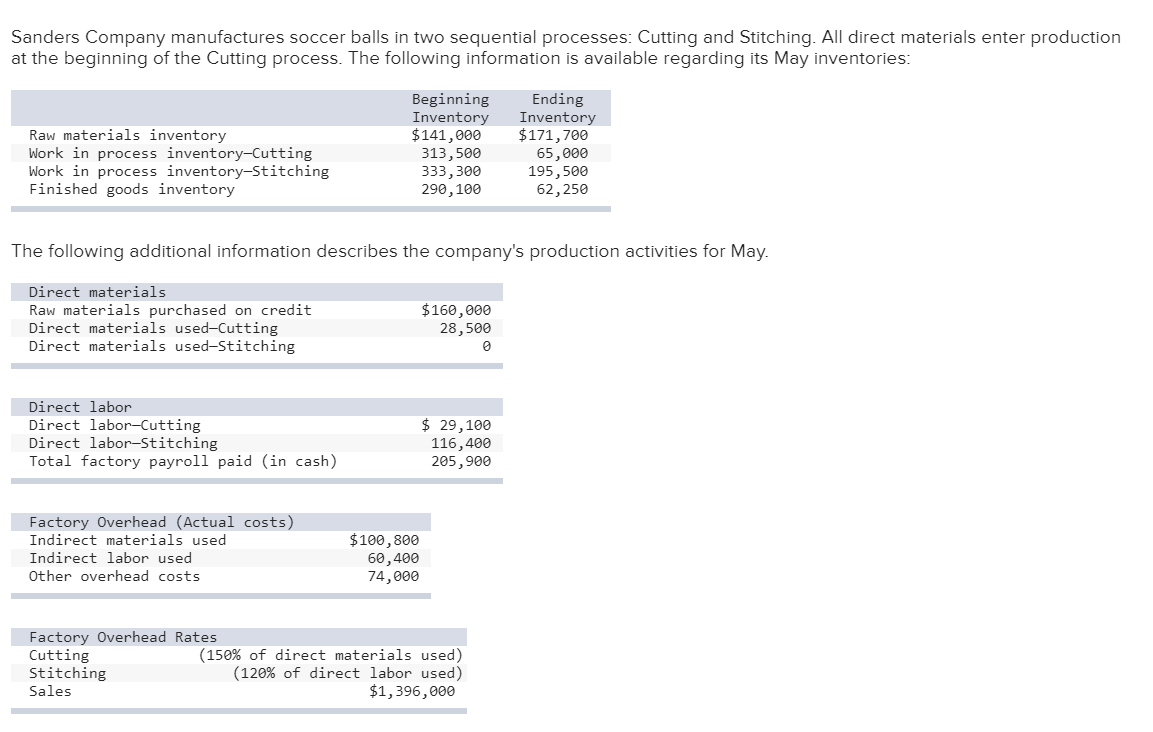

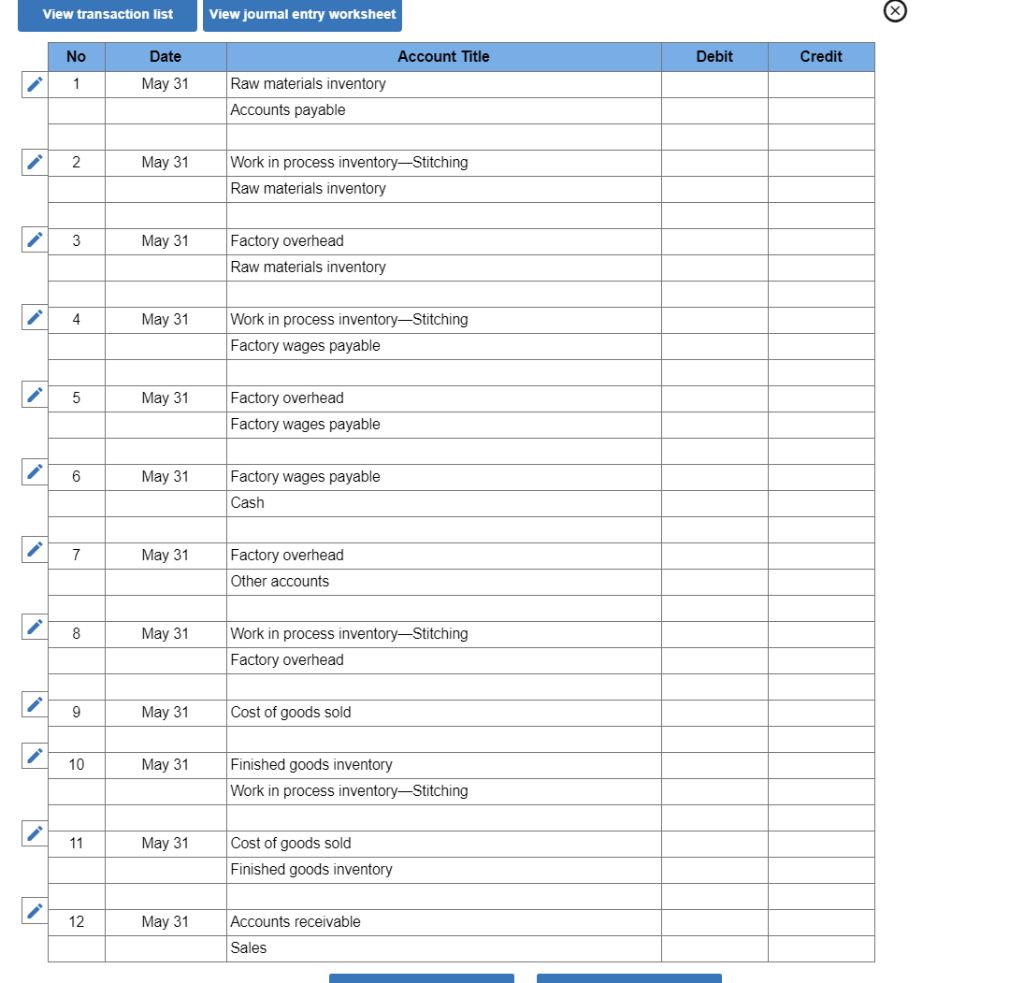

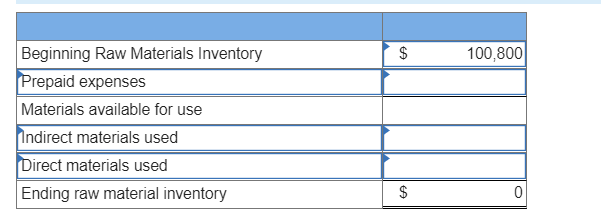

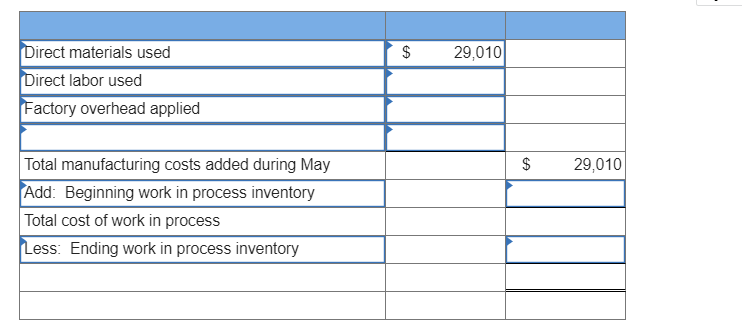

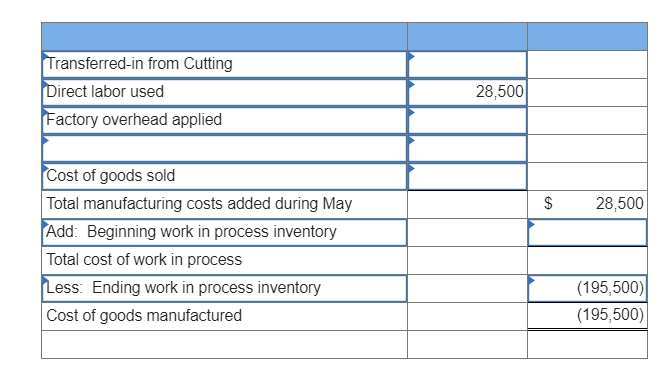

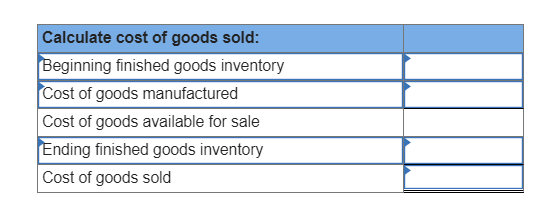

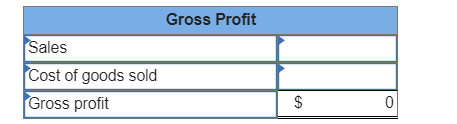

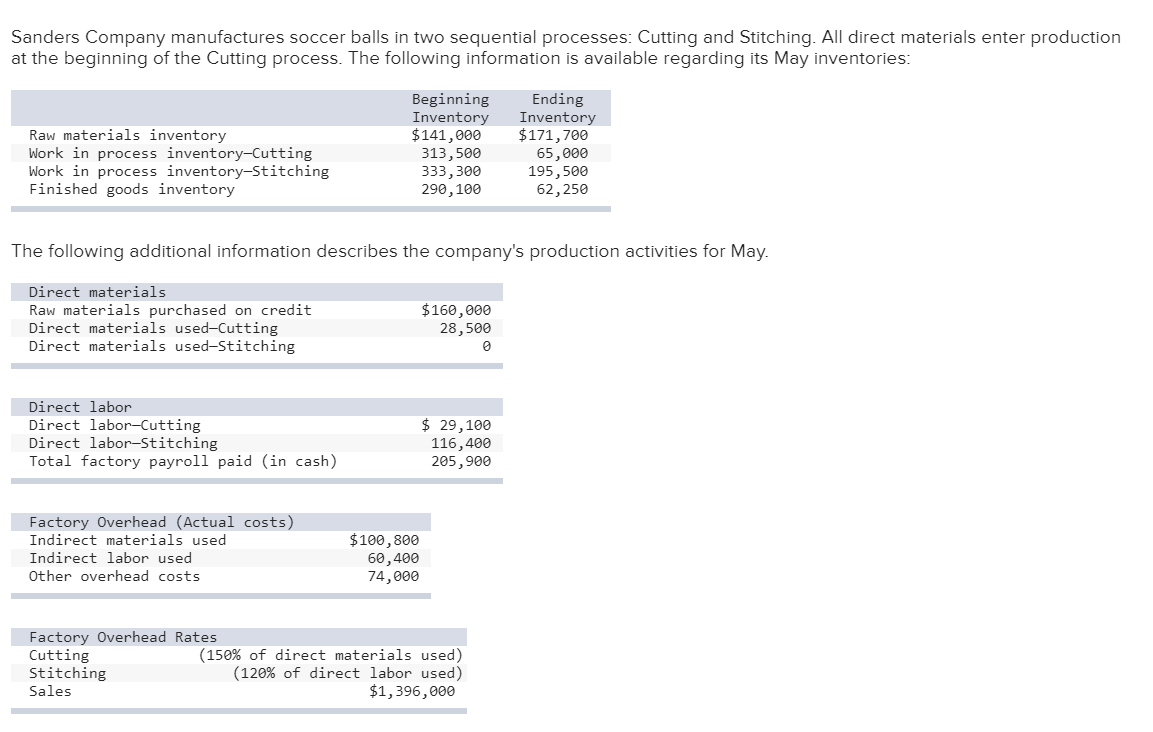

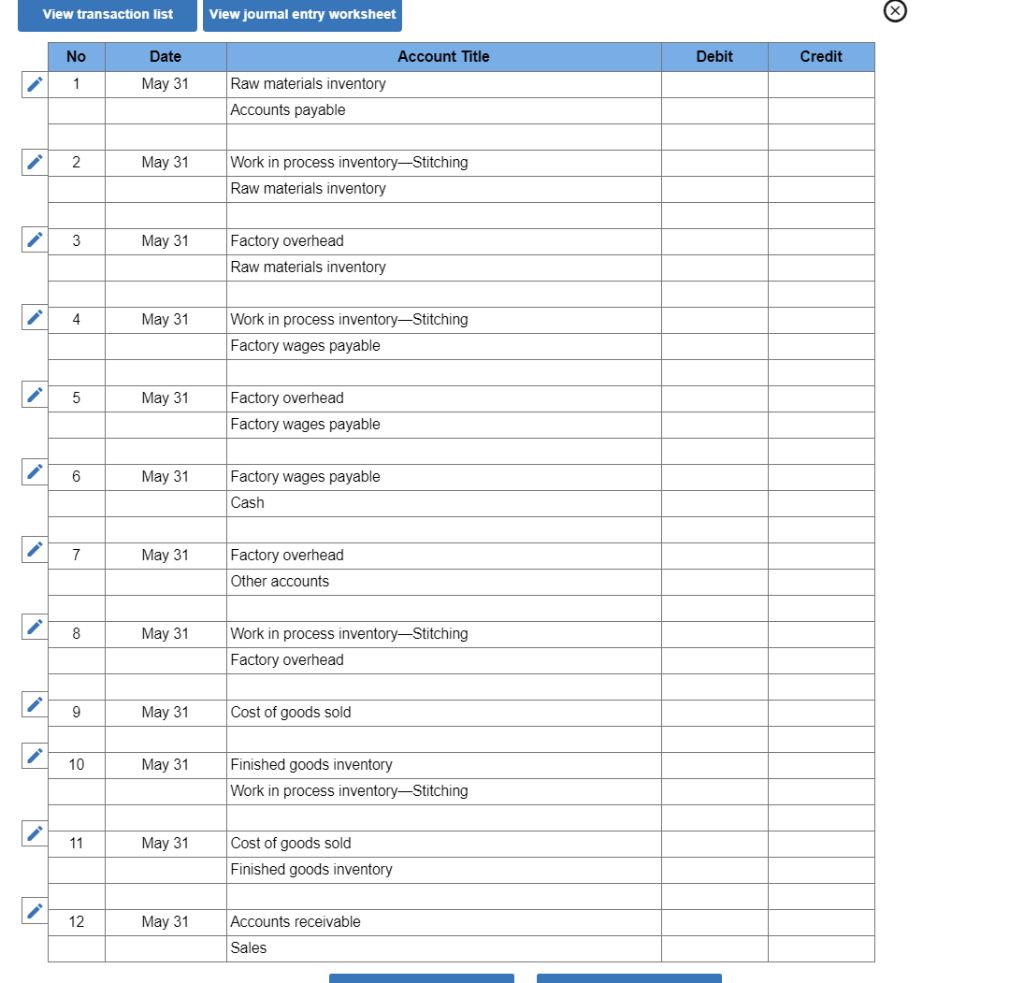

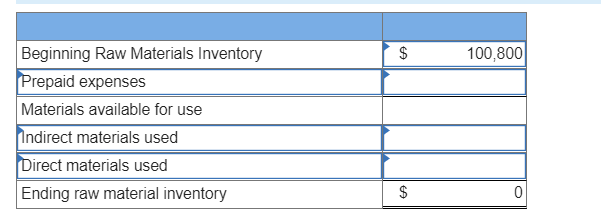

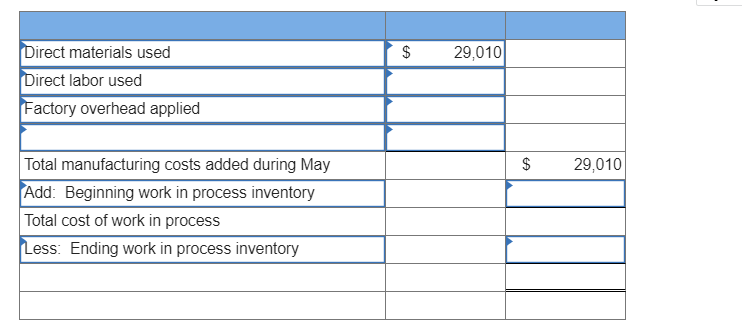

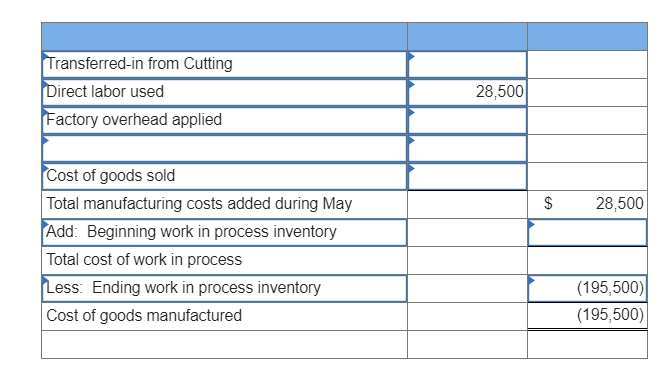

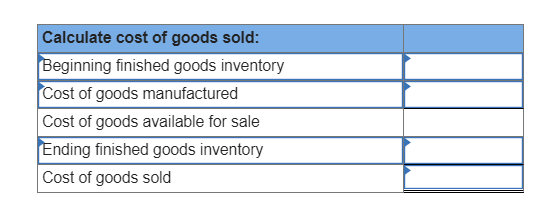

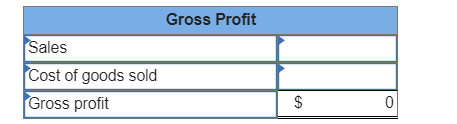

Sanders Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Inventory $141,000 313,500 333,300 290, 100 Ending Inventory $171,700 65,000 195,500 62,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching $160,000 28,500 0 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 29,100 116,400 205,900 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $100,800 60,400 74,000 Factory Overhead Rates Cutting (150% of direct materials used) Stitching (120% of direct labor used) Sales $1,396,000 View transaction list View journal entry worksheet No Account Title Debit Credit Date May 31 1 Raw materials inventory Accounts payable 2 May 31 Work in process inventory-Stitching Raw materials inventory 3 May 31 Factory overhead Raw materials inventory 4 May 31 Work in process inventory-Stitching Factory wages payable 5 May 31 Factory overhead Factory wages payable 6 May 31 Factory wages payable Cash 7 May 31 Factory overhead Other accounts 8 May 31 Work in process inventory-Stitching Factory overhead 9 May 31 Cost of goods sold 10 May 31 Finished goods inventory Work in process inventoryStitching 11 May 31 Cost of goods sold Finished goods inventory 12 May 31 Accounts receivable Sales $ 100,800 Beginning Raw Materials Inventory Prepaid expenses Materials available for use Indirect materials used Direct materials used Ending raw material inventory $ 0 $ 29,010 Direct materials used Direct labor used Factory overhead applied $ $ 29,010 Total manufacturing costs added during May Add: Beginning work in process inventory Total cost of work in process Less: Ending work in process inventory Transferred-in from Cutting Direct labor used Factory overhead applied 28,500 $ $ 28,500 Cost of goods sold Total manufacturing costs added during May Add: Beginning work in process inventory Total cost of work in process Less: Ending work in process inventory Cost of goods manufactured (195,500) (195,500) Calculate cost of goods sold: Beginning finished goods inventory Cost of goods manufactured Cost of goods available for sale Ending finished goods inventory Cost of goods sold Gross Profit Sales Cost of goods sold Gross profit $ $ 0 Sanders Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Inventory $141,000 313,500 333,300 290, 100 Ending Inventory $171,700 65,000 195,500 62,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching $160,000 28,500 0 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 29,100 116,400 205,900 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $100,800 60,400 74,000 Factory Overhead Rates Cutting (150% of direct materials used) Stitching (120% of direct labor used) Sales $1,396,000 View transaction list View journal entry worksheet No Account Title Debit Credit Date May 31 1 Raw materials inventory Accounts payable 2 May 31 Work in process inventory-Stitching Raw materials inventory 3 May 31 Factory overhead Raw materials inventory 4 May 31 Work in process inventory-Stitching Factory wages payable 5 May 31 Factory overhead Factory wages payable 6 May 31 Factory wages payable Cash 7 May 31 Factory overhead Other accounts 8 May 31 Work in process inventory-Stitching Factory overhead 9 May 31 Cost of goods sold 10 May 31 Finished goods inventory Work in process inventoryStitching 11 May 31 Cost of goods sold Finished goods inventory 12 May 31 Accounts receivable Sales $ 100,800 Beginning Raw Materials Inventory Prepaid expenses Materials available for use Indirect materials used Direct materials used Ending raw material inventory $ 0 $ 29,010 Direct materials used Direct labor used Factory overhead applied $ $ 29,010 Total manufacturing costs added during May Add: Beginning work in process inventory Total cost of work in process Less: Ending work in process inventory Transferred-in from Cutting Direct labor used Factory overhead applied 28,500 $ $ 28,500 Cost of goods sold Total manufacturing costs added during May Add: Beginning work in process inventory Total cost of work in process Less: Ending work in process inventory Cost of goods manufactured (195,500) (195,500) Calculate cost of goods sold: Beginning finished goods inventory Cost of goods manufactured Cost of goods available for sale Ending finished goods inventory Cost of goods sold Gross Profit Sales Cost of goods sold Gross profit $ $ 0