Question

Sanjay died on 6 November 2020, at which point his estate was valued at a 800,000. The estate included a main residence valued at

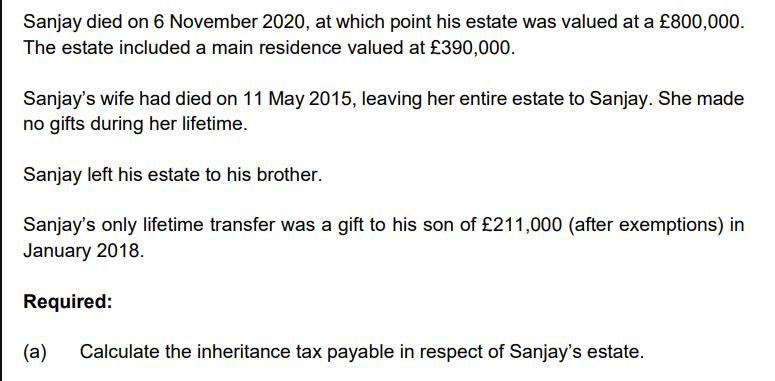

Sanjay died on 6 November 2020, at which point his estate was valued at a 800,000. The estate included a main residence valued at 390,000. Sanjay's wife had died on 11 May 2015, leaving her entire estate to Sanjay. She made no gifts during her lifetime. Sanjay left his estate to his brother. Sanjay's only lifetime transfer was a gift to his son of 211,000 (after exemptions) in January 2018. Required: (a) Calculate the inheritance tax payable in respect of Sanjay's estate.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the inheritance tax payable in respect of Sanjays estate we need to consider various fa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2017 Comprehensive

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

40th Edition

1305874161, 978-1305874169

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App