Question

Sasha Do is reviewing the financial statement of company AAA in order to estimate and analyse the company's performance for 2020. The following items are

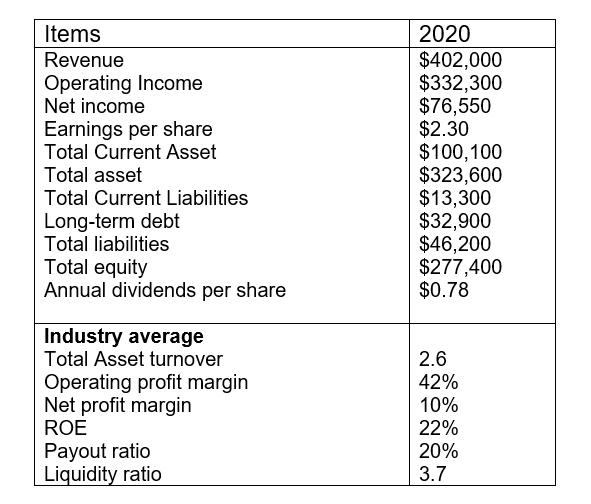

Sasha Do is reviewing the financial statement of company AAA in order to estimate and analyse the company's performance for 2020. The following items are extracts from AAA's income statement and balance sheet.

(a)

Identify and calculate DuPont components.

(b)

Determine the ROE for the year based on DuPont Components and calculate the company's plowback rate.

(c)

Calculate the company's plowback rate. Calculate the sustainable growth rate based on the firm's ROE and plowback rate.

(d)

List all the ratios side by side against the backdrop of the industry's performance shown in the above table; provide helpful comments on the company's performance.

Items Revenue Operating Income Net income Earnings per share Total Current Asset Total asset Total Current Liabilities Long-term debt Total liabilities Total equity Annual dividends per share Industry average Total Asset turnover Operating profit margin Net profit margin ROE Payout ratio Liquidity ratio 2020 $402,000 $332,300 $76,550 $2.30 $100,100 $323,600 $13,300 $32,900 $46,200 $277,400 $0.78 2.6 42% 10% 22% 20% 3.7

Step by Step Solution

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started