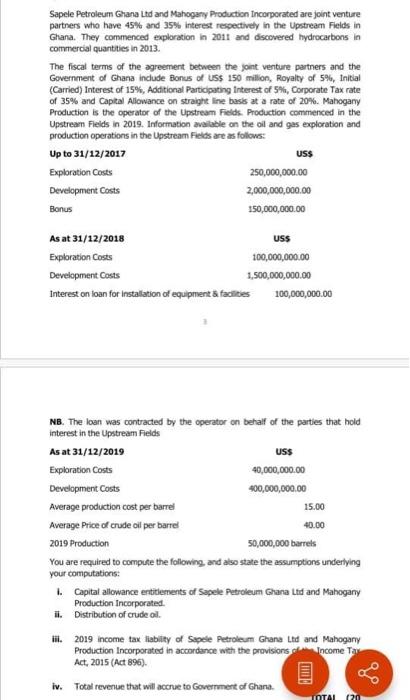

Sapele Petroleum Ghana Ltd and Mahogany Production Incorporated are joint venture partners who have 45% and 35% Interest respectively in the Upstream Fields in Ghana. They commenced exploration in 2011 and discovered hydrocarbons in commercial quantities in 2013. The fiscal terms of the agreement between the joint venture partners and the Government of Ghana include Bonus of US$ 150 million, Royalty of 5%, Initial (Carried) Interest of 15%, Additional Participating interest of 5%, Corporate Tax rate of 35% and Capital Allowance on straight line basis at a rate of 20%. Mahogany Production is the operator of the Upstream Fields. Production commenced in the Upstream Fields in 2019. Information available on the oil and gas exploration and production operations in the Upstream Fields are as follows: Up to 31/12/2017 USS Exploration Costs 250,000,000.00 Development Costs 2,000,000,000.00 Bonus 150,000,000.00 As at 31/12/2018 USS Exploration Costs 100,000,000.00 Development Costs 1.500,000,000.00 Interest on loan for Installation of equipment & facies 100,000,000.00 NB. The loan was contracted by the operator on behalf of the parties that hold interest in the Upstream Fields As at 31/12/2019 USS Exploration Costs 40,000,000.00 Development Costs 400,000,000.00 Average production cost per barrel 15.00 Average Price of crude oil per barrel 40.00 2019 Production 50,000,000 barrels You are required to compute the following and also state the assumptions underlying your computations: Capital allowance entitlements of Sapele Petroleum Ghana Ltd and Mahogany Production Incorporated il. Distribution of crude oil ili. 2019 income tax liability of Sepete Petroleum Ghana Ltd and Mahogany Production Incorporated in accordance with the provisions of Income Ta Act, 2015 (Act 896) iv. Total revenue that will accrue to Government of Ghana. TOTAL 120 Sapele Petroleum Ghana Ltd and Mahogany Production Incorporated are joint venture partners who have 45% and 35% Interest respectively in the Upstream Fields in Ghana. They commenced exploration in 2011 and discovered hydrocarbons in commercial quantities in 2013. The fiscal terms of the agreement between the joint venture partners and the Government of Ghana include Bonus of US$ 150 million, Royalty of 5%, Initial (Carried) Interest of 15%, Additional Participating interest of 5%, Corporate Tax rate of 35% and Capital Allowance on straight line basis at a rate of 20%. Mahogany Production is the operator of the Upstream Fields. Production commenced in the Upstream Fields in 2019. Information available on the oil and gas exploration and production operations in the Upstream Fields are as follows: Up to 31/12/2017 USS Exploration Costs 250,000,000.00 Development Costs 2,000,000,000.00 Bonus 150,000,000.00 As at 31/12/2018 USS Exploration Costs 100,000,000.00 Development Costs 1.500,000,000.00 Interest on loan for Installation of equipment & facies 100,000,000.00 NB. The loan was contracted by the operator on behalf of the parties that hold interest in the Upstream Fields As at 31/12/2019 USS Exploration Costs 40,000,000.00 Development Costs 400,000,000.00 Average production cost per barrel 15.00 Average Price of crude oil per barrel 40.00 2019 Production 50,000,000 barrels You are required to compute the following and also state the assumptions underlying your computations: Capital allowance entitlements of Sapele Petroleum Ghana Ltd and Mahogany Production Incorporated il. Distribution of crude oil ili. 2019 income tax liability of Sepete Petroleum Ghana Ltd and Mahogany Production Incorporated in accordance with the provisions of Income Ta Act, 2015 (Act 896) iv. Total revenue that will accrue to Government of Ghana. TOTAL 120