Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sandra is the cfo in her late father's business(passed away 5 years ago). shes married to chriss and they both just turned 65.chris is a

sandra is the cfo in her late father's business(passed away 5 years ago). shes married to chriss and they both just turned 65.chris is a stay at home dad and cared for 2 children now adults. chris never worked and has decided to remain home and care for his granchildren both aged 2 and 4.

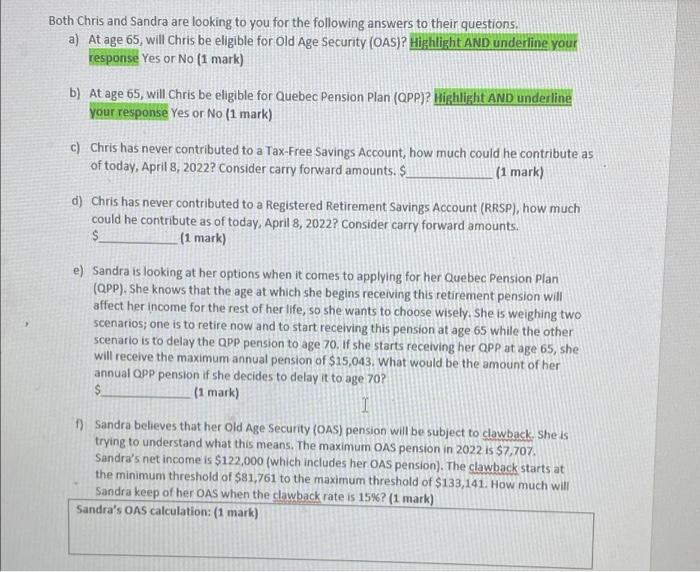

Both Chris and Sandra are looking to you for the following answers to their questions, a) At age 65, will Chris be eligible for Old Age Security (OAS)? Highlight AND underline your response Yes or No (1 mark) b) At age 65, Will Chris be eligible for Quebec Pension Plan (APP)? Highlight AND underline your response Yes or No (1 mark) C) Chris has never contributed to a Tax-Free Savings Account, how much could he contribute as of today, April 8, 2022? Consider carry forward amounts. $. (1 mark) d) Chris has never contributed to a Registered Retirement Savings Account (RRSP), how much could he contribute as of today, April 8, 2022? Consider carry forward amounts. $ (1 mark) e) Sandra is looking at her options when it comes to applying for her Quebec Pension Plan (QPP). She knows that the age at which she begins receiving this retirement pension will affect her income for the rest of her life, so she wants to choose wisely. She is weighing two scenarios; one is to retire now and to start receiving this pension at age 65 while the other scenario is to delay the QPP pension to age 70. If she starts receiving her OPP at age 65, she will receive the maximum annual pension of $15,043. What would be the amount of her annual QPP pension if she decides to delay it to age 70? $ (1 mark) I 1) Sandra believes that her Old Age Security (OAS) pension will be subject to clawback. She is trying to understand what this means. The maximum OAS pension in 2022 is $7,707 Sandra's net income is $122,000 (which includes her OAS pension). The clawback starts at the minimum threshold of $81,761 to the maximum threshold of $133,141. How much will Sandra keep of her oss when the clawback rate is 15%? (1 mark) Sandra's OAS calculation: (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started