Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SAS is a Telecommunications company that commenced trading in 2010 in the country of Ambrosia. In 2016 it created a similar division in the country

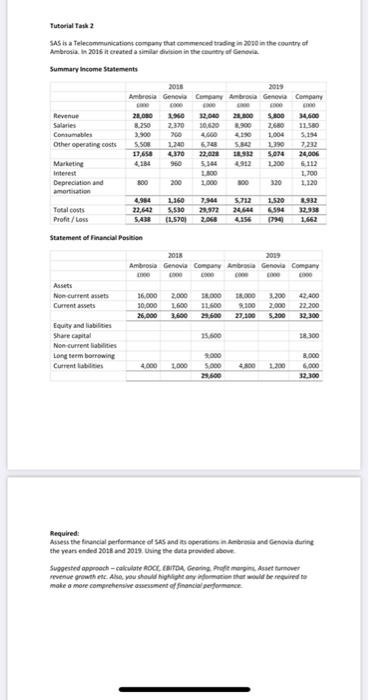

SAS is a Telecommunications company that commenced trading in 2010 in the country of Ambrosia. In 2016 it created a similar division in the country of Genovia.

Summary Income Statements

Ambrosia

000

28,080

8,250 3,900 5,508 17,658 4,184

800

4,984 22,642 5,438

2018 2019

Genovia Company Ambrosia Genovia Company

Revenue

Salaries

Consumables

Other operating costs

Marketing Interest

Depreciation and amortisation

Total costs Profit / Loss

000

3,960

2,370 760 1,240 4,370 960

200

1,160

5,530 (1,570)

2018 Genovia 000

2,000 1,600 3,600

1,000

000

32,040

10,620 4,660 6,748 22,028 5,144 1,800 1,000

7,944 29,972 2,068

Company

000

18,000 11,600 29,600

15,600

9,000

5,000

29,600

000

28,800

8,900 4,190 5,842 18,932 4,912

800

5,712 24,644 4,156

Ambrosia

000

18,000 9,100 27,100

4,800

000

5,800

2,680 1,004 1,390 5,074 1,200

320

1,520 6,594 (794)

2019 Genovia 000

3,200 2,000 5,200

1,200

000

34,600

11,580 5,194 7,232 24,006 6,112 1,700 1,120

8,932 32,938 1,662

Company

000

42,400 22,200 32,300

18,300

8,000

6,000

32,300

Statement of Financial Position

Assets Non-current assets Current assets

Equity and liabilities Share capital Non-current liabilities Long term borrowing Current liabilities

Ambrosia

000

16,000 10,000 26,000

4,000

Required:

Assess the financial performance of SAS and its operations in Ambrosia and Genovia during the years ended 2018 and 2019. Using the data provided above.

Suggested approach calculate ROCE, EBITDA, Gearing, Profit margins, Asset turnover revenue growth etc. Also, you should highlight any information that would be required to make a more comprehensive assessment of financial performance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started