Question

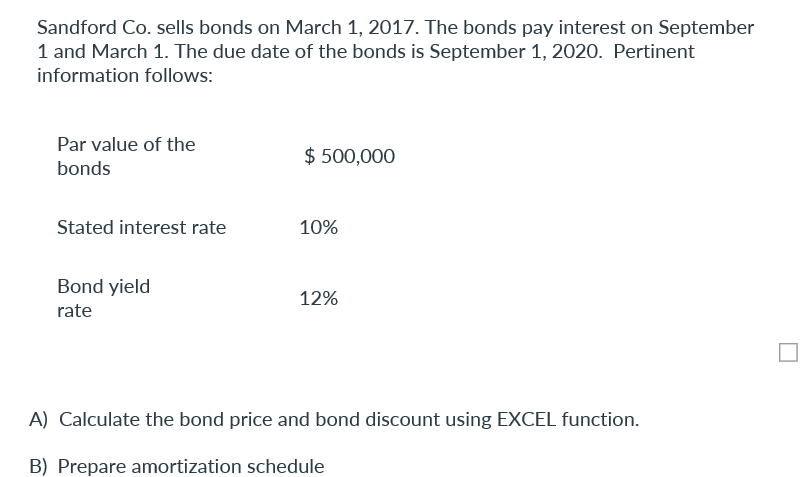

Sandford Co. sells bonds on March 1, 2017. The bonds pay interest on September 1 and March 1. The due date of the bonds

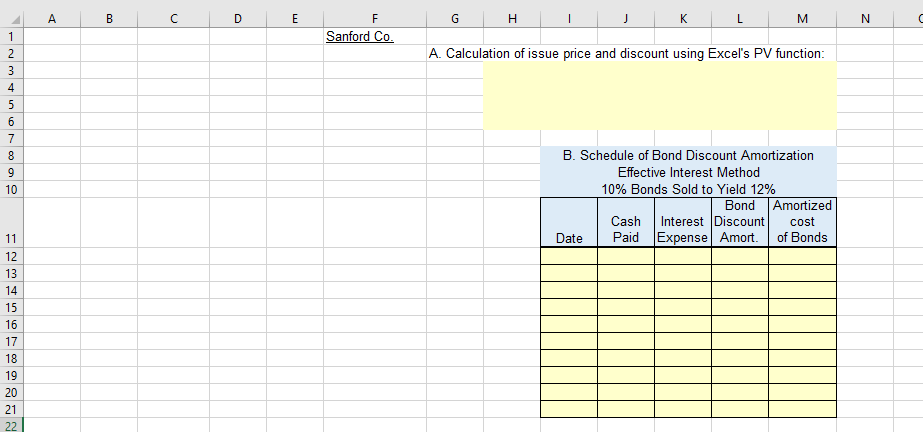

Sandford Co. sells bonds on March 1, 2017. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2020. Pertinent information follows: Par value of the bonds Stated interest rate Bond yield rate $ 500,000 10% 12% A) Calculate the bond price and bond discount using EXCEL function. B) Prepare amortization schedule Nin 678092 2 3 10 11 12 13 14 15 16 17 18 19 20 21 22 A B D E F Sanford Co. G H J K Date L M A. Calculation of issue price and discount using Excel's PV function: B. Schedule of Bond Discount Amortization Effective Interest Method 10% Bonds Sold to Yield 12% Bond Amortized Cash Interest Discount Paid Expense Amort. cost of Bonds N C

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy

11th Canadian edition Volume 2

1119048540, 978-1119048541

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App