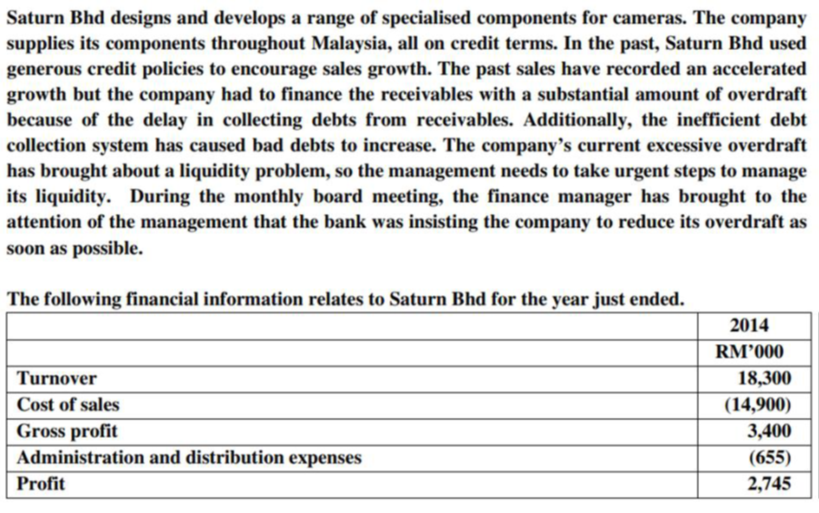

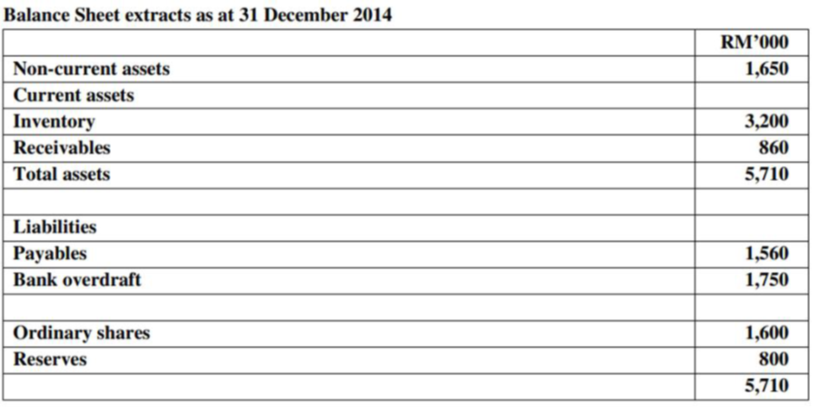

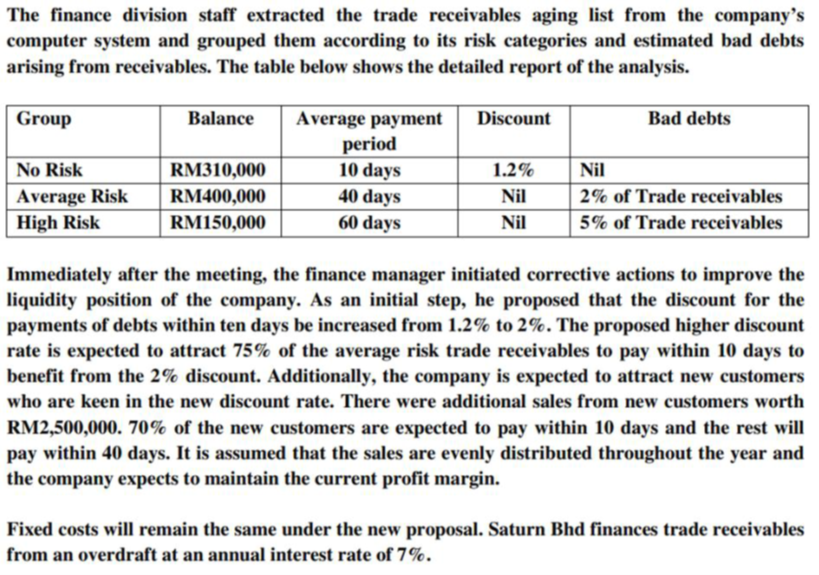

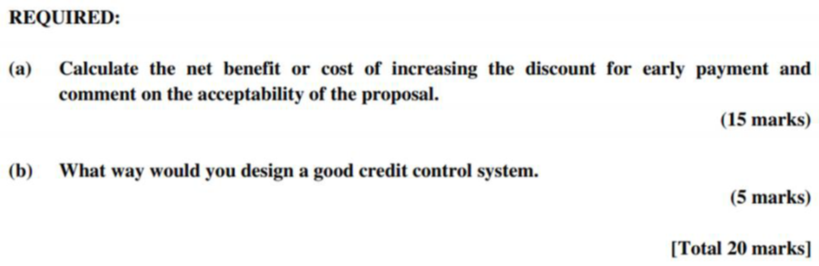

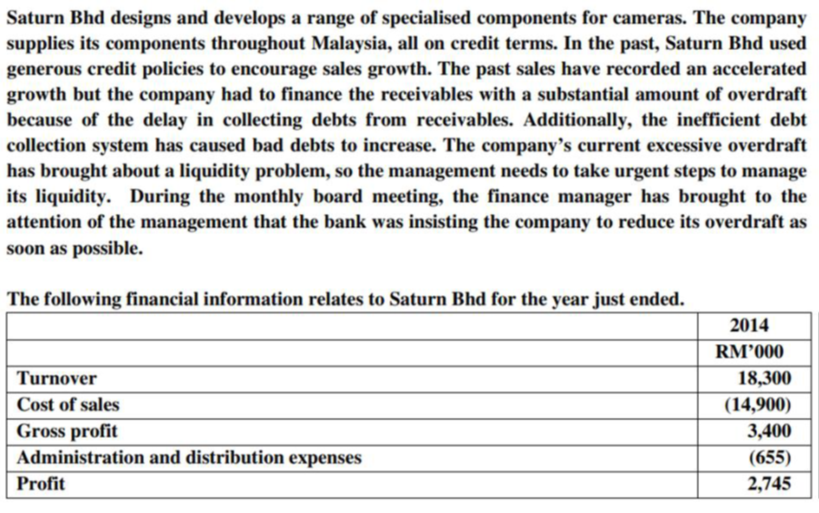

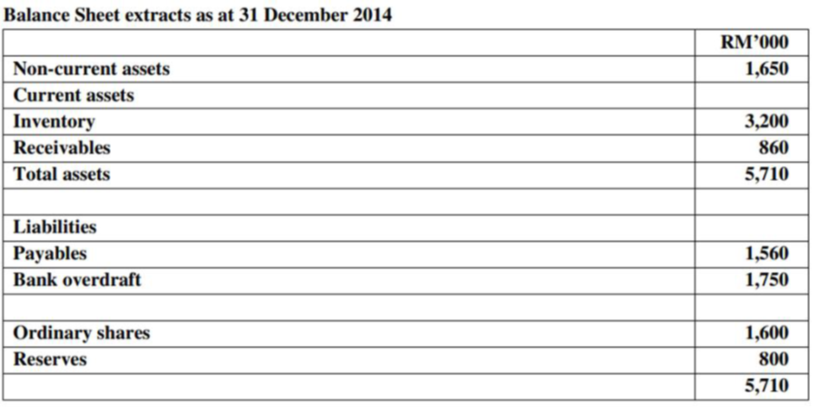

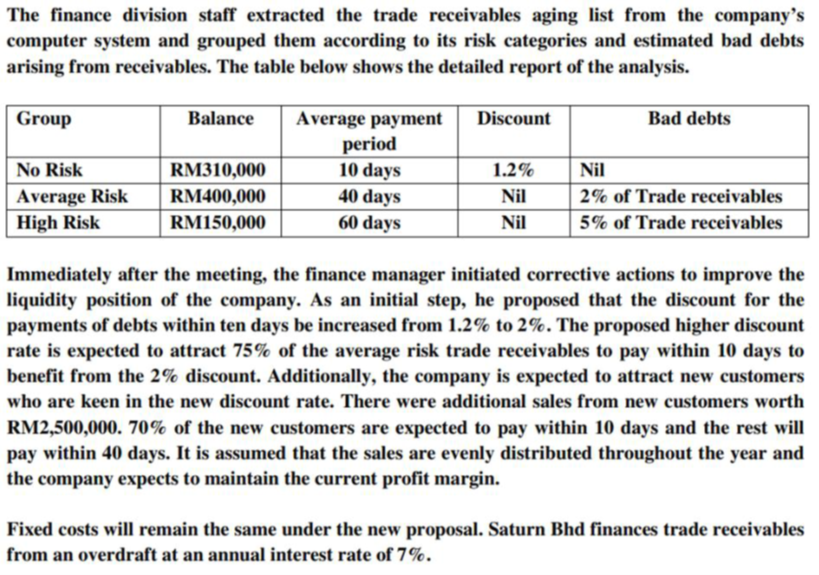

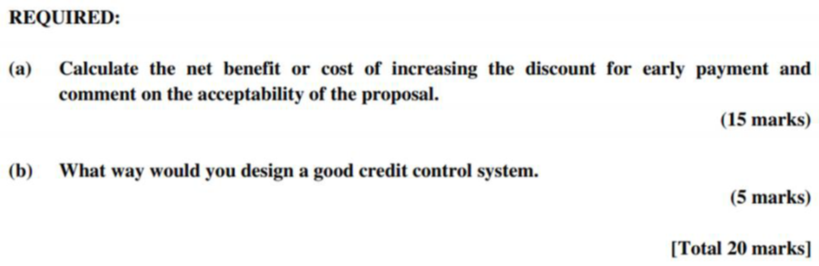

Saturn Bhd designs and develops a range of specialised components for cameras. The company supplies its components throughout Malaysia, all on credit terms. In the past, Saturn Bhd used generous credit policies to encourage sales growth. The past sales have recorded an accelerated growth but the company had to finance the receivables with a substantial amount of overdraft because of the delay in collecting debts from receivables. Additionally, the inefficient debt collection system has caused bad debts to increase. The company's current excessive overdraft has brought about a liquidity problem, so the management needs to take urgent steps to manage its liquidity. During the monthly board meeting, the finance manager has brought to the attention of the management that the bank was insisting the company to reduce its overdraft as soon as possible. Danan CL The finance division staff extracted the trade receivables aging list from the company's computer system and grouped them according to its risk categories and estimated bad debts arising from receivables. The table below shows the detailed report of the analysis. Immediately after the meeting, the finance manager initiated corrective actions to improve the liquidity position of the company. As an initial step, he proposed that the discount for the payments of debts within ten days be increased from 1.2% to 2%. The proposed higher discount rate is expected to attract 75% of the average risk trade receivables to pay within 10 days to benefit from the 2% discount. Additionally, the company is expected to attract new customers who are keen in the new discount rate. There were additional sales from new customers worth RM2,500,000. 70% of the new customers are expected to pay within 10 days and the rest will pay within 40 days. It is assumed that the sales are evenly distributed throughout the year and the company expects to maintain the current profit margin. Fixed costs will remain the same under the new proposal. Saturn Bhd finances trade receivables from an overdraft at an annual interest rate of 7%. (a) Calculate the net benefit or cost of increasing the discount for early payment and comment on the acceptability of the proposal. (15 marks) (b) What way would you design a good credit control system. (5 marks) [Total 20 marks] Saturn Bhd designs and develops a range of specialised components for cameras. The company supplies its components throughout Malaysia, all on credit terms. In the past, Saturn Bhd used generous credit policies to encourage sales growth. The past sales have recorded an accelerated growth but the company had to finance the receivables with a substantial amount of overdraft because of the delay in collecting debts from receivables. Additionally, the inefficient debt collection system has caused bad debts to increase. The company's current excessive overdraft has brought about a liquidity problem, so the management needs to take urgent steps to manage its liquidity. During the monthly board meeting, the finance manager has brought to the attention of the management that the bank was insisting the company to reduce its overdraft as soon as possible. Danan CL The finance division staff extracted the trade receivables aging list from the company's computer system and grouped them according to its risk categories and estimated bad debts arising from receivables. The table below shows the detailed report of the analysis. Immediately after the meeting, the finance manager initiated corrective actions to improve the liquidity position of the company. As an initial step, he proposed that the discount for the payments of debts within ten days be increased from 1.2% to 2%. The proposed higher discount rate is expected to attract 75% of the average risk trade receivables to pay within 10 days to benefit from the 2% discount. Additionally, the company is expected to attract new customers who are keen in the new discount rate. There were additional sales from new customers worth RM2,500,000. 70% of the new customers are expected to pay within 10 days and the rest will pay within 40 days. It is assumed that the sales are evenly distributed throughout the year and the company expects to maintain the current profit margin. Fixed costs will remain the same under the new proposal. Saturn Bhd finances trade receivables from an overdraft at an annual interest rate of 7%. (a) Calculate the net benefit or cost of increasing the discount for early payment and comment on the acceptability of the proposal. (15 marks) (b) What way would you design a good credit control system. (5 marks) [Total 20 marks]