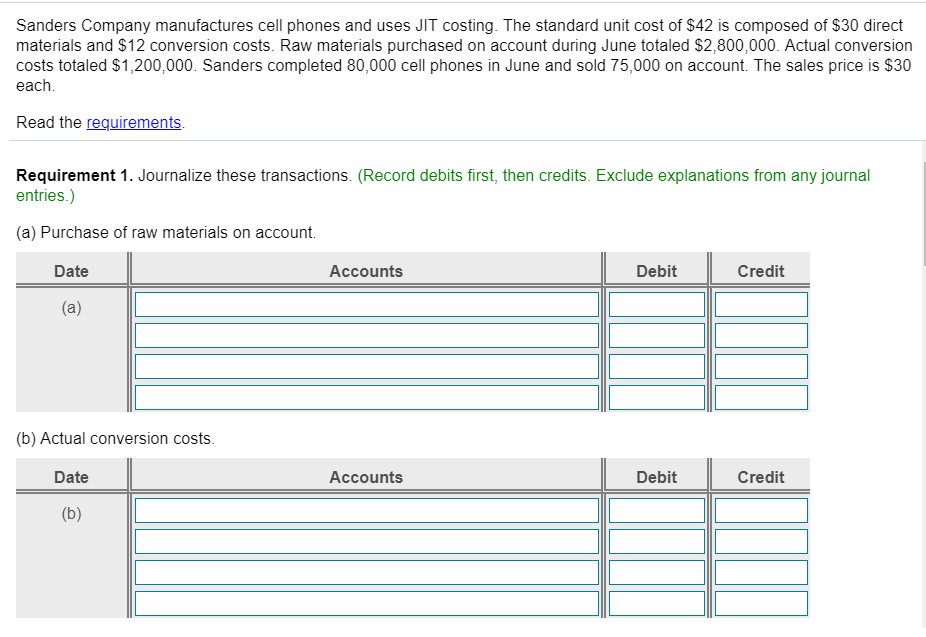

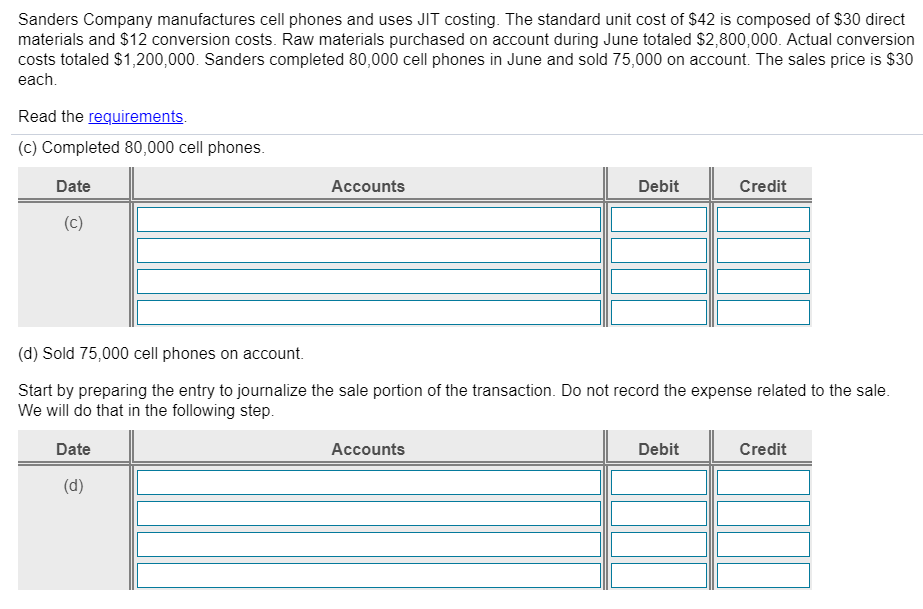

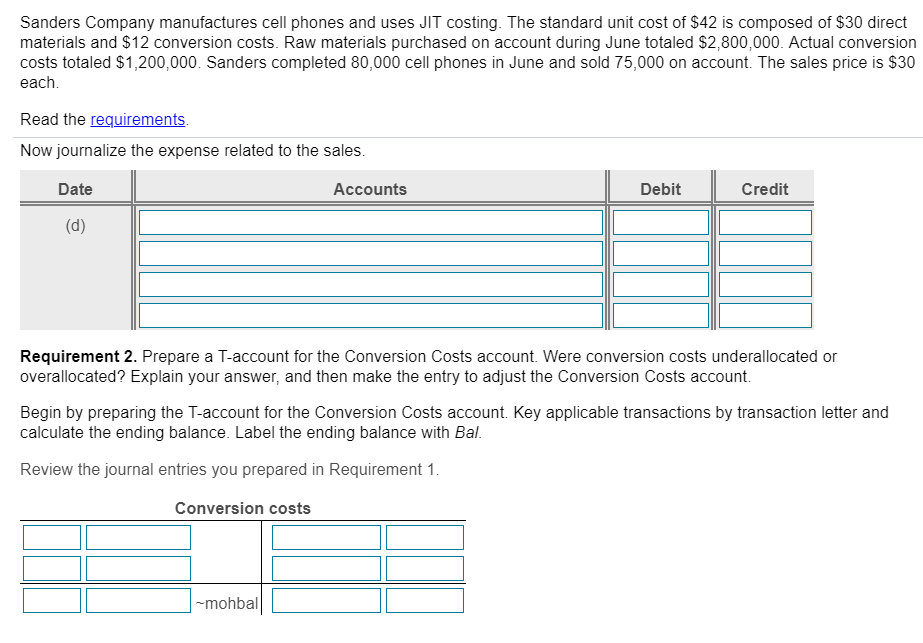

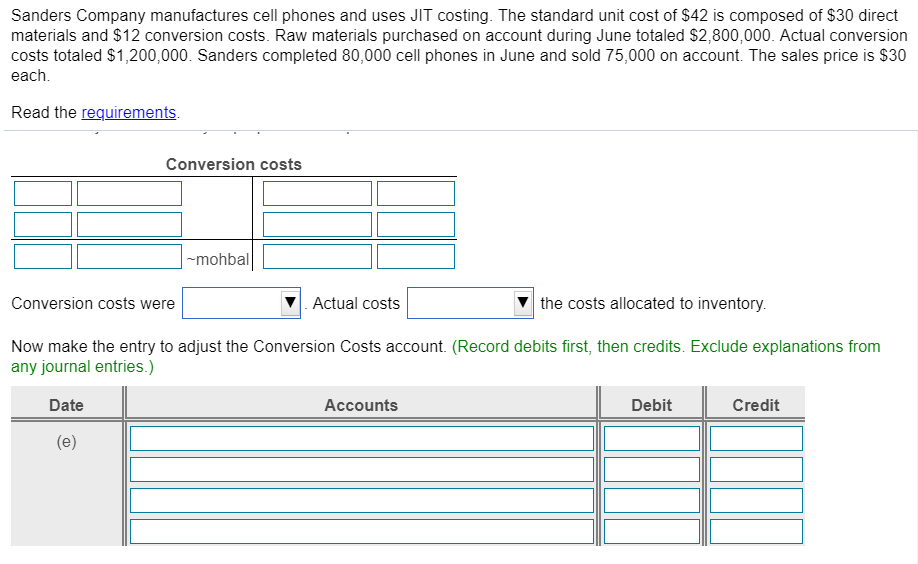

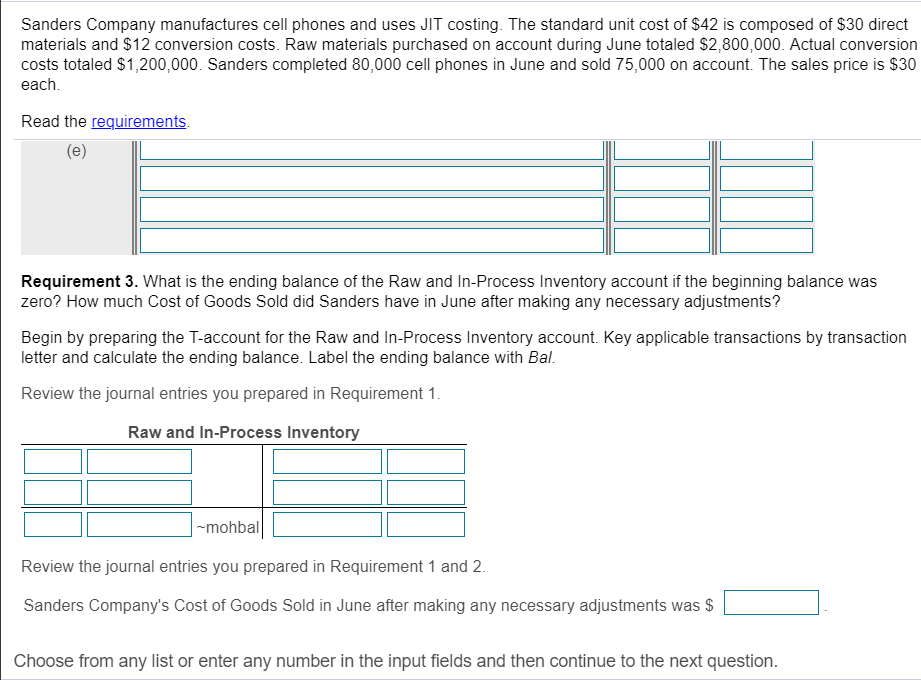

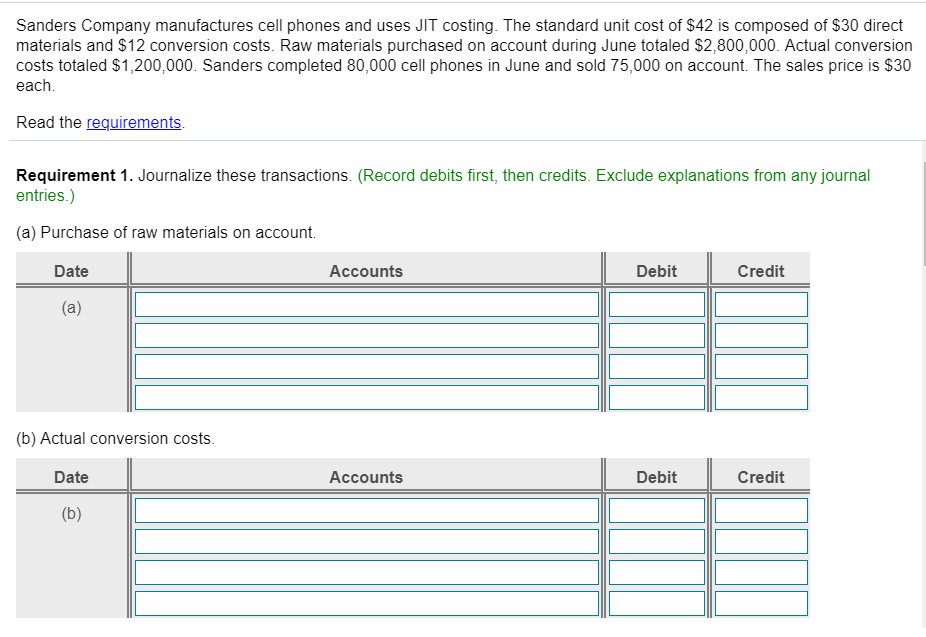

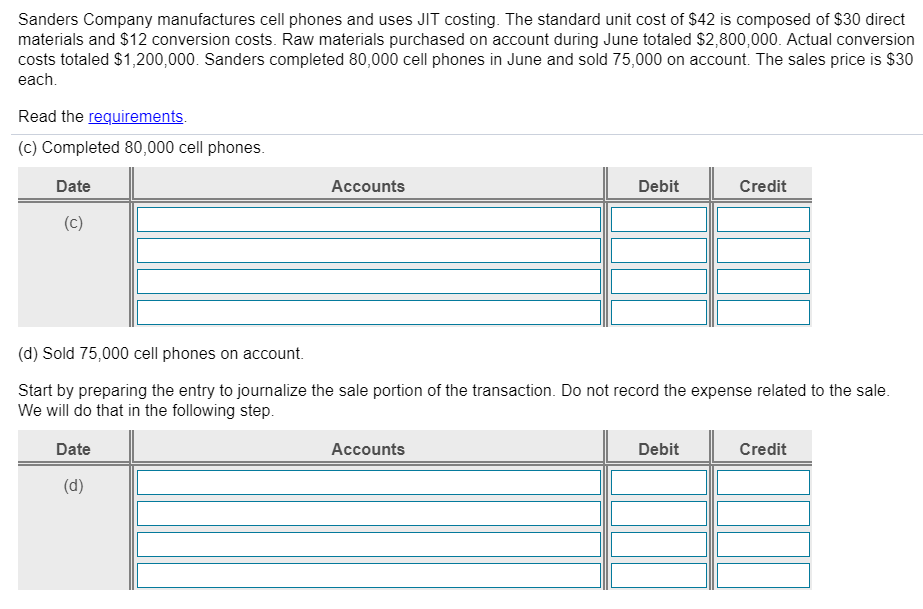

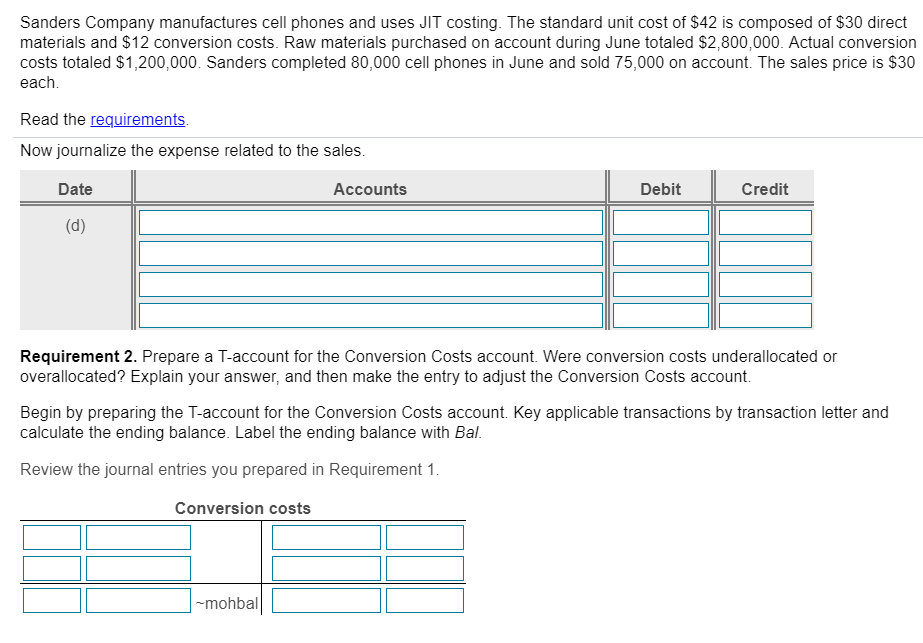

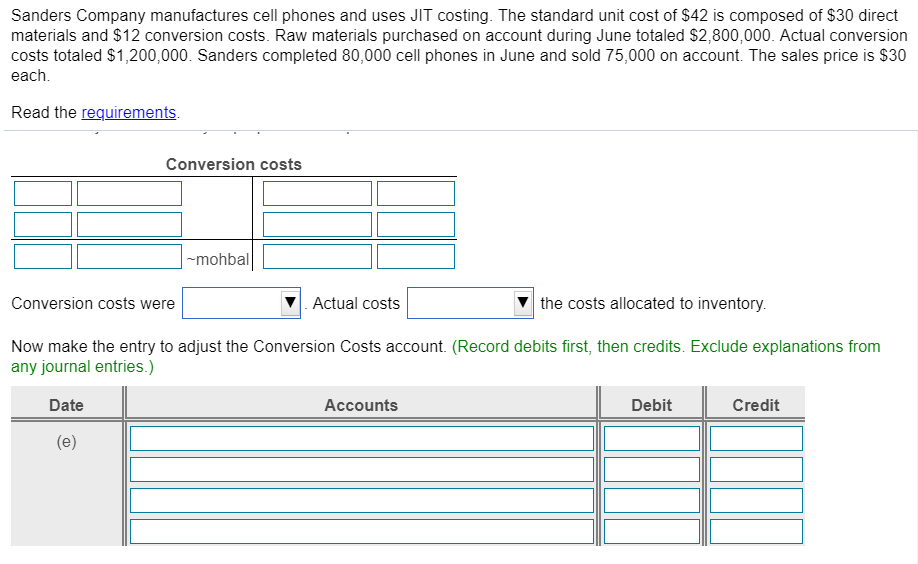

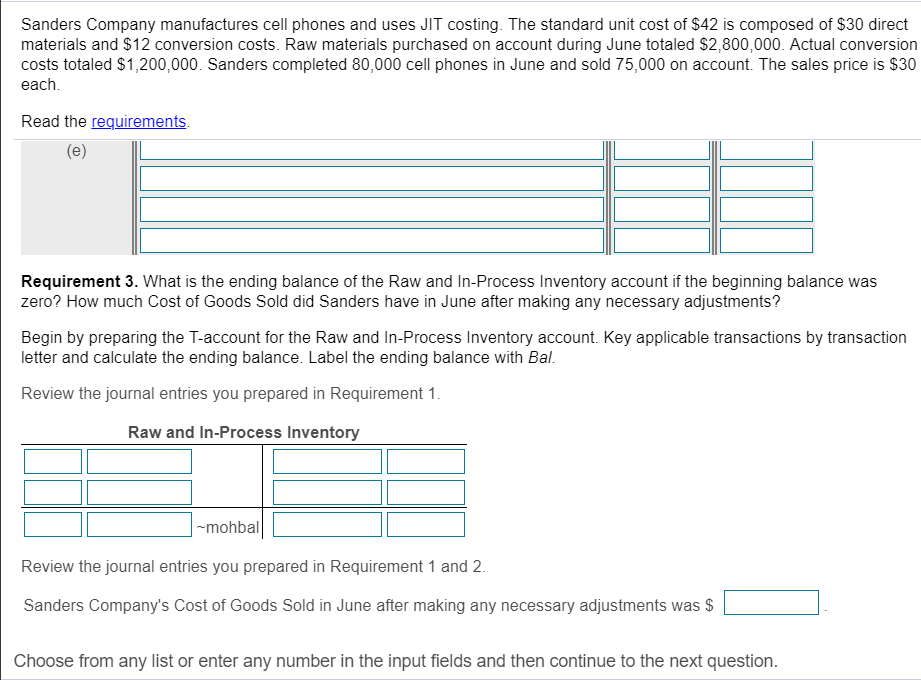

Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements. Requirement 1. Journalize these transactions. (Record debits first, then credits. Exclude explanations from any journal entries.) (a) Purchase of raw materials on account. Date Accounts Debit Credit (b) Actual conversion costs. Date Accounts Debit Credit Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 diredt materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is S30 each Read the requirements. C) Completed 80,000 cell phones Date Accounts Debit Credit (d) Sold 75,000 cell phones on account. Start by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements. Now journalize the expense related to the sales Date Accounts Debit Credit Requirement 2. Prepare a T-account for the Conversion Costs account. Were conversion costs underallocated or overallocated? Explain your answer, and then make the entry to adjust the Conversion Costs account. Begin by preparing the T-account for the Conversion Costs account. Key applicable transactions by transaction letter and calculate the ending balance. Label the ending balance with Bal. Review the journal entries you prepared in Requirement 1 Conversion costs -mohbal Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements. Conversion costs mohbal Conversion costs were Actual costs V the costs allocated to inventory Now make the entry to adjust the Conversion Costs account. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements Requirement 3. What is the ending balance of the Raw and In-Process Inventory account if the beginning balance was zero? How much Cost of Goods Sold did Sanders have in June after making any necessary adjustments? Begin by preparing the T-account for the Raw and In-Process Inventory account. Key applicable transactions by transaction letter and calculate the ending balance. Label the ending balance with Bal Review the journal entries you prepared in Requirement 1 Raw and In-Process Inventory mohbal Review the journal entries you prepared in Requirement 1 and 2 Sanders Company's Cost of Goods Sold in June after making any necessary adjustments was $ Choose from any list or enter any number in the input fields and then continue to the next question Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements. Requirement 1. Journalize these transactions. (Record debits first, then credits. Exclude explanations from any journal entries.) (a) Purchase of raw materials on account. Date Accounts Debit Credit (b) Actual conversion costs. Date Accounts Debit Credit Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 diredt materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is S30 each Read the requirements. C) Completed 80,000 cell phones Date Accounts Debit Credit (d) Sold 75,000 cell phones on account. Start by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements. Now journalize the expense related to the sales Date Accounts Debit Credit Requirement 2. Prepare a T-account for the Conversion Costs account. Were conversion costs underallocated or overallocated? Explain your answer, and then make the entry to adjust the Conversion Costs account. Begin by preparing the T-account for the Conversion Costs account. Key applicable transactions by transaction letter and calculate the ending balance. Label the ending balance with Bal. Review the journal entries you prepared in Requirement 1 Conversion costs -mohbal Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements. Conversion costs mohbal Conversion costs were Actual costs V the costs allocated to inventory Now make the entry to adjust the Conversion Costs account. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Sanders Company manufactures cell phones and uses JIT costing. The standard unit cost of $42 is composed of $30 direct materials and $12 conversion costs. Raw materials purchased on account during June totaled $2,800,000. Actual conversion costs totaled $1,200,000. Sanders completed 80,000 cell phones in June and sold 75,000 on account. The sales price is $30 each Read the requirements Requirement 3. What is the ending balance of the Raw and In-Process Inventory account if the beginning balance was zero? How much Cost of Goods Sold did Sanders have in June after making any necessary adjustments? Begin by preparing the T-account for the Raw and In-Process Inventory account. Key applicable transactions by transaction letter and calculate the ending balance. Label the ending balance with Bal Review the journal entries you prepared in Requirement 1 Raw and In-Process Inventory mohbal Review the journal entries you prepared in Requirement 1 and 2 Sanders Company's Cost of Goods Sold in June after making any necessary adjustments was $ Choose from any list or enter any number in the input fields and then continue to the next