Question

Savannah is buying a $190,000 home. She has been approved for a 3.28% mortgage rate. She was required to make a 20% down payment

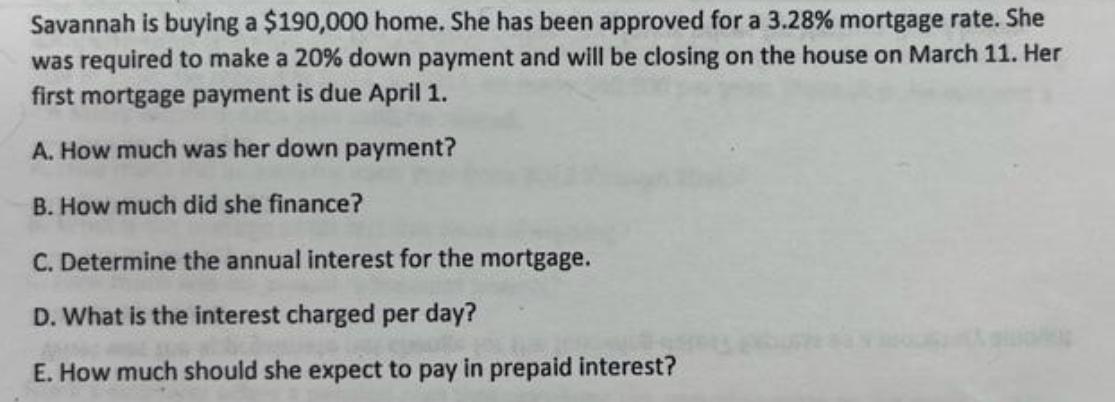

Savannah is buying a $190,000 home. She has been approved for a 3.28% mortgage rate. She was required to make a 20% down payment and will be closing on the house on March 11. Her first mortgage payment is due April 1. A. How much was her down payment? B. How much did she finance? C. Determine the annual interest for the mortgage. D. What is the interest charged per day? E. How much should she expect to pay in prepaid interest?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Down Payment Price of the home 190000 Down payment percentage 20 Down payment 20 190000 38000 Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Algebra Advanced Algebra With Financial Applications

Authors: Robert Gerver, Richard J. Sgroi

2nd Edition

1337271799, 978-1337271790

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App