Question

Sanders Co. is planning to finance an expansion of its operations by borrowing $54,300. City Bank has agreed to loan Sanders the funds. Sanders has

Sanders Co. is planning to finance an expansion of its operations by borrowing $54,300. City Bank has agreed to loan Sanders the funds. Sanders has two repayment options: (1) to issue a note with the principal due in 10 years and with interest payable annually or (2) to issue a note to repay $5,430 of the principal each year along with the annual interest based on the unpaid principal balance. Assume the interest rate is 9.5 percent for each option.

Required

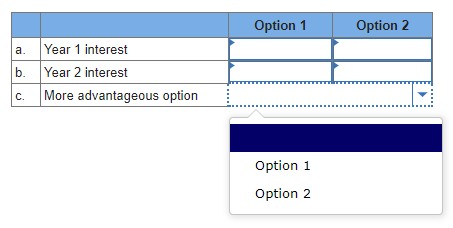

a. What amount of interest will Sanders pay in year 1 under option 1 and under option 2? (Round your final answers to the nearest dollar amount.)

b. What amount of interest will Sanders pay in year 2 under option 1 and under option 2? (Round your final answers to the nearest dollar amount.)

c. Which option is more advantageous if Sanders wants to minimize costs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started