Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sanaponic, Inc. will pay a dividend of $6 for each of the next 3 years, $8 for each of the years 4-7, and $10

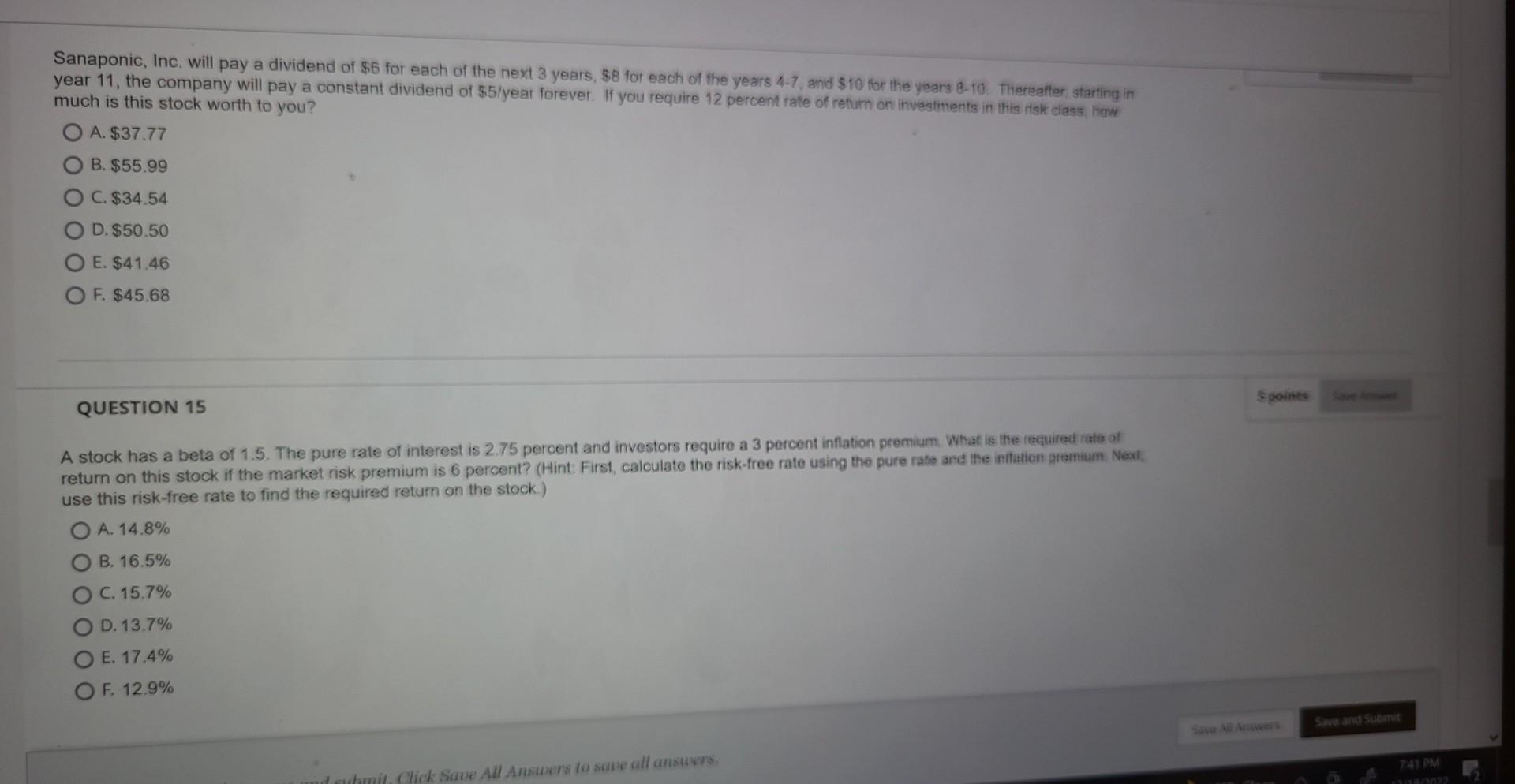

Sanaponic, Inc. will pay a dividend of $6 for each of the next 3 years, $8 for each of the years 4-7, and $10 for the years 8-10. Thereafter starting in year 11, the company will pay a constant dividend of $5/year forever. If you require 12 percent rate of return on investments in this risk class, how much is this stock worth to you? OA. $37.77 B. $55.99 C. $34.54 OD. $50.50 E. $41.46 OF. $45.68 QUESTION 15 A stock has a beta of 1.5. The pure rate of interest is 2.75 percent and investors require a 3 percent inflation premium. What is the required rate of return on this stock if the market risk premium is 6 percent? (Hint: First, calculate the risk-free rate using the pure rate and the inflation premium. Next, use this risk-free rate to find the required return on the stock.) OA. 14.8% B. 16.5% C. 15.7% OD. 13.7% OE. 17.4% O F. 12.9% and submit. Click Save All Answers to save all answers. Spoints Save and Submit 7:41 PM 13/18/2022

Step by Step Solution

★★★★★

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started