Santa Maria Widget reviewed the following information from its accounting records for the year ended December 31, 2011, before adjustment: Sales during 2011 $800,000

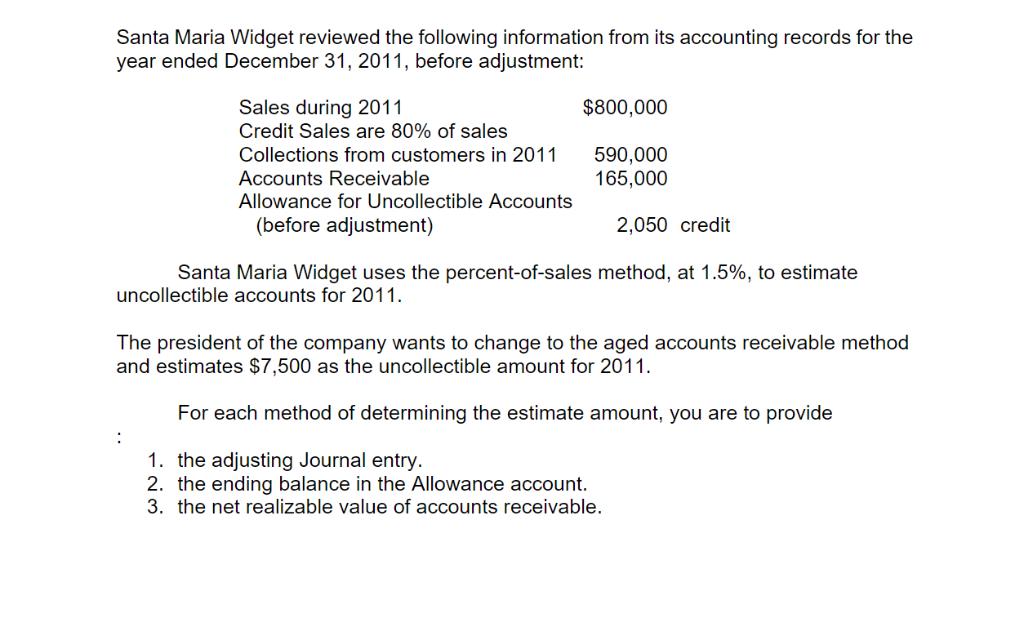

Santa Maria Widget reviewed the following information from its accounting records for the year ended December 31, 2011, before adjustment: Sales during 2011 $800,000 Credit Sales are 80% of sales Collections from customers in 2011 590,000 Accounts Receivable 165,000 Allowance for Uncollectible Accounts 2,050 credit (before adjustment) Santa Maria Widget uses the percent-of-sales method, at 1.5%, to estimate uncollectible accounts for 2011. The president of the company wants to change to the aged accounts receivable method and estimates $7,500 as the uncollectible amount for 2011. : For each method of determining the estimate amount, you are to provide 1. the adjusting Journal entry. 2. the ending balance in the Allowance account. 3. the net realizable value of accounts receivable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Adjusting Journal Entry for Each Method Method 1 PercentofSales Method Santa Maria Widget uses the percentofsales method at 15 to estimate unco...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started