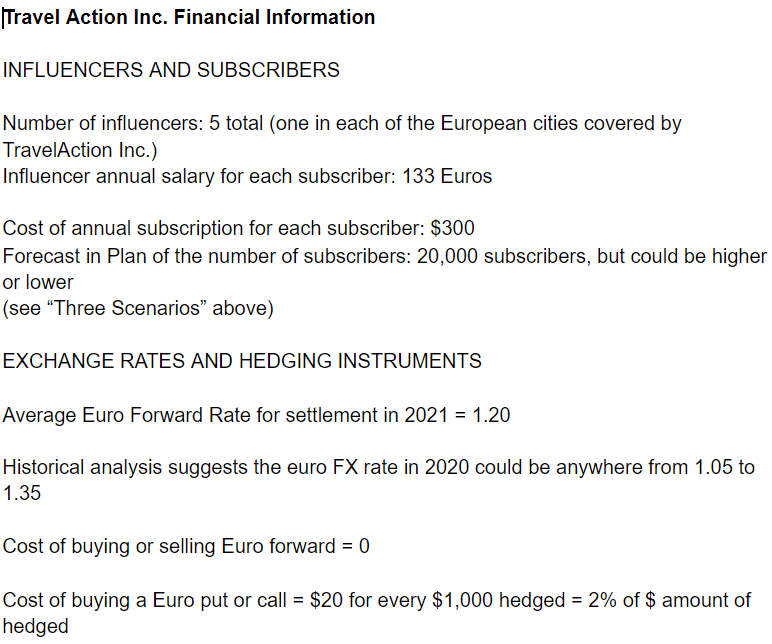

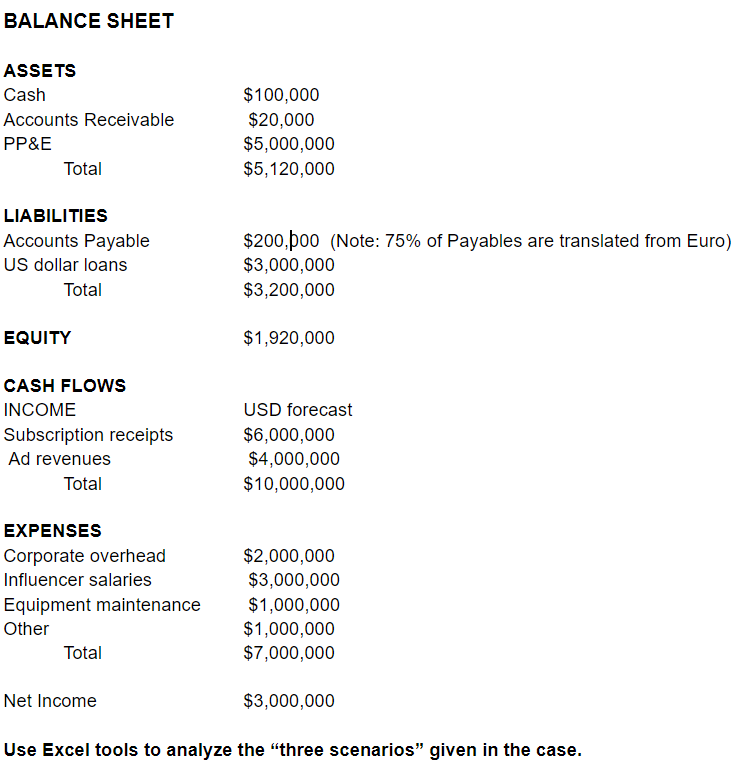

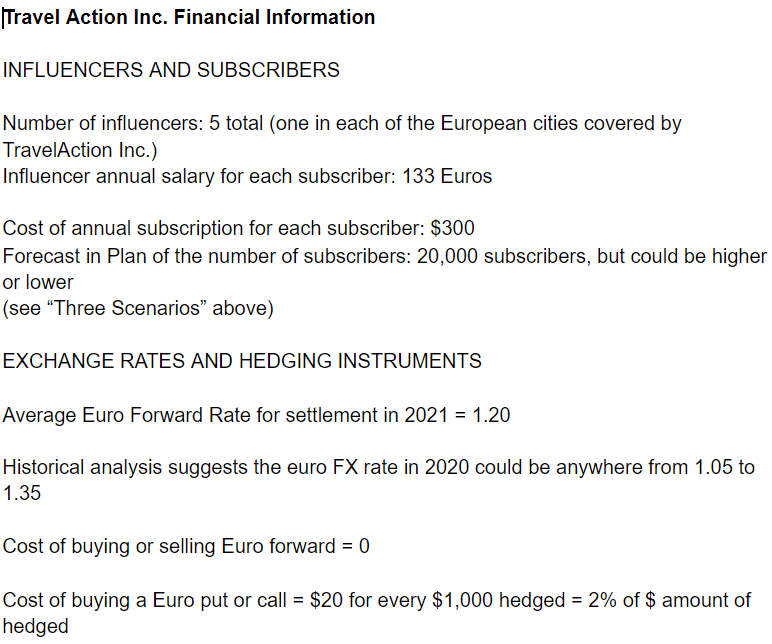

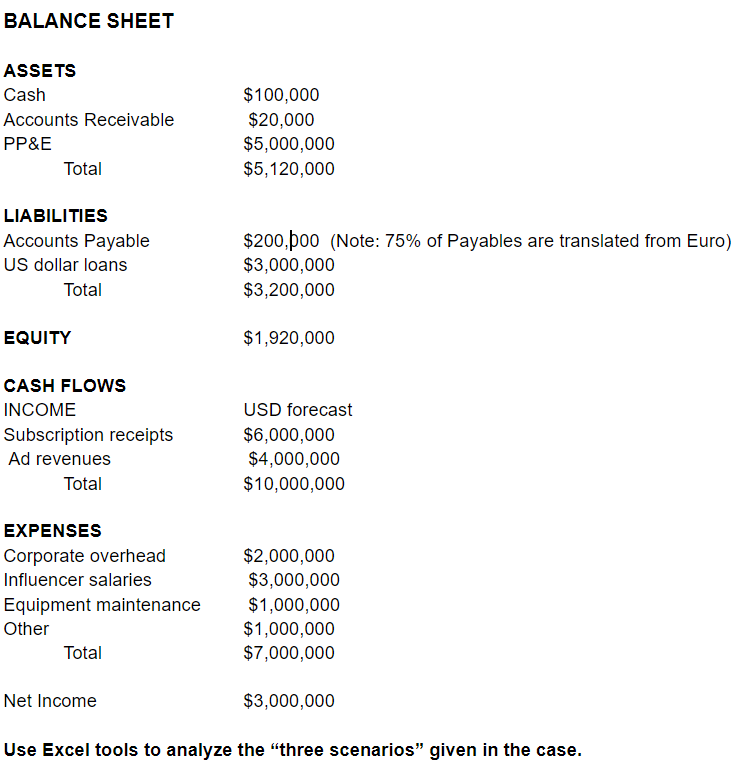

Sarah Jones, Vice President and Treasurer of TravelAction Inc., is returning from a short beach vacation with her family and jogging quickly up the escalator to her Manhattan office. The business planning cycle looms ahead, making the summer vacation period seem like a distant memory. The date is September 15, 2021. The 2022 Financial Plan needs to be finalized by the end of the month. The Plan, compiled by business management, will provide a view of all revenues, costs, and resulting business profits within the business of TravelAction Inc. in 2022. Management will be held accountable for achieving these results, and possibly rewarded with large bonuses for exceeding the Plan, or punished with low bonuses for underperforming the Plan. Sarah and her treasury team do not have the responsibility of developing the Plan, but instead have the responsibility to identify and fecommend how to manage the foreign exchange exposures within the Plan. In prior years the foreign exchange exposures were left unmanaged, but in this planning cycle the company is considering putting in place hedges to manage the exposures. Sarah does not have experience managing foreign exchange exposures with derivatives, and she has hired you to put together a proposal for how to best manage the exposures. This might include using options, forwards, or a combination of options and forwards, or any other hedging tools or strategies. Sarah and her treasury team are concerned about three types of foreign exchange exposures in the Plan, and she is looking for your recommendations. Three exposures; Competitive Exposures, Translation exposures, Transaction Exposures Three Scenarios: Management has indicated that although the forecasted number of subscribers is 20,000, the actual number may be as few as 10,000 or as high as 40,000. Your hedging recommendation to management should include how your hedging plan will be impacted by these three possible amounts of subscribers in the actual business results. Travel Action Inc. Financial Information INFLUENCERS AND SUBSCRIBERS Number of influencers: 5 total (one in each of the European cities covered by TravelAction Inc.) Influencer annual salary for each subscriber: 133 Euros Cost of annual subscription for each subscriber: $300 Forecast in Plan of the number of subscribers: 20,000 subscribers, but could be higher or lower (see "Three Scenarios" above) EXCHANGE RATES AND HEDGING INSTRUMENTS Average Euro Forward Rate for settlement in 2021 = 1.20 Historical analysis suggests the euro FX rate in 2020 could be anywhere from 1.05 to 1.35 Cost of buying or selling Euro forward = 0 Cost of buying a Euro put or call = $20 for every $1,000 hedged = 2% of $ amount of hedged BALANCE SHEET ASSETS Cash Accounts Receivable PP&E Total $100,000 $20,000 $5,000,000 $5,120,000 LIABILITIES Accounts Payable US dollar loans Total $200,(Note: 75% of Payables are translated from Euro) $3,000,000 $3,200,000 EQUITY $1,920,000 CASH FLOWS INCOME Subscription receipts Ad revenues Total USD forecast $6,000,000 $4,000,000 $10,000,000 EXPENSES Corporate overhead Influencer salaries Equipment maintenance Other Total $2,000,000 $3,000,000 $1,000,000 $1,000,000 $7,000,000 Net Income $3,000,000 Use Excel tools to analyze the "three scenarios" given in the case. Sarah Jones, Vice President and Treasurer of TravelAction Inc., is returning from a short beach vacation with her family and jogging quickly up the escalator to her Manhattan office. The business planning cycle looms ahead, making the summer vacation period seem like a distant memory. The date is September 15, 2021. The 2022 Financial Plan needs to be finalized by the end of the month. The Plan, compiled by business management, will provide a view of all revenues, costs, and resulting business profits within the business of TravelAction Inc. in 2022. Management will be held accountable for achieving these results, and possibly rewarded with large bonuses for exceeding the Plan, or punished with low bonuses for underperforming the Plan. Sarah and her treasury team do not have the responsibility of developing the Plan, but instead have the responsibility to identify and fecommend how to manage the foreign exchange exposures within the Plan. In prior years the foreign exchange exposures were left unmanaged, but in this planning cycle the company is considering putting in place hedges to manage the exposures. Sarah does not have experience managing foreign exchange exposures with derivatives, and she has hired you to put together a proposal for how to best manage the exposures. This might include using options, forwards, or a combination of options and forwards, or any other hedging tools or strategies. Sarah and her treasury team are concerned about three types of foreign exchange exposures in the Plan, and she is looking for your recommendations. Three exposures; Competitive Exposures, Translation exposures, Transaction Exposures Three Scenarios: Management has indicated that although the forecasted number of subscribers is 20,000, the actual number may be as few as 10,000 or as high as 40,000. Your hedging recommendation to management should include how your hedging plan will be impacted by these three possible amounts of subscribers in the actual business results. Travel Action Inc. Financial Information INFLUENCERS AND SUBSCRIBERS Number of influencers: 5 total (one in each of the European cities covered by TravelAction Inc.) Influencer annual salary for each subscriber: 133 Euros Cost of annual subscription for each subscriber: $300 Forecast in Plan of the number of subscribers: 20,000 subscribers, but could be higher or lower (see "Three Scenarios" above) EXCHANGE RATES AND HEDGING INSTRUMENTS Average Euro Forward Rate for settlement in 2021 = 1.20 Historical analysis suggests the euro FX rate in 2020 could be anywhere from 1.05 to 1.35 Cost of buying or selling Euro forward = 0 Cost of buying a Euro put or call = $20 for every $1,000 hedged = 2% of $ amount of hedged BALANCE SHEET ASSETS Cash Accounts Receivable PP&E Total $100,000 $20,000 $5,000,000 $5,120,000 LIABILITIES Accounts Payable US dollar loans Total $200,(Note: 75% of Payables are translated from Euro) $3,000,000 $3,200,000 EQUITY $1,920,000 CASH FLOWS INCOME Subscription receipts Ad revenues Total USD forecast $6,000,000 $4,000,000 $10,000,000 EXPENSES Corporate overhead Influencer salaries Equipment maintenance Other Total $2,000,000 $3,000,000 $1,000,000 $1,000,000 $7,000,000 Net Income $3,000,000 Use Excel tools to analyze the "three scenarios" given in the case