Answered step by step

Verified Expert Solution

Question

1 Approved Answer

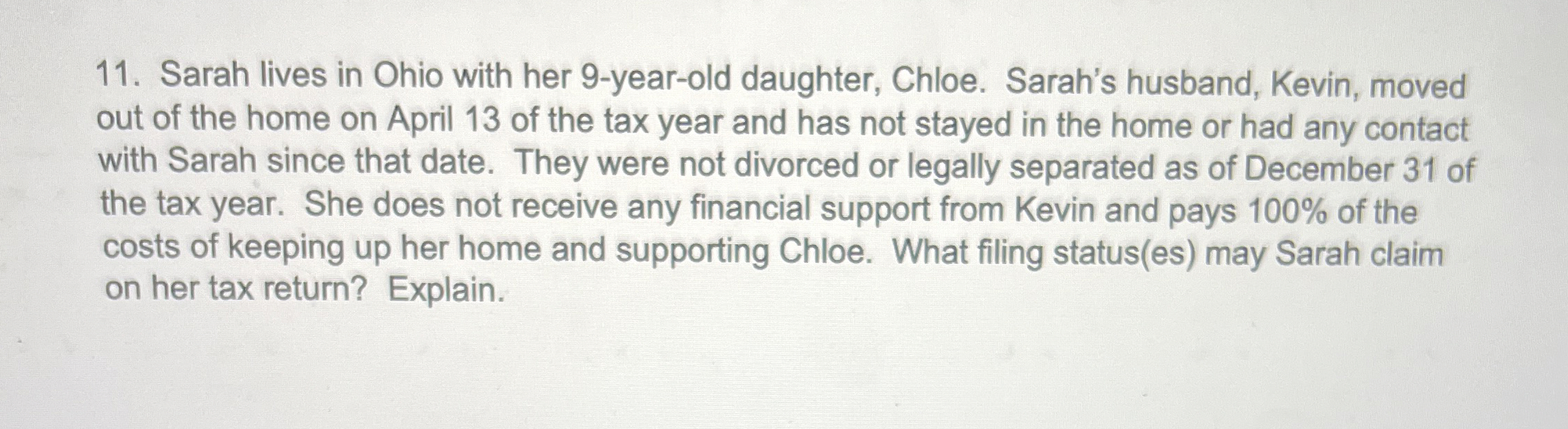

Sarah lives in Ohio with her 9 - year - old daughter, Chloe. Sarah's husband, Kevin, moved out of the home on April 1 3

Sarah lives in Ohio with her yearold daughter, Chloe. Sarah's husband, Kevin, moved

out of the home on April of the tax year and has not stayed in the home or had any contact

with Sarah since that date. They were not divorced or legally separated as of December of

the tax year. She does not receive any financial support from Kevin and pays of the

costs of keeping up her home and supporting Chloe. What filing statuses may Sarah claim

on her tax return? Use Tax Year. Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started