Question

Save Answer JJB Corporation suffered an accounting and taxable loss of $200,000 in 20X5, its first year of operations. There were no temporary or

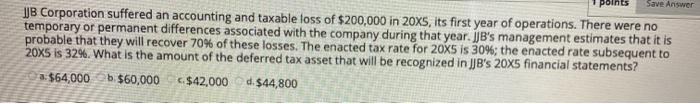

Save Answer JJB Corporation suffered an accounting and taxable loss of $200,000 in 20X5, its first year of operations. There were no temporary or permanent differences associated with the company during that year. JJB's management estimates that it is probable that they will recover 70% of these losses. The enacted tax rate for 20X5 is 30%; the enacted rate subsequent to 20X5 is 32%. What is the amount of the deferred tax asset that will be recognized in JJB's 20X5 financial statements? $64,000 b. $60,000 $42,000 d.$44,800

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer 44800 Explanation A deferred tax asset is created wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App