Question

Samuelson and Messenger (S&M) began 2018 with 320 units of its one product. These units were purchased near the end of 2017 for $22 each.

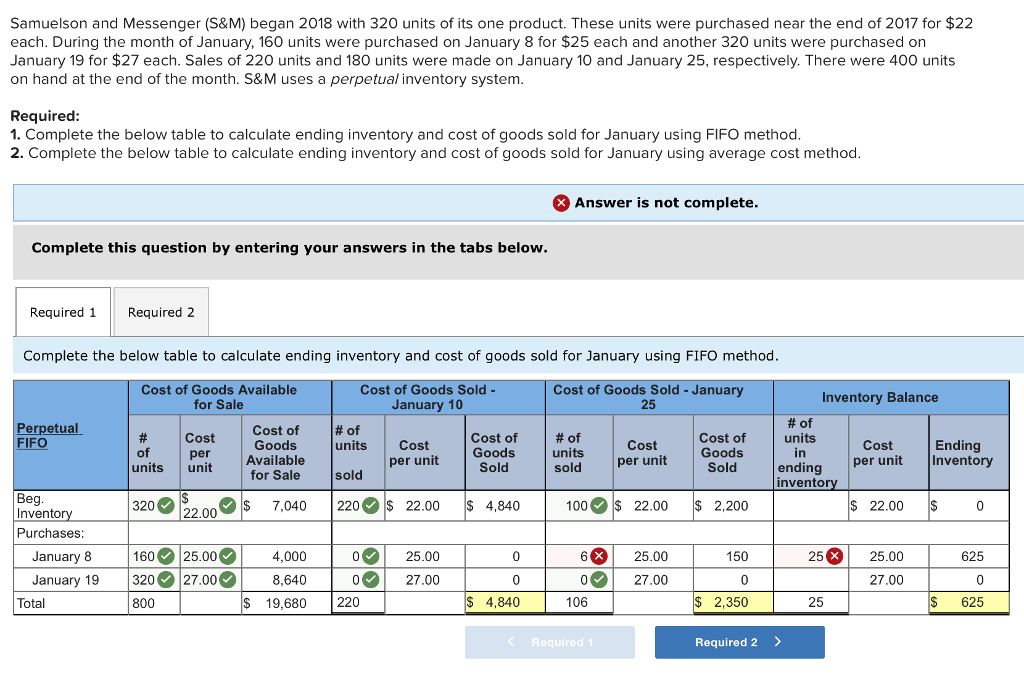

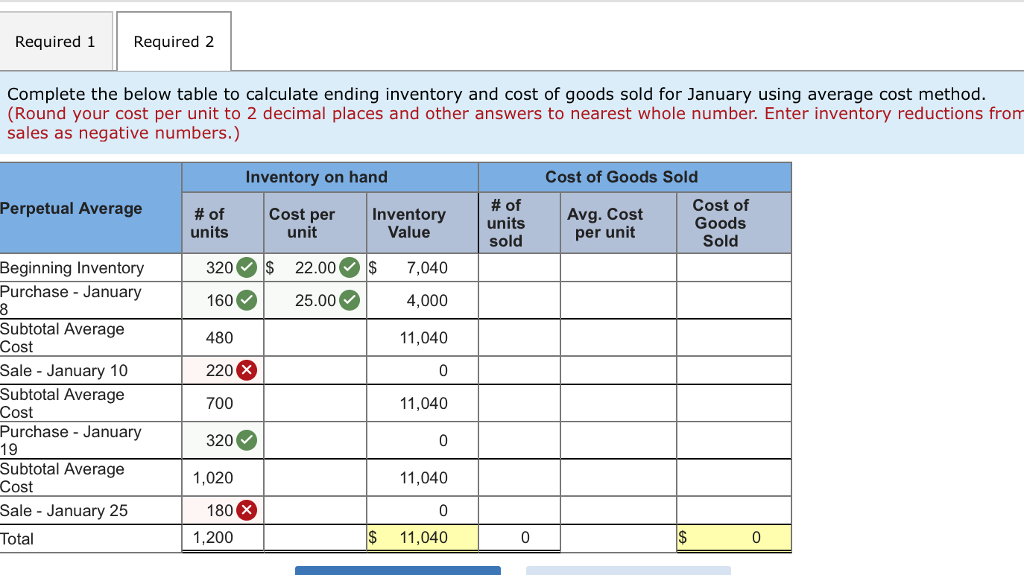

Samuelson and Messenger (S&M) began 2018 with 320 units of its one product. These units were purchased near the end of 2017 for $22 each. During the month of January, 160 units were purchased on January 8 for $25 each and another 320 units were purchased on January 19 for $27 each. Sales of 220 units and 180 units were made on January 10 and January 25, respectively. There were 400 units on hand at the end of the month. S&M uses a perpetual inventory system.

Required:

1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO method.

2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost method.

Samuelson and Messenger (S&M) began 2018 with 320 units of its one product. These units were purchased near the end of 2017 for $22 each. During the month of January, 160 units were purchased on January 8 for $25 each and another 320 units were purchased on January 19 for $27 each. Sales of 220 units and 180 units were made on January 10 and January 25, respectively. There were 400 units on hand at the end of the month. S&M uses a perpetual inventory system Required 1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO method 2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost method Answer is not complete Complete this question by entering your answers in the tabs below. Required 1Required 2 Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO method Cost of Goods Sold- January 10 Cost of Goods Sold - January 25 Cost of Goods Available Inventory Balance for Sale Perpetual FIFO Cost of Goods Available for Sale Cost of Cost of Goods Sold #of unitsper u sold units in ending inventor Cost Cost per unit Cost er unit Inventory units Cost Ending of units unit Sold 32022.000$ 7,040 | 22001$ 22.00 |$ 4,840 | 1000$ 22.00 $ 2.200 22.00 S Inventor Purchases January 8 |1600|25.00 4,000 | 00| 25.00 January 19 3200|27.000| 8,640 | 00127.00 6 25.00 150 25 25.00 625 27.00 27.00 Total 800 $ 19,680 220 $ 4,840 106 $ 2,350 25 S 625

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started