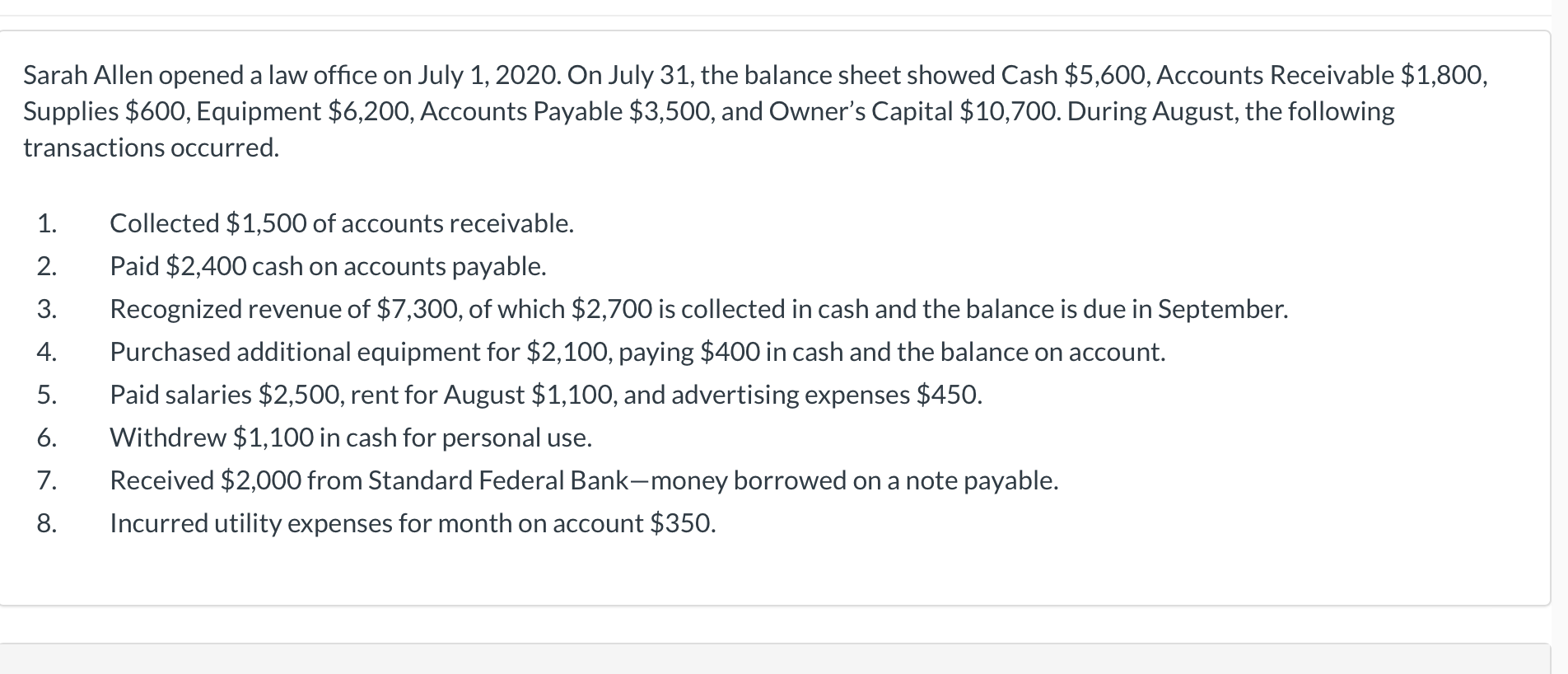

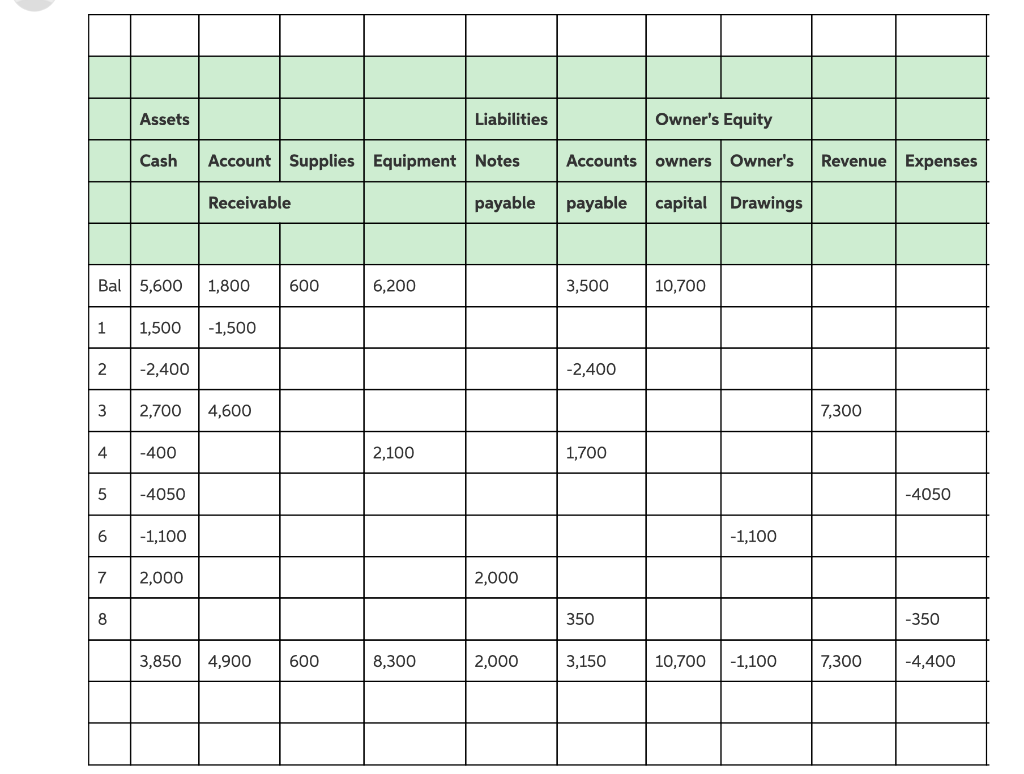

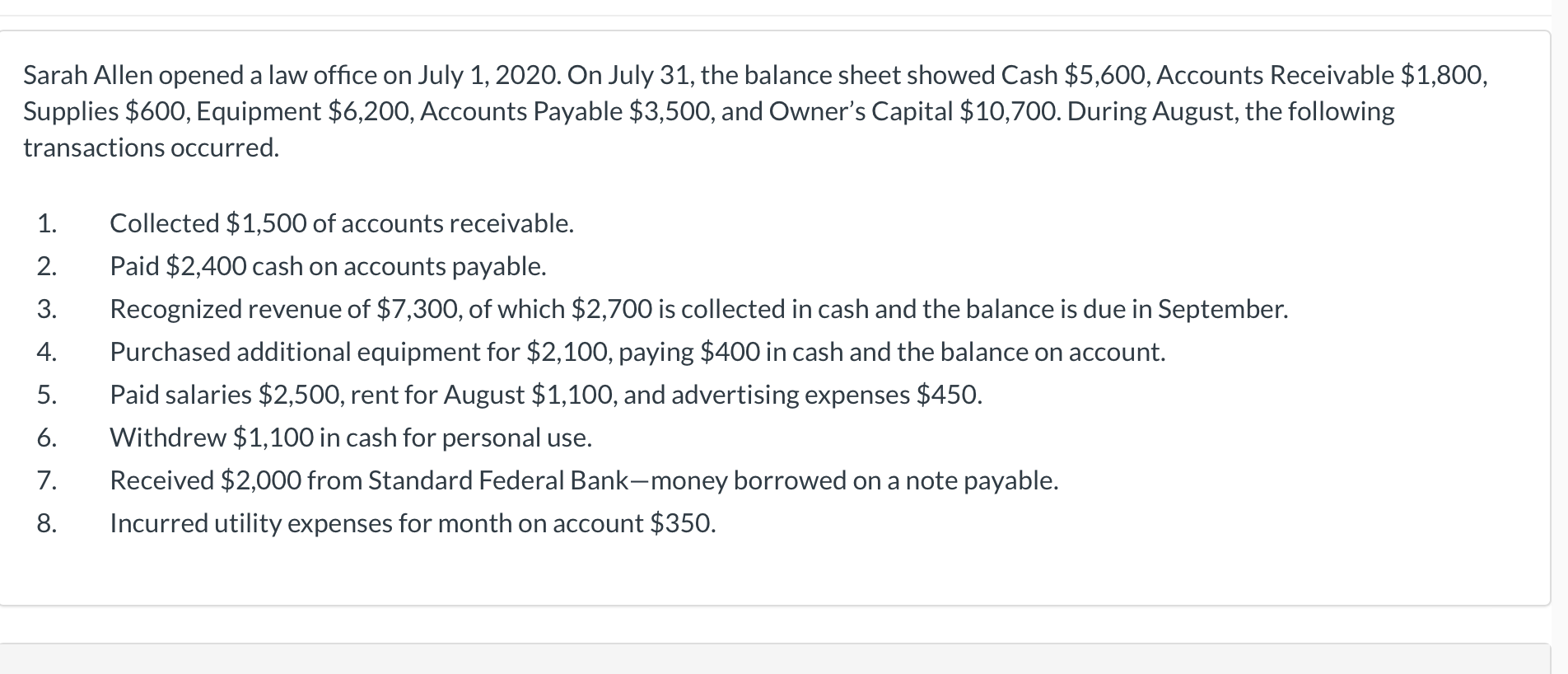

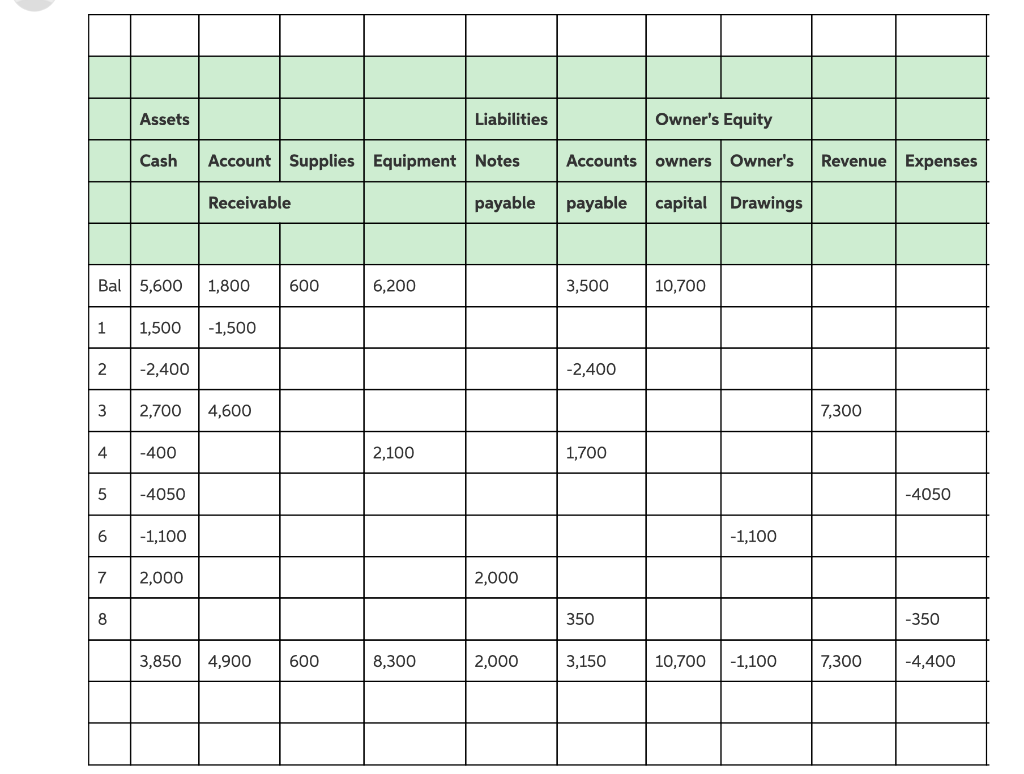

Sarah Allen opened a law office on July 1, 2020. On July 31, the balance sheet showed Cash $5,600, Accounts Receivable $1,800, Supplies $600, Equipment $6,200, Accounts Payable $3,500, and Owner's Capital $10,700. During August, the following transactions occurred. 1. 2. 3. 4. Collected $1,500 of accounts receivable. Paid $2,400 cash on accounts payable. Recognized revenue of $7,300, of which $2,700 is collected in cash and the balance is due in September. Purchased additional equipment for $2,100, paying $400 in cash and the balance on account. Paid salaries $2,500, rent for August $1,100, and advertising expenses $450. Withdrew $1,100 in cash for personal use. Received $2,000 from Standard Federal Bank-money borrowed on a note payable. Incurred utility expenses for month on account $350. 5. 0 N 00 Assets Liabilities Owner's Equity Cash Account Supplies Equipment Notes Accounts owners Owner's Revenue Expenses Receivable payable payable capital Drawings Bal 5,600 1,800 600 6,200 3,500 10,700 1 1,500 -1,500 -2,400 -2,400 wn 2,700 4,600 7,300 4 -400 2,100 1,700 5 -4050 -4050 6 -1,100 -1,100 7 2,000 2,000 8 350 -350 3,850 4,900 600 8,300 2,000 3,150 10,700 -1,100 7,300 -4,400 SARAH ALLEN, ATTORNEY AT LAW Income Statement $ TA Sarah Allen opened a law office on July 1, 2020. On July 31, the balance sheet showed Cash $5,600, Accounts Receivable $1,800, Supplies $600, Equipment $6,200, Accounts Payable $3,500, and Owner's Capital $10,700. During August, the following transactions occurred. 1. 2. 3. 4. Collected $1,500 of accounts receivable. Paid $2,400 cash on accounts payable. Recognized revenue of $7,300, of which $2,700 is collected in cash and the balance is due in September. Purchased additional equipment for $2,100, paying $400 in cash and the balance on account. Paid salaries $2,500, rent for August $1,100, and advertising expenses $450. Withdrew $1,100 in cash for personal use. Received $2,000 from Standard Federal Bank-money borrowed on a note payable. Incurred utility expenses for month on account $350. 5. 0 N 00 Assets Liabilities Owner's Equity Cash Account Supplies Equipment Notes Accounts owners Owner's Revenue Expenses Receivable payable payable capital Drawings Bal 5,600 1,800 600 6,200 3,500 10,700 1 1,500 -1,500 -2,400 -2,400 wn 2,700 4,600 7,300 4 -400 2,100 1,700 5 -4050 -4050 6 -1,100 -1,100 7 2,000 2,000 8 350 -350 3,850 4,900 600 8,300 2,000 3,150 10,700 -1,100 7,300 -4,400 SARAH ALLEN, ATTORNEY AT LAW Income Statement $ TA