Question

Samuel Ltd went into voluntary liquidation on 30 June 2018, its summarized statement of financial position then being: The assets were realised by the

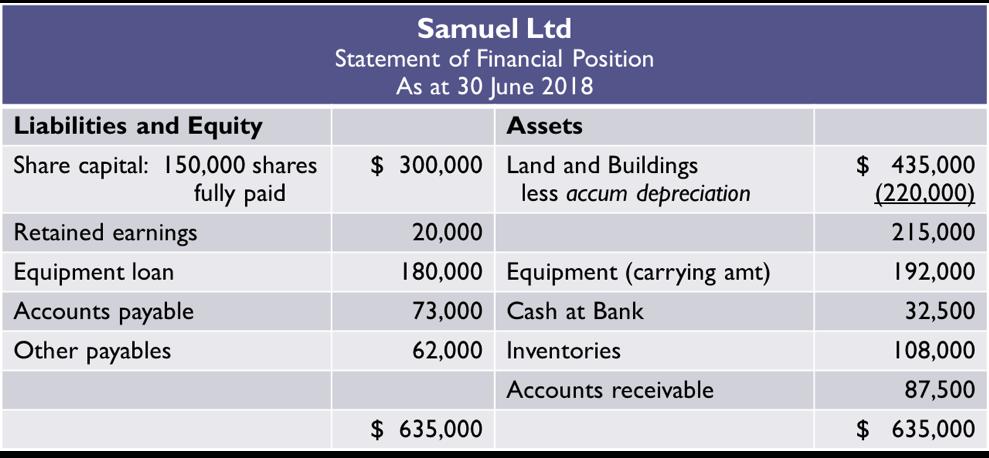

Samuel Ltd went into voluntary liquidation on 30 June 2018, its summarized statement of financial position then being:

The assets were realised by the liquidator as follows:

Land and Buildings $220,000 (before selling expenses of $22,000)

Inventories 95,000

Accounts receivable 85,500

Other Payables allowed $11,000 discount, Accounts payable were paid in full.

Other costs included liquidation costs of $8,500;

Liquidator's remuneration $25,000;

Employee entitlements $9,500.

The mortgage holder sold the equipment for $208,000.

Required:

Record the above in the

1. Liquidation account,

2. Liquidator's Cash account and

3. Shareholders' Distribution account.

Liabilities and Equity Share capital: 150,000 shares fully paid Retained earnings Equipment loan Accounts payable Other payables Samuel Ltd Statement of Financial Position As at 30 June 2018 Assets $ 300,000 Land and Buildings less accum depreciation 20,000 180,000 Equipment (carrying amt) 73,000 Cash at Bank 62,000 Inventories $ 635,000 Accounts receivable $ 435,000 (220,000) 215,000 192,000 32,500 108,000 87,500 $ 635,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Liquidation account is given below Selling Expenses 22000 Land and Build...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started