Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Savannah always had an interest in ballet since she was young. She received training as a ballerina and over the years, she has participated

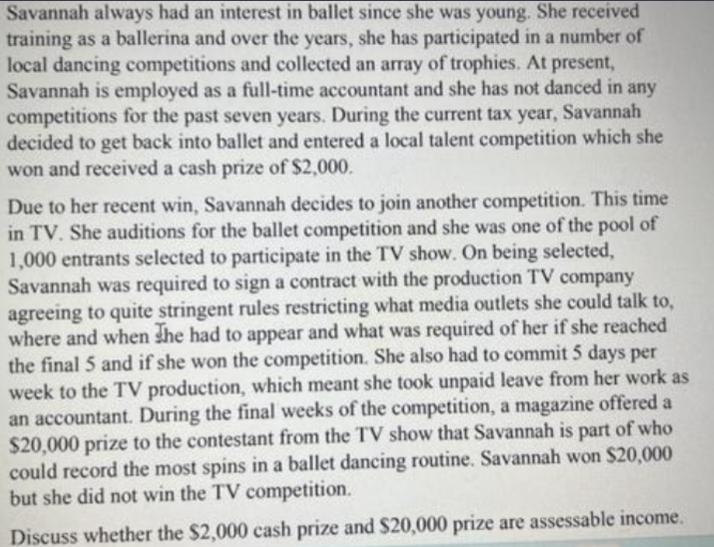

Savannah always had an interest in ballet since she was young. She received training as a ballerina and over the years, she has participated in a number of local dancing competitions and collected an array of trophies. At present, Savannah is employed as a full-time accountant and she has not danced in any competitions for the past seven years. During the current tax year, Savannah decided to get back into ballet and entered a local talent competition which she won and received a cash prize of $2,000. Due to her recent win, Savannah decides to join another competition. This time in TV. She auditions for the ballet competition and she was one of the pool of 1,000 entrants selected to participate in the TV show. On being selected, Savannah was required to sign a contract with the production TV company agreeing to quite stringent rules restricting what media outlets she could talk to, where and when he had to appear and what was required of her if she reached the final 5 and if she won the competition. She also had to commit 5 days per week to the TV production, which meant she took unpaid leave from her work as an accountant. During the final weeks of the competition, a magazine offered a $20,000 prize to the contestant from the TV show that Savannah is part of who could record the most spins in a ballet dancing routine. Savannah won $20,000 but she did not win the TV competition. Discuss whether the $2,000 cash prize and $20,000 prize are assessable income.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Tax on winning prizes is reported on the IRS Form 1099 Misc The income from winning ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started