Answered step by step

Verified Expert Solution

Question

1 Approved Answer

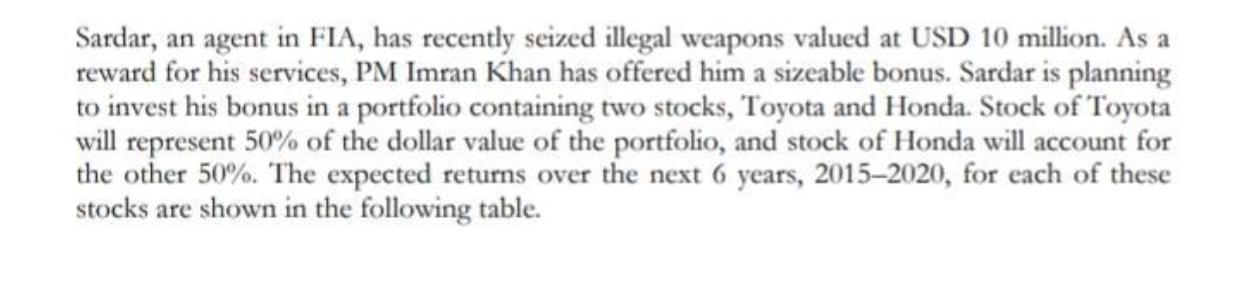

Sardar, an agent in FIA, has recently seized illegal weapons valued at USD 10 million. As a reward for his services, PM Imran Khan

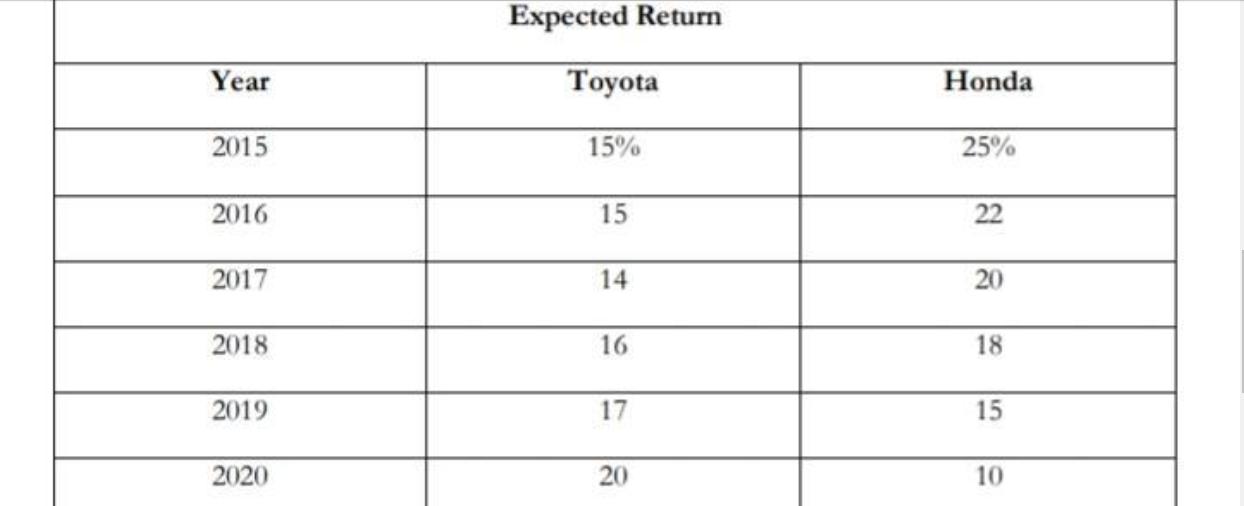

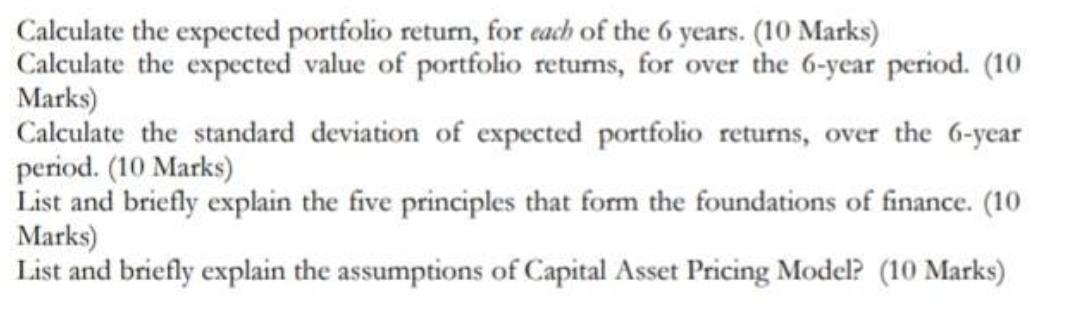

Sardar, an agent in FIA, has recently seized illegal weapons valued at USD 10 million. As a reward for his services, PM Imran Khan has offered him a sizeable bonus. Sardar is planning to invest his bonus in a portfolio containing two stocks, Toyota and Honda. Stock of Toyota will represent 50% of the dollar value of the portfolio, and stock of Honda will account for the other 50%. The expected returns over the next 6 years, 2015-2020, for each of these stocks are shown in the following table. Year 2015 2016 2017 2018 2019 2020 Expected Return Toyota 15% 15 14 16 17 20 Honda 25% 22 20 18 15 10 Calculate the expected portfolio return, for each of the 6 years. (10 Marks) Calculate the expected value of portfolio returns, for over the 6-year period. (10 Marks) Calculate the standard deviation of expected portfolio returns, over the 6-year period. (10 Marks) List and briefly explain the five principles that form the foundations of finance. (10 Marks) List and briefly explain the assumptions of Capital Asset Pricing Model? (10 Marks)

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected portfolio return for each of the 6 years we need to multiply the weight of each stock by its expected return Year 2015 Expected Portfolio Return Weight of Toyota Expected Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started