Answered step by step

Verified Expert Solution

Question

1 Approved Answer

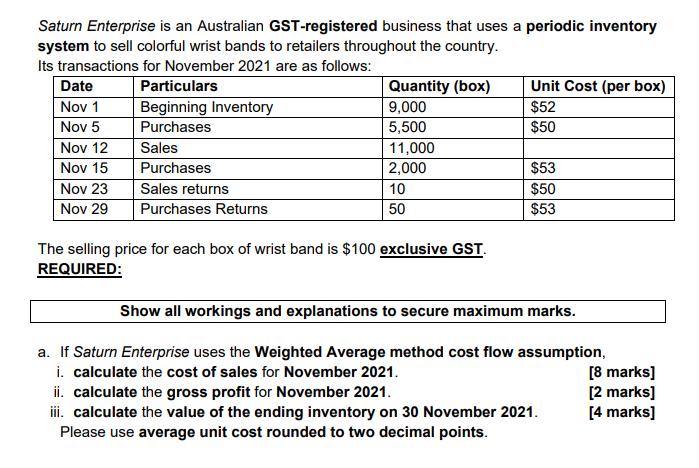

Saturn Enterprise is an Australian GST-registered business that uses a periodic inventory system to sell colorful wrist bands to retailers throughout the country. Its

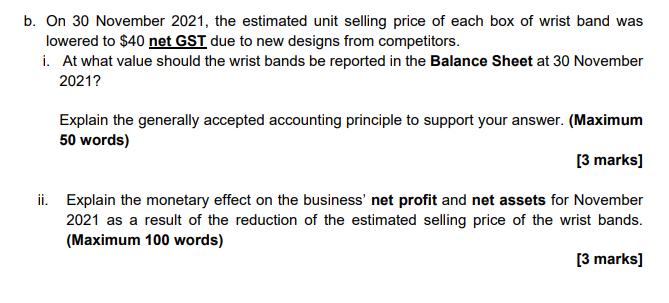

Saturn Enterprise is an Australian GST-registered business that uses a periodic inventory system to sell colorful wrist bands to retailers throughout the country. Its transactions for November 2021 are as follows: Date Particulars Quantity (box) Unit Cost (per box) Beginning Inventory Purchases Nov 1 9,000 $52 Nov 5 5,500 $50 Nov 12 Sales 11,000 Nov 15 Purchases 2,000 $53 Nov 23 Nov 29 Sales returns 10 $50 Purchases Returns 50 $53 The selling price for each box of wrist band is $100 exclusive GST. REQUIRED: Show all workings and explanations to secure maximum marks. a. If Saturn Enterprise uses the Weighted Average method cost flow assumption, i. calculate the cost of sales for November 2021. ii. calculate the gross profit for November 2021. i. calculate the value of the ending inventory on 30 November 2021. Please use average unit cost rounded to two decimal points. [8 marks] [2 marks] [4 marks] b. On 30 November 2021, the estimated unit selling price of each box of wrist band was lowered to $40 net GST due to new designs from competitors. i. At what value should the wrist bands be reported in the Balance Sheet at 30 November 2021? Explain the generally accepted accounting principle to support your answer. (Maximum 50 words) [3 marks] ii. Explain the monetary effect on the business' net profit and net assets for November 2021 as a result of the reduction of the estimated selling price of the wrist bands. (Maximum 100 words) [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

As per IAS 2 the cost of inventory is calculated using the FIFO method or Weighted average cost meth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started