Answered step by step

Verified Expert Solution

Question

1 Approved Answer

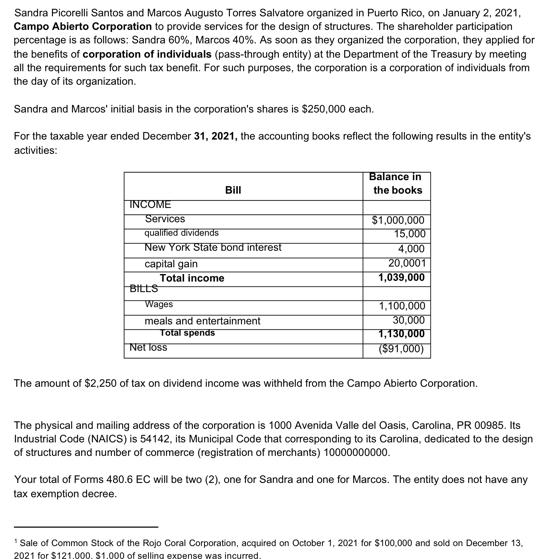

Sandra Picorelli Santos and Marcos Augusto Torres Salvatore organized in Puerto Rico, on January 2, 2021, Campo Abierto Corporation to provide services for the

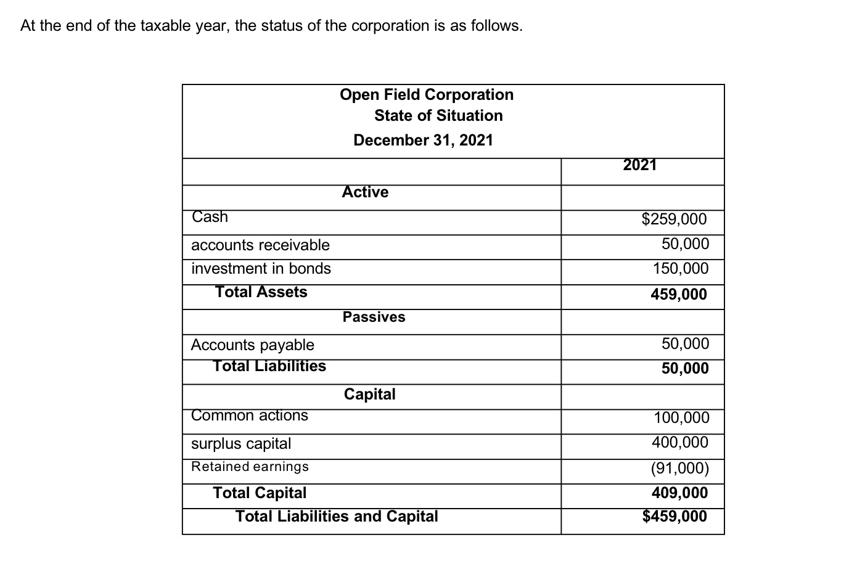

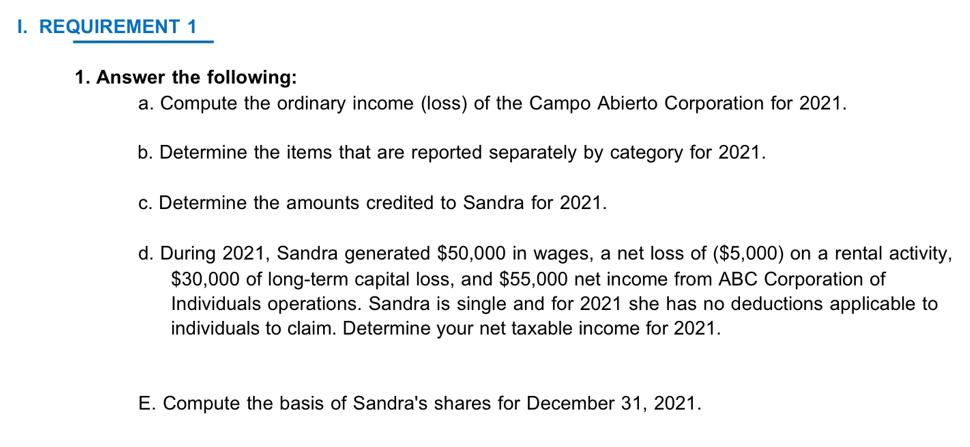

Sandra Picorelli Santos and Marcos Augusto Torres Salvatore organized in Puerto Rico, on January 2, 2021, Campo Abierto Corporation to provide services for the design of structures. The shareholder participation percentage is as follows: Sandra 60%, Marcos 40%. As soon as they organized the corporation, they applied for the benefits of corporation of individuals (pass-through entity) at the Department of the Treasury by meeting all the requirements for such tax benefit. For such purposes, the corporation is a corporation of individuals from the day of its organization. Sandra and Marcos' initial basis in the corporation's shares is $250,000 each. For the taxable year ended December 31, 2021, the accounting books reflect the following results in the entity's activities: INCOME Services qualified dividends New York State bond interest capital gain Total income BILLS Bill Wages meals and entertainment Total spends Net loss Balance in the books $1,000,000 15,000 4,000 20,0001 1,039,000 1,100,000 30,000 1,130,000 ($91,000) The amount of $2,250 of tax on dividend income was withheld from the Campo Abierto Corporation. The physical and mailing address of the corporation is 1000 Avenida Valle del Oasis, Carolina, PR 00985. Its Industrial Code (NAICS) is 54142, its Municipal Code that corresponding to its Carolina, dedicated to the design of structures and number of commerce (registration of merchants) 10000000000. Your total of Forms 480.6 EC will be two (2), one for Sandra and one for Marcos. The entity does not have any tax exemption decree. Sale of Common Stock of the Rojo Coral Corporation, acquired on October 1, 2021 for $100,000 and sold on December 13, 2021 for $121.000. $1.000 of selling expense was incurred. At the end of the taxable year, the status of the corporation is as follows. Cash accounts receivable investment in bonds Total Assets Accounts payable Total Liabilities Common actions surplus capital Retained earnings Total Capital Open Field Corporation State of Situation December 31, 2021 Active Passives Capital Total Liabilities and Capital 2021 $259,000 50,000 150,000 459,000 50,000 50,000 100,000 400,000 (91,000) 409,000 $459,000 I. REQUIREMENT 1 1. Answer the following: a. Compute the ordinary income (loss) of the Campo Abierto Corporation for 2021. b. Determine the items that are reported separately by category for 2021. c. Determine the amounts credited to Sandra for 2021. d. During 2021, Sandra generated $50,000 in wages, a net loss of ($5,000) on a rental activity, $30,000 of long-term capital loss, and $55,000 net income from ABC Corporation of Individuals operations. Sandra is single and for 2021 she has no deductions applicable to individuals to claim. Determine your net taxable income for 2021. E. Compute the basis of Sandra's shares for December 31, 2021.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each part of Requirement 1 based on the information provided in the images a Compute the ordinary income loss of the Campo Abierto Corporation for 2021 To calculate the ordinary income we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started