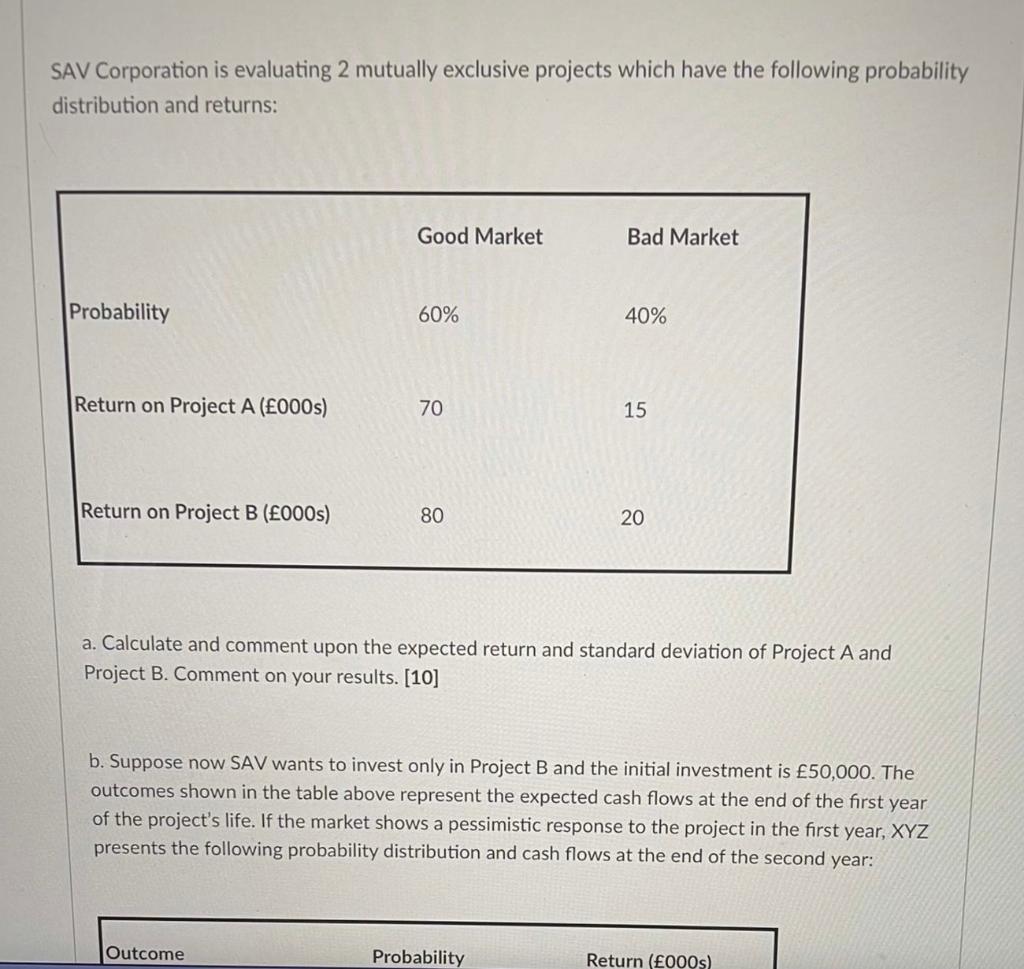

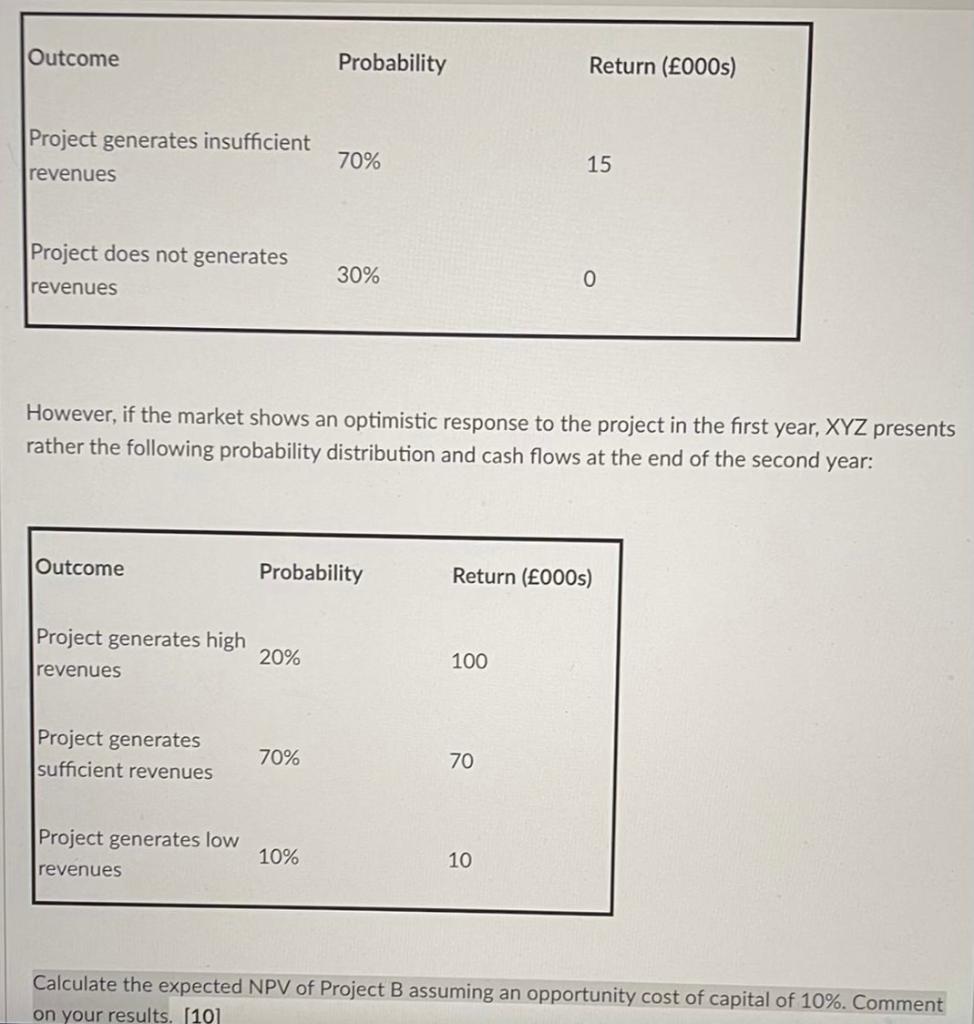

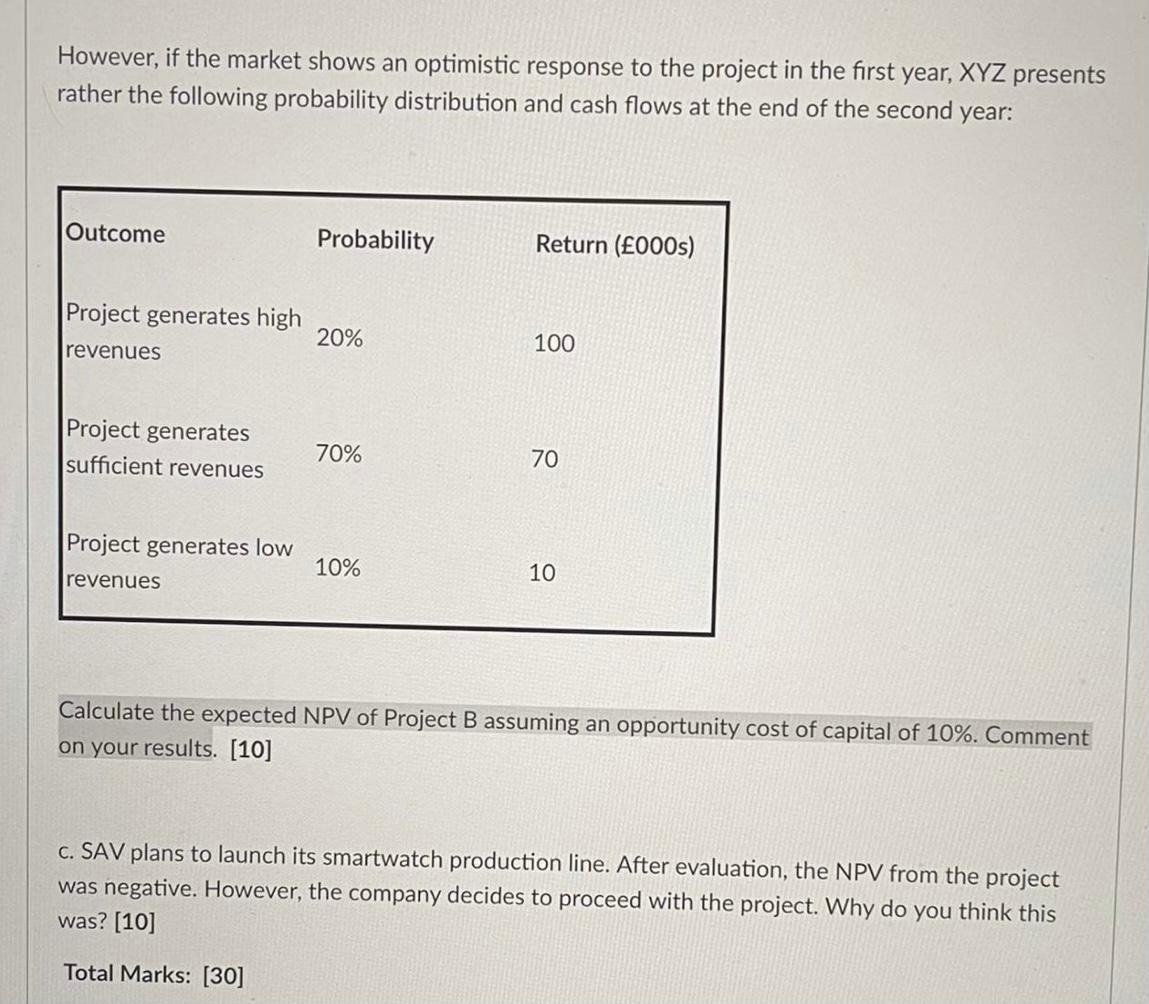

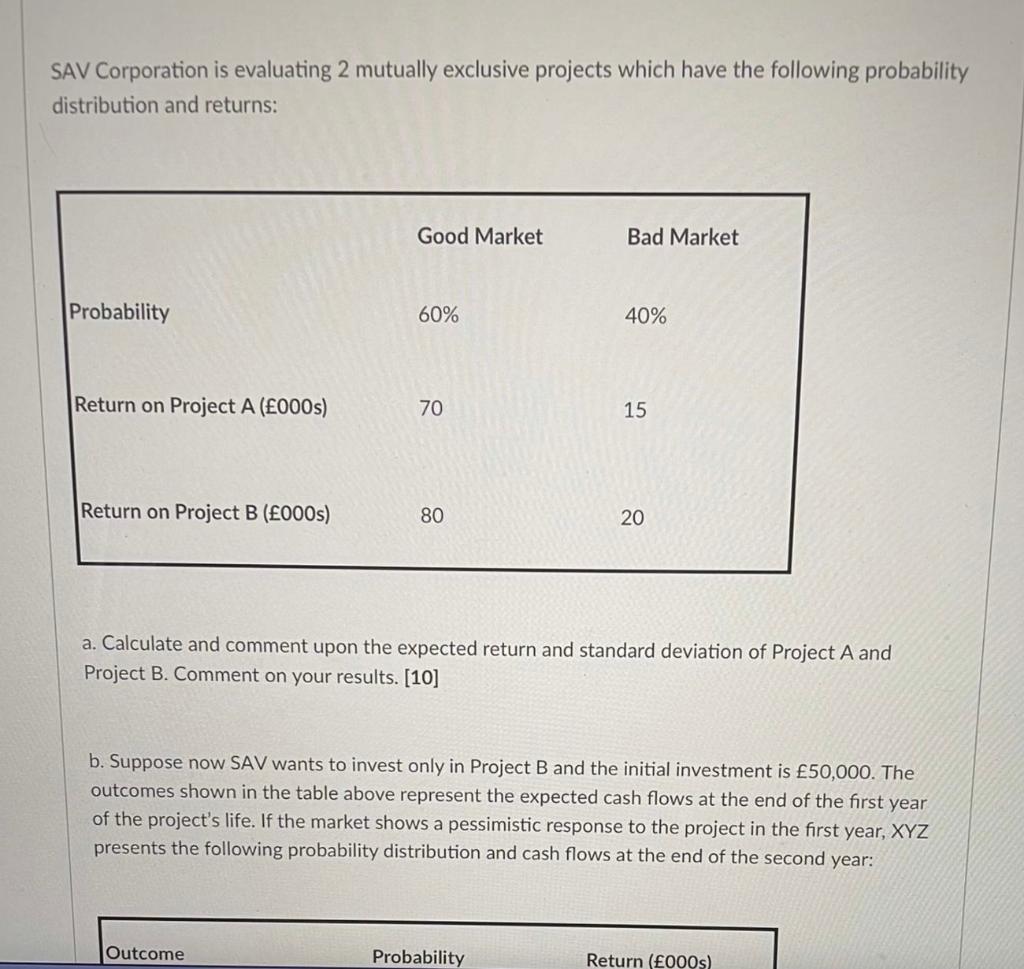

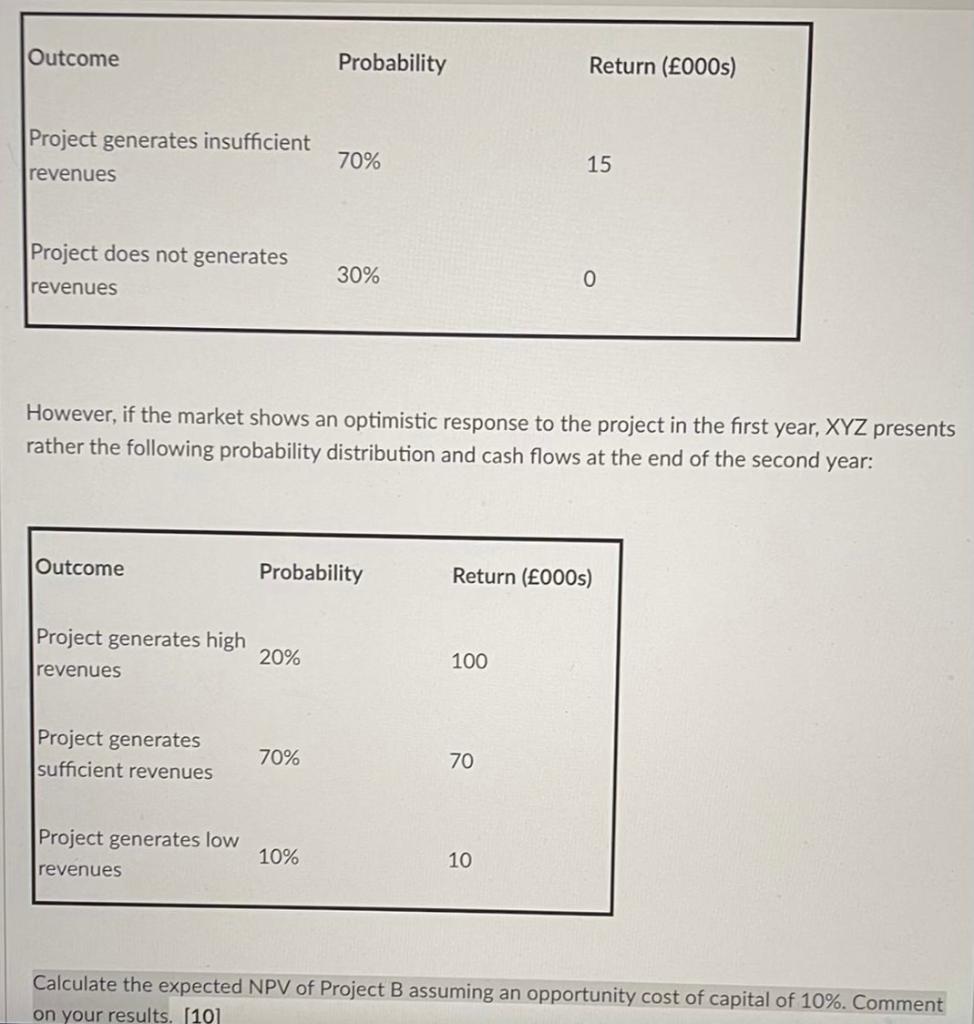

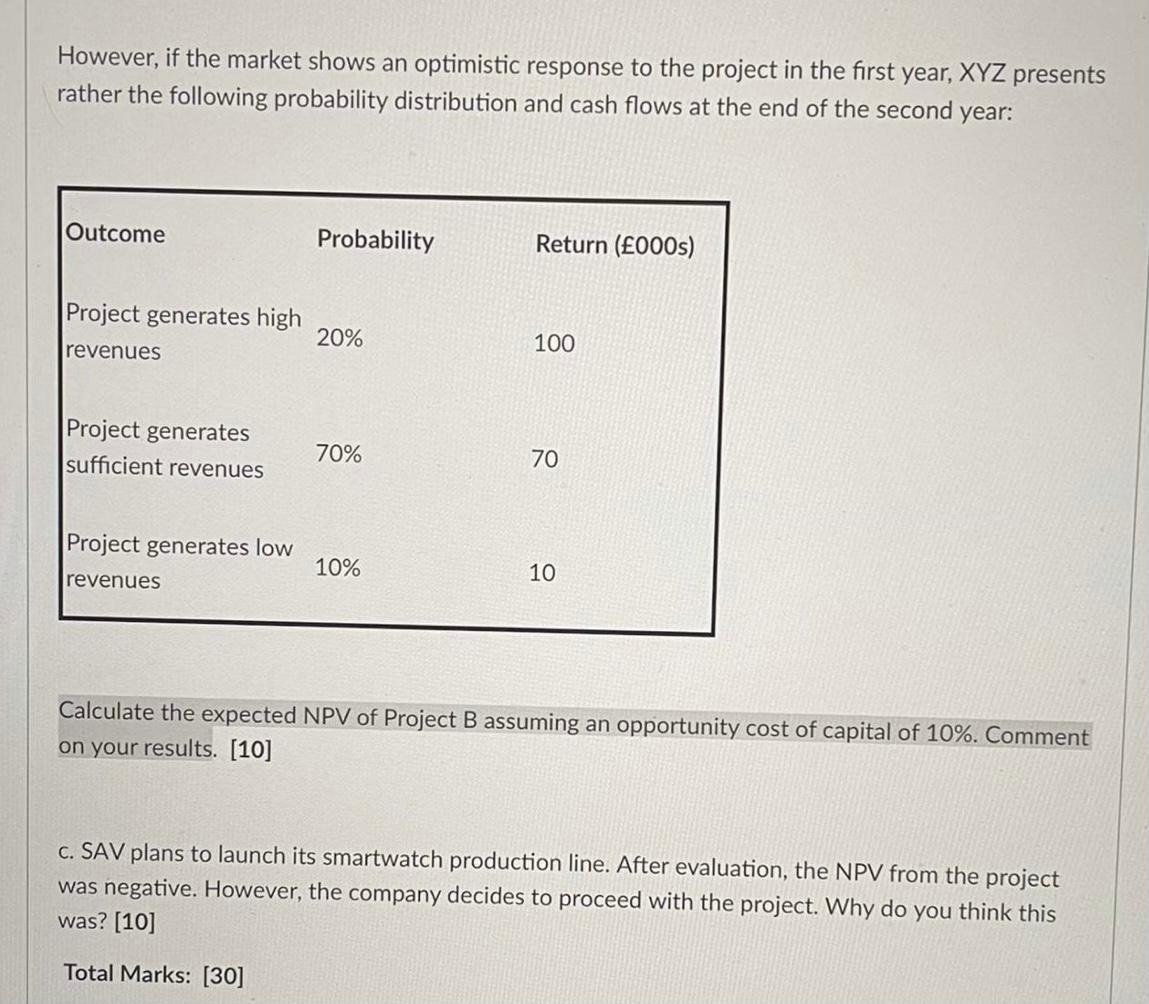

SAV Corporation is evaluating 2 mutually exclusive projects which have the following probability distribution and returns: Good Market Bad Market Probability 60% 40% Return on Project A (000s) 70 15 Return on Project B (000s) 80 20 a. Calculate and comment upon the expected return and standard deviation of Project A and Project B. Comment on your results. [10] b. Suppose now SAV wants to invest only in Project B and the initial investment is 50,000. The outcomes shown in the table above represent the expected cash flows at the end of the first year of the project's life. If the market shows a pessimistic response to the project in the first year, XYZ presents the following probability distribution and cash flows at the end of the second year: Outcome Probability Return (000s) Outcome Probability Return (000s) Project generates insufficient 70% 15 revenues Project does not generates 30% 0 revenues However, if the market shows an optimistic response to the project in the first year, XYZ presents rather the following probability distribution and cash flows at the end of the second year: Outcome Probability Return (000s) Project generates high 20% 100 revenues Project generates 70% 70 sufficient revenues Project generates low 10% 10 revenues Calculate the expected NPV of Project B assuming an opportunity cost of capital of 10%. Comment on your results. [10] However, if the market shows an optimistic response to the project in the first year, XYZ presents rather the following probability distribution and cash flows at the end of the second year: Outcome Probability Return (000s) Project generates high 20% 100 revenues Project generates 70% 70 sufficient revenues Project generates low 10% 10 revenues Calculate the expected NPV of Project B assuming an opportunity cost of capital of 10%. Comment on your results. [10] c. SAV plans to launch its smartwatch production line. After evaluation, the NPV from the project was negative. However, the company decides to proceed with the project. Why do you think this was? [10] Total Marks: [30] SAV Corporation is evaluating 2 mutually exclusive projects which have the following probability distribution and returns: Good Market Bad Market Probability 60% 40% Return on Project A (000s) 70 15 Return on Project B (000s) 80 20 a. Calculate and comment upon the expected return and standard deviation of Project A and Project B. Comment on your results. [10] b. Suppose now SAV wants to invest only in Project B and the initial investment is 50,000. The outcomes shown in the table above represent the expected cash flows at the end of the first year of the project's life. If the market shows a pessimistic response to the project in the first year, XYZ presents the following probability distribution and cash flows at the end of the second year: Outcome Probability Return (000s) Outcome Probability Return (000s) Project generates insufficient 70% 15 revenues Project does not generates 30% 0 revenues However, if the market shows an optimistic response to the project in the first year, XYZ presents rather the following probability distribution and cash flows at the end of the second year: Outcome Probability Return (000s) Project generates high 20% 100 revenues Project generates 70% 70 sufficient revenues Project generates low 10% 10 revenues Calculate the expected NPV of Project B assuming an opportunity cost of capital of 10%. Comment on your results. [10] However, if the market shows an optimistic response to the project in the first year, XYZ presents rather the following probability distribution and cash flows at the end of the second year: Outcome Probability Return (000s) Project generates high 20% 100 revenues Project generates 70% 70 sufficient revenues Project generates low 10% 10 revenues Calculate the expected NPV of Project B assuming an opportunity cost of capital of 10%. Comment on your results. [10] c. SAV plans to launch its smartwatch production line. After evaluation, the NPV from the project was negative. However, the company decides to proceed with the project. Why do you think this was? [10] Total Marks: [30]