Answered step by step

Verified Expert Solution

Question

1 Approved Answer

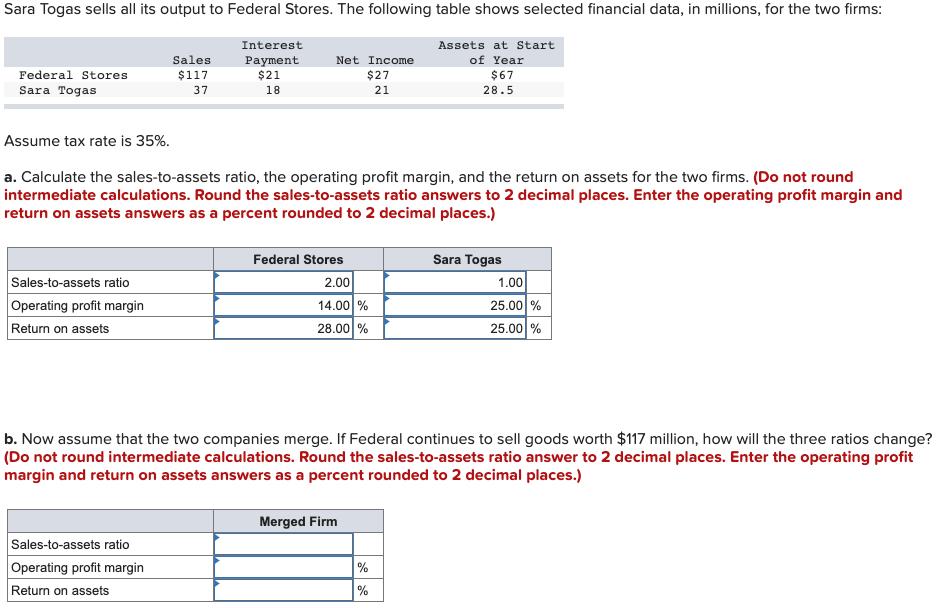

Sara Togas sells all its output to Federal Stores. The following table shows selected financial data, in millions, for the two firms: Interest Assets

Sara Togas sells all its output to Federal Stores. The following table shows selected financial data, in millions, for the two firms: Interest Assets at Start Sales Federal Stores Sara Togas $117 37 Payment $21 18 Net Income $27 of Year 21 $67 28.5 Assume tax rate is 35%. a. Calculate the sales-to-assets ratio, the operating profit margin, and the return on assets for the two firms. (Do not round intermediate calculations. Round the sales-to-assets ratio answers to 2 decimal places. Enter the operating profit margin and return on assets answers as a percent rounded to 2 decimal places.) Sales-to-assets ratio Operating profit margin Return on assets Federal Stores 2.00 14.00 % 28.00% Sara Togas 1.00 25.00% 25.00% b. Now assume that the two companies merge. If Federal continues to sell goods worth $117 million, how will the three ratios change? (Do not round intermediate calculations. Round the sales-to-assets ratio answer to 2 decimal places. Enter the operating profit margin and return on assets answers as a percent rounded to 2 decimal places.) Sales-to-assets ratio Operating profit margin Return on assets Merged Firm % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started