Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sanjay (47) has been working for a federally regulated financial institution for over ten years, but now has decided to leave for another firm.

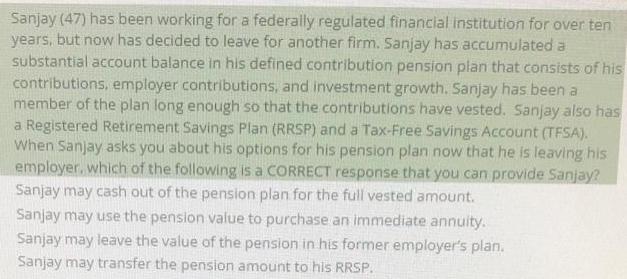

Sanjay (47) has been working for a federally regulated financial institution for over ten years, but now has decided to leave for another firm. Sanjay has accumulated a substantial account balance in his defined contribution pension plan that consists of his contributions, employer contributions, and investment growth. Sanjay has been a member of the plan long enough so that the contributions have vested. Sanjay also has a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA). When Sanjay asks you about his options for his pension plan now that he is leaving his employer, which of the following is a CORRECT response that you can provide Sanjay? Sanjay may cash out of the pension plan for the full vested amount. Sanjay may use the pension value to purchase an immediate annuity. Sanjay may leave the value of the pension in his former employer's plan. Sanjay may transfer the pension amount to his RRSP.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Correct answer is d From the given information its quite clear that Sanjay may transfer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started