Answered step by step

Verified Expert Solution

Question

1 Approved Answer

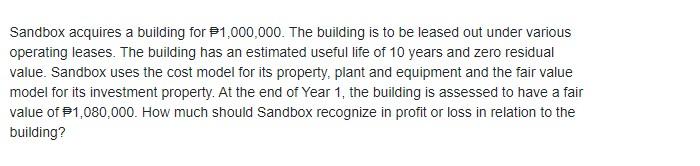

Sandbox acquires a building for $1,000,000. The building is to be leased out under various operating leases. The building has an estimated useful life

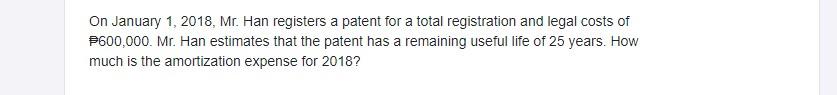

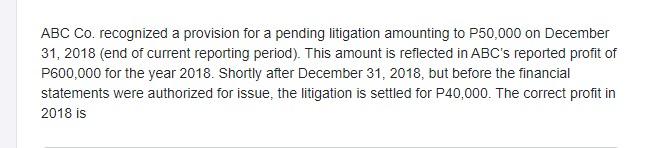

Sandbox acquires a building for $1,000,000. The building is to be leased out under various operating leases. The building has an estimated useful life of 10 years and zero residual value. Sandbox uses the cost model for its property, plant and equipment and the fair value model for its investment property. At the end of Year 1, the building is assessed to have a fair value of $1,080,000. How much should Sandbox recognize in profit or loss in relation to the building? On January 1, 2018, Mr. Han registers a patent for a total registration and legal costs of P600,000. Mr. Han estimates that the patent has a remaining useful life of 25 years. How much is the amortization expense for 2018? ABC Co. recognized a provision for a pending litigation amounting to P50,000 on December 31, 2018 (end of current reporting period). This amount is reflected in ABC's reported profit of P600,000 for the year 2018. Shortly after December 31, 2018, but before the financial statements were authorized for issue, the litigation is settled for P40,000. The correct profit in 2018 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started