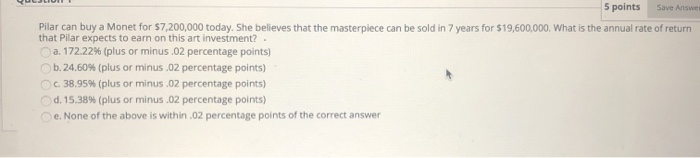

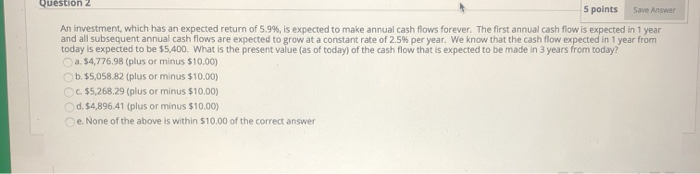

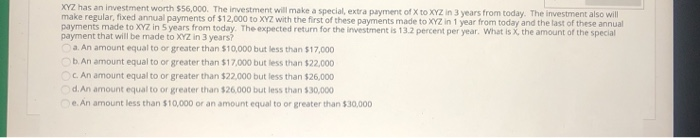

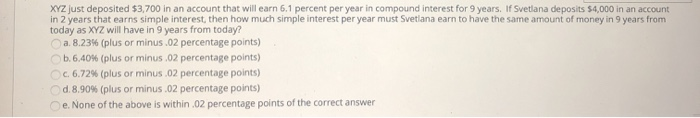

Save Answer 5 points Pilar can buy a Monet for $7,200,000 today. She believes that the masterpiece can be sold in 7 years for $19,600,000. What is the annual rate of return that Pilar expects to earn on this art investment? . a. 172.22% (plus or minus .02 percentage points) b.24.60% (plus or minus .02 percentage points) C 38,95% (plus or minus .02 percentage points) d. 15,38% (plus or minus .02 percentage points) e. None of the above is within .02 percentage points of the correct answer Question 2 5 points Save Answer An investment, which has an expected return of 5.9%, is expected to make annual cash flows forever. The first annual cash flow is expected in 1 year and all subsequent annual cash flows are expected to grow at a constant rate of 2.5% per year. We know that the cash flow expected in 1 year from today is expected to be $5,400. What is the present value (as of today) of the cash flow that is expected to be made in 3 years from today? a. $4,776,98 (plus or minus 510.00) b.$5,058.82 (plus or minus $10.00) c. $5,268.29 (plus or minus $10.00) d. $4,896.41 (plus or minus $10.00) e. None of the above is within $10.00 of the correct answer XYZ has an investment worth $56,000. The investment will make a special, extra payment of X to XYZ in 3 years from today. The investment also will make regular fixed annual payments of $12,000 to XYZ with the first of these payments made to XYZ in 1 year from today and the last of these annual payments made to XYZ in 5 years from today. The expected return for the investment is 13.2 percent per year. What is the amount of the special payment that will be made to XYZ in 3 years? a. An amount equal to or greater than $10,000 but less than $17,000 b. An amount equal to or greater than $17.000 but less than $22.000 c. An amount equal to or greater than $22,000 but less than $26,000 d. An amount equal to or greater than $26.000 but less than $30,000 e. An amountless than $10,000 or an amount equal to or greater than $30,000 XYZ just deposited $3,700 in an account that will earn 6.1 percent per year in compound interest for 9 years. If Svetlana deposits $4,000 in an account in 2 years that earns simple interest, then how much simple interest per year must Svetlana earn to have the same amount of money in 9 years from today as XYZ will have in 9 years from today? a 8.23% (plus or minus .02 percentage points) b. 6,40% (plus or minus .02 percentage points) C. 6.72% (plus or minus .02 percentage points) d. 8.90% (plus or minus .02 percentage points) e. None of the above is within 02 percentage points of the correct