Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sandhill Inc. sells tickets for a Caribbean cruise on Ship Away Cruise Lines to Sunland Company employees. The total cruise package price to Sunland Company

- Sandhill Inc. sells tickets for a Caribbean cruise on Ship Away Cruise Lines to Sunland Company employees. The total cruise package price to Sunland Company employees is $ Sandhill Inc. receives a commission of of the total price. Sandhill Inc. therefore remits $ to ShipAway.Prepare the journal entry to record the receipt of payment of $ from employees for the cruise packages and theremittance and revenue recognized by Sandhill Inc. on this transaction. Credit account titles are automatically indented when amount isentered. Do not indent manually. If no entry is required, select No entry" for the account titles and enter for the amounts. List all debit entries before credit entries.No Account Titles and Explanation Debit Credit Accounts Payable Sales Revenue Textbook and Media. The following are independent situations. Situation :Sunland Cosmetics acquired of the shares of common stock of Martinez Fashion at a total cost of $ per share onMarch On June Martinez declared and paid $ cash dividends to all stockholders. On December Martinezreported net income of $ for the year. At December the market price of Martinez Fashion was $ per share.Situation :Coronado, Inc. obtained significant influence over Seles Corporation by buying of Seles's outstanding shares of commonstock at a total cost of $ per share on January On June Seles declared and paid cash dividends of $ to allstockholders. On December Seles reported a net income of $ for the year.Prepare all necessary journal entries in for both situations. List all debit entries before credit entries. Credit account titles areautomatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles andenter for the amounts. Record journal entries in the order presented in the problem.DateAccount Titles and ExplanationDebitCredittion : Sunland CosmeticsCashCashDividend RevenueFair Value AdjustmentUnrealized Holding Gain or Loss Equity

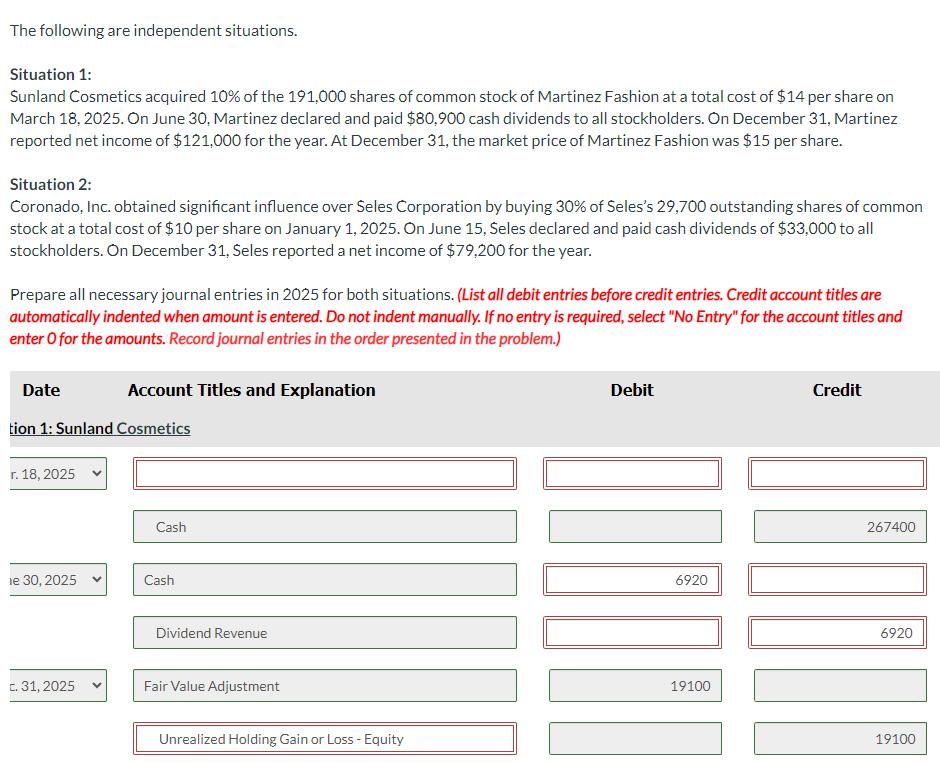

The following are independent situations. Situation 1: Sunland Cosmetics acquired 10% of the 191,000 shares of common stock of Martinez Fashion at a total cost of $14 per share on March 18, 2025. On June 30, Martinez declared and paid $80,900 cash dividends to all stockholders. On December 31, Martinez reported net income of $121,000 for the year. At December 31, the market price of Martinez Fashion was $15 per share. Situation 2: Coronado, Inc. obtained significant influence over Seles Corporation by buying 30% of Seles's 29,700 outstanding shares of common stock at a total cost of $10 per share on January 1, 2025. On June 15, Seles declared and paid cash dividends of $33,000 to all stockholders. On December 31, Seles reported a net income of $79,200 for the year. Prepare all necessary journal entries in 2025 for both situations. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation tion 1: Sunland Cosmetics T. 18, 2025 Cash le 30, 2025 Cash Dividend Revenue c. 31, 2025 Fair Value Adjustment Unrealized Holding Gain or Loss - Equity Debit 6920 19100 Credit 267400 6920 19100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started