Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sarah, her husband and four young children live in Wellington. Sarah gets a lucrative job offer in London and the family decide to move

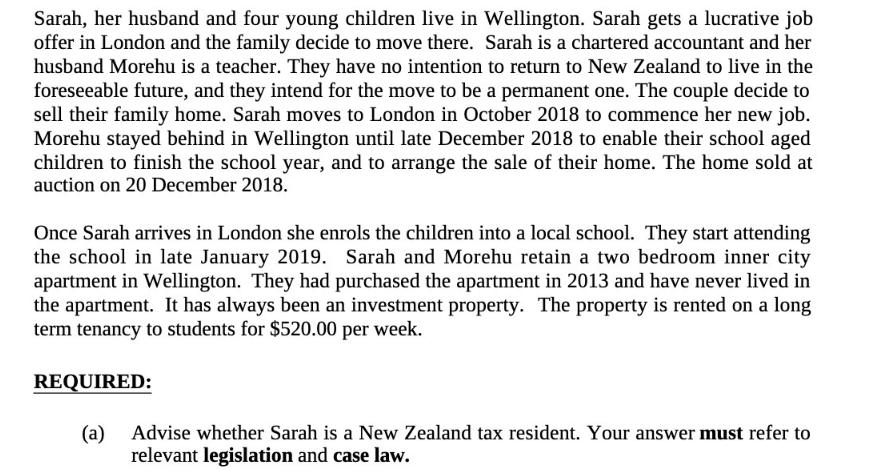

Sarah, her husband and four young children live in Wellington. Sarah gets a lucrative job offer in London and the family decide to move there. Sarah is a chartered accountant and her husband Morehu is a teacher. They have no intention to return to New Zealand to live in the foreseeable future, and they intend for the move to be a permanent one. The couple decide to sell their family home. Sarah moves to London in October 2018 to commence her new job. Morehu stayed behind in Wellington until late December 2018 to enable their school aged children to finish the school year, and to arrange the sale of their home. The home sold at auction on 20 December 2018. Once Sarah arrives in London she enrols the children into a local school. They start attending the school in late January 2019. Sarah and Morehu retain a two bedroom inner city apartment in Wellington. They had purchased the apartment in 2013 and have never lived in the apartment. It has always been an investment property. The property is rented on a long term tenancy to students for $520.00 per week. REQUIRED: (a) Advise whether Sarah is a New Zealand tax resident. Your answer must refer to relevant legislation and case law.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

In order to determine Sarahs tax residency status in New Zealand we need to consider the relevant le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started