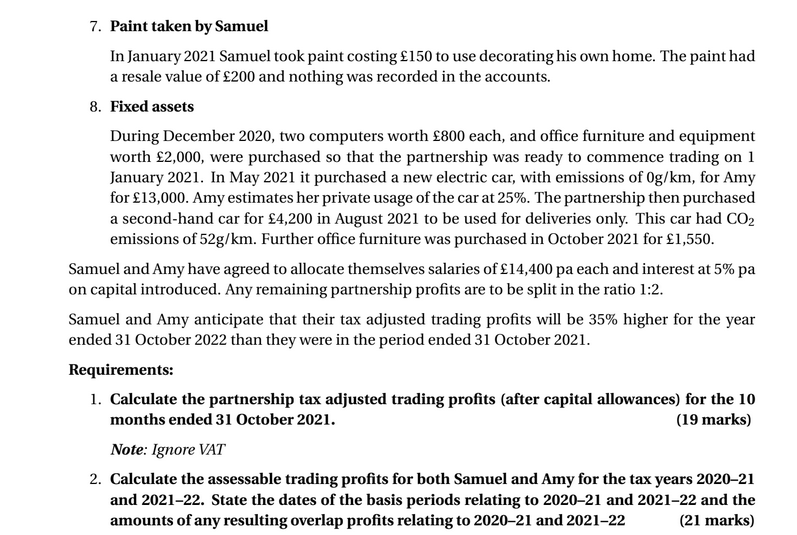

Samuel and Amy formed the Sam, Amy & Co partnership on 1 January 2021 as interior designers, having both worked for Disegno UK Ltd for a number of years. Samuel invested 100,000 in the partnership and Amy invested 75,000. The first accounts were prepared for the 10 months to 31 October 2021 and will be prepared annually thereafter. The accounting profits of the partnership for the 10 months ended 31 October 2021 are 92,245 after accounting for the following items. Notes Depreciation 4,500 Rent of the whole building 1 13,500 Heating and lighting of the whole building 1 1,450 Overdraft interest 1,345 Legal costs 2 1,690 Staff costs 3 36,804 Repairs 4 3,188 Lease costs for Samuel's car 5 2,400 Motor expenses 6 & 8 3,348 Interest income 400 Notes 1. Office building The partnership rents offices in a 10-year old building owned by Samuel personally. Amy has lived in the flat above the offices since 1 January 2021. The partnership pays Samuel 1,350 per month as rent for the offices and the flat. Amy estimates that the flat represents 30% of the office building. 2. Legal costs The legal costs were 300 for advices regarding setting up the partnership. Legal fees for pre- paring supplier contracts and employment contracts were 1,390. 3. Staff costs Employee salary and class 1 NICS 12,804 Partners' salaries 24,000 36,804

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started