Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sardelli City plans to begin and complete construction of a new library during its fiscal year ending December 31, 2014. Record the transactions, identified

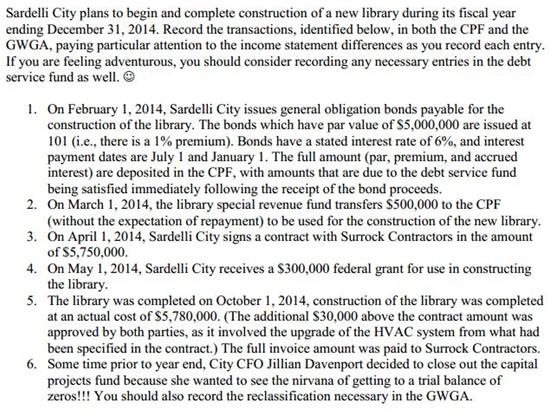

Sardelli City plans to begin and complete construction of a new library during its fiscal year ending December 31, 2014. Record the transactions, identified below, in both the CPF and the GWGA, paying particular attention to the income statement differences as you record each entry. If you are feeling adventurous, you should consider recording any necessary entries in the debt service fund as well. 1. On February 1, 2014, Sardelli City issues general obligation bonds payable for the construction of the library. The bonds which have par value of $5,000,000 are issued at 101 (i.e., there is a 1% premium). Bonds have a stated interest rate of 6%, and interest payment dates are July 1 and January 1. The full amount (par, premium, and accrued interest) are deposited in the CPF, with amounts that are due to the debt service fund being satisfied immediately following the receipt of the bond proceeds. 2. On March 1, 2014, the library special revenue fund transfers $500,000 to the CPF (without the expectation of repayment) to be used for the construction of the new library. 3. On April 1, 2014, Sardelli City signs a contract with Surrock Contractors in the amount of $5,750,000. 4. On May 1, 2014, Sardelli City receives a $300,000 federal grant for use in constructing the library. 5. The library was completed on October 1, 2014, construction of the library was completed at an actual cost of $5,780,000. (The additional $30,000 above the contract amount was approved by both parties, as it involved the upgrade of the HVAC system from what had been specified in the contract.) The full invoice amount was paid to Surrock Contractors. 6. Some time prior to year end, City CFO Jillian Davenport decided to close out the capital projects fund because she wanted to see the nirvana of getting to a trial balance of zeros!!! You should also record the reclassification necessary in the GWGA.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 CPF Debit General Obligation Bonds Payable 5005000 Credit Cash 5005000 Debit Accrued I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started