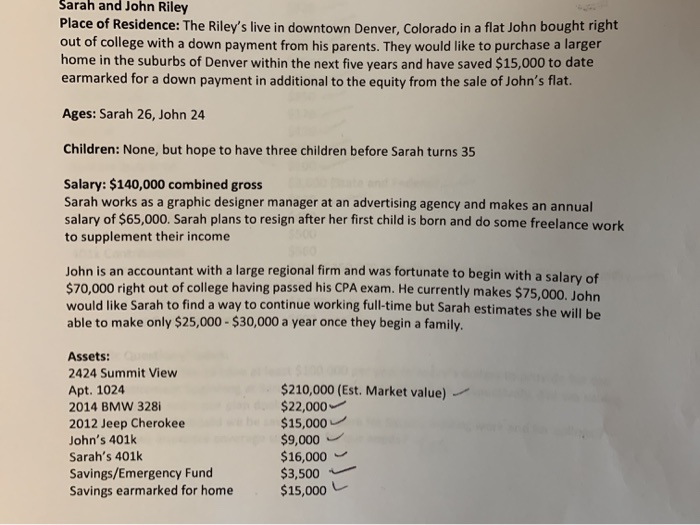

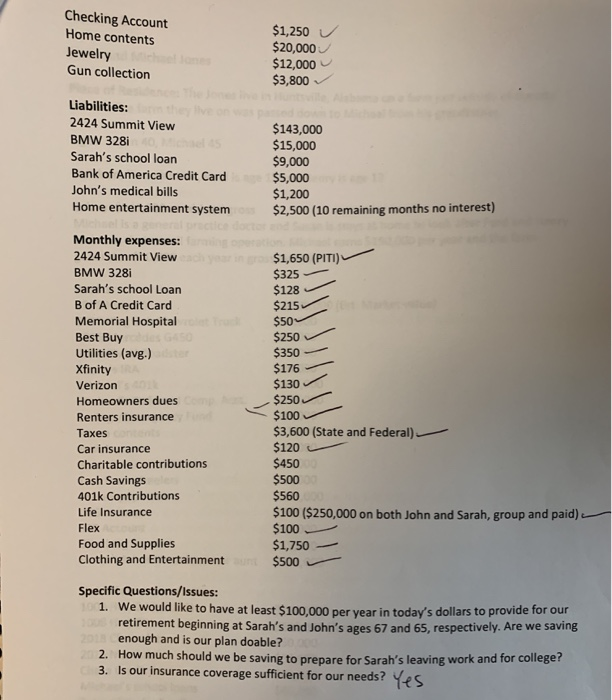

Sarah and John Riley Place of Residence: The Riley's live in downtown Denver, Colorado in a flat John bought me out of college with a down payment from his parents. They would like to purchase a larger home in the suburbs of Denver within the next five vears and have saved $15,000 to date earmarked for a down payment in additional to the equity from the sale of John's flat. Ages: Sarah 26, John 24 Children: None, but hope to have three children before Sarah turns 35 Salary: $140,000 combined gross Sarah works as a graphic designer manager at an advertising agency and makes an annual salary of $65,000. Sarah plans to resign after her first child is born and do some freelance work! to supplement their income John is an accountant with a large regional firm and was fortunate to begin with a salary of $70,000 right out of college having passed his CPA exam. He currently makes $75,000. John would like Sarah to find a way to continue working full-time but Sarah estimates she will be able to make only $25,000 - $30,000 a year once they begin a family. Assets: 2424 Summit View Apt. 1024 2014 BMW 328i 2012 Jeep Cherokee John's 401k Sarah's 401k Savings/Emergency Fund Savings earmarked for home $210,000 (Est. Market value) $22,000 $15,000 $9,000 $16,000 $3,500 $15,000 Checking Account Home contents Jewelry Gun collection $1,250 $20,000 $12,000 $3,800 Liabilities: 2424 Summit View BMW 328i Sarah's school loan Bank of America Credit Card John's medical bills Home entertainment system $143,000 $15,000 $9,000 $5,000 $1,200 $2.500 (10 remaining months no interest) Monthly expenses: 2424 Summit View BMW 328i Sarah's school Loan B of A Credit Card Memorial Hospital Best Buy Utilities (avg.) Xfinity Verizon Homeowners dues Renters insurance Taxes Car insurance Charitable contributions Cash Savings 401k Contributions Life Insurance Flex Food and Supplies Clothing and Entertainment $1,650 (PITI) $325 $128 $215 $50 $250 $350 $176 $130 $250 $100 $3,600 (State and Federal) $120 $450 $500 $560 $100 ($250,000 on both John and Sarah, group and paid) $100 $1,750 $500 Specific Questions/Issues: 1. We would like to have at least $100.000 per year in today's dollars to provide for our retirement beginning at Sarah's and John's ages 67 and 65, respectively. Are we saving enough and is our plan doable? 2. How much should we be saving to prepare for Sarah's leaving work and for college? 3. Is our insurance coverage sufficient for our needs? Yes Sarah and John Riley Place of Residence: The Riley's live in downtown Denver, Colorado in a flat John bought me out of college with a down payment from his parents. They would like to purchase a larger home in the suburbs of Denver within the next five vears and have saved $15,000 to date earmarked for a down payment in additional to the equity from the sale of John's flat. Ages: Sarah 26, John 24 Children: None, but hope to have three children before Sarah turns 35 Salary: $140,000 combined gross Sarah works as a graphic designer manager at an advertising agency and makes an annual salary of $65,000. Sarah plans to resign after her first child is born and do some freelance work! to supplement their income John is an accountant with a large regional firm and was fortunate to begin with a salary of $70,000 right out of college having passed his CPA exam. He currently makes $75,000. John would like Sarah to find a way to continue working full-time but Sarah estimates she will be able to make only $25,000 - $30,000 a year once they begin a family. Assets: 2424 Summit View Apt. 1024 2014 BMW 328i 2012 Jeep Cherokee John's 401k Sarah's 401k Savings/Emergency Fund Savings earmarked for home $210,000 (Est. Market value) $22,000 $15,000 $9,000 $16,000 $3,500 $15,000 Checking Account Home contents Jewelry Gun collection $1,250 $20,000 $12,000 $3,800 Liabilities: 2424 Summit View BMW 328i Sarah's school loan Bank of America Credit Card John's medical bills Home entertainment system $143,000 $15,000 $9,000 $5,000 $1,200 $2.500 (10 remaining months no interest) Monthly expenses: 2424 Summit View BMW 328i Sarah's school Loan B of A Credit Card Memorial Hospital Best Buy Utilities (avg.) Xfinity Verizon Homeowners dues Renters insurance Taxes Car insurance Charitable contributions Cash Savings 401k Contributions Life Insurance Flex Food and Supplies Clothing and Entertainment $1,650 (PITI) $325 $128 $215 $50 $250 $350 $176 $130 $250 $100 $3,600 (State and Federal) $120 $450 $500 $560 $100 ($250,000 on both John and Sarah, group and paid) $100 $1,750 $500 Specific Questions/Issues: 1. We would like to have at least $100.000 per year in today's dollars to provide for our retirement beginning at Sarah's and John's ages 67 and 65, respectively. Are we saving enough and is our plan doable? 2. How much should we be saving to prepare for Sarah's leaving work and for college? 3. Is our insurance coverage sufficient for our needs? Yes