Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sarah was an equal partner in the Highgrove Partnership, which she established with Kate as equal partners in 1983. The partnership carried on a

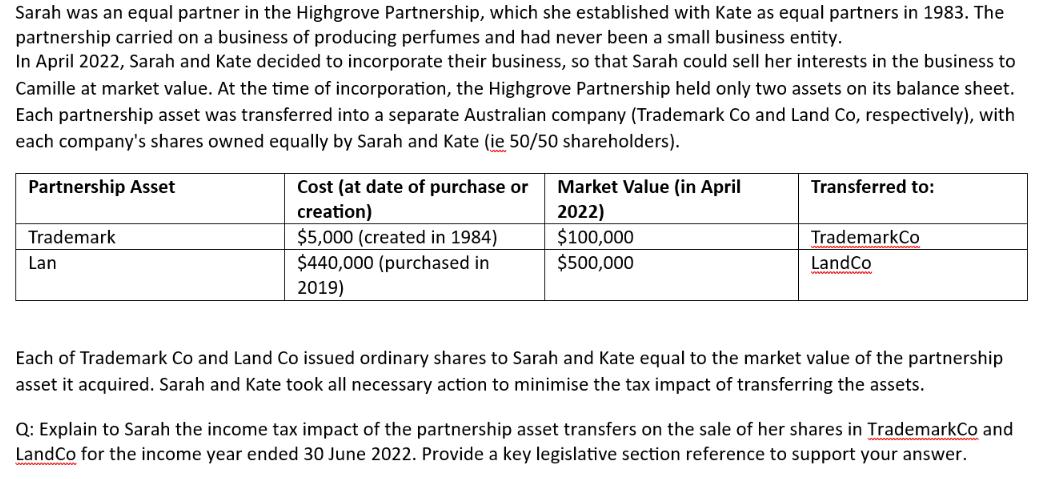

Sarah was an equal partner in the Highgrove Partnership, which she established with Kate as equal partners in 1983. The partnership carried on a business of producing perfumes and had never been a small business entity. In April 2022, Sarah and Kate decided to incorporate their business, so that Sarah could sell her interests in the business to Camille at market value. At the time of incorporation, the Highgrove Partnership held only two assets on its balance sheet. Each partnership asset was transferred into a separate Australian company (Trademark Co and Land Co, respectively), with each company's shares owned equally by Sarah and Kate (ie 50/50 shareholders). Partnership Asset Trademark Lan Cost (at date of purchase or creation) $5,000 (created in 1984) $440,000 (purchased in 2019) Market Value (in April 2022) $100,000 $500,000 Transferred to: TrademarkCo LandCo Each of Trademark Co and Land Co issued ordinary shares to Sarah and Kate equal to the market value of the partnership asset it acquired. Sarah and Kate took all necessary action to minimise the tax impact of transferring the assets. Q: Explain to Sarah the income tax impact of the partnership asset transfers on the sale of her shares in TrademarkCo and LandCo for the income year ended 30 June 2022. Provide a key legislative section reference to support your answer.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The income tax impact of the partnership asset transfers on the sale of Sarahs shares in TrademarkCo ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started