Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sarah graduated from High School. She is now deciding whether to enroll in a 2-year intensive course in information technology. The direct costs and

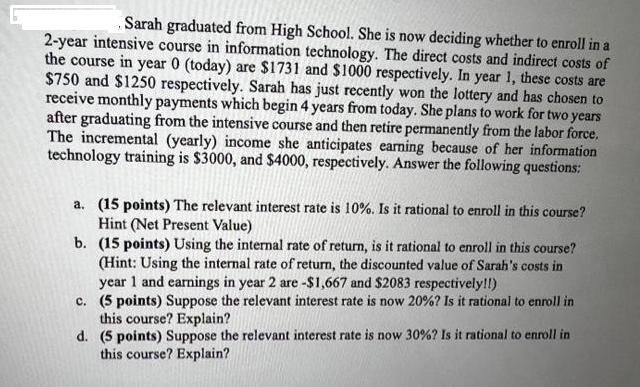

Sarah graduated from High School. She is now deciding whether to enroll in a 2-year intensive course in information technology. The direct costs and indirect costs of the course in year 0 (today) are $1731 and $1000 respectively. In year 1, these costs are $750 and $1250 respectively. Sarah has just recently won the lottery and has chosen to receive monthly payments which begin 4 years from today. She plans to work for two years after graduating from the intensive course and then retire permanently from the labor force. The incremental (yearly) income she anticipates earning because of her information technology training is $3000, and $4000, respectively. Answer the following questions: a. (15 points) The relevant interest rate is 10%. Is it rational to enroll in this course? Hint (Net Present Value) b. (15 points) Using the internal rate of return, is it rational to enroll in this course? (Hint: Using the internal rate of return, the discounted value of Sarah's costs in year 1 and earnings in year 2 are -$1,667 and $2083 respectively!!) c. (5 points) Suppose the relevant interest rate is now 20%? Is it rational to enroll in this course? Explain? d. (5 points) Suppose the relevant interest rate is now 30 %? Is it rational to enroll in this course? Explain?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the Net Present Value NPV and Internal Rate of Return IRR for Sarahs decision to enro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started