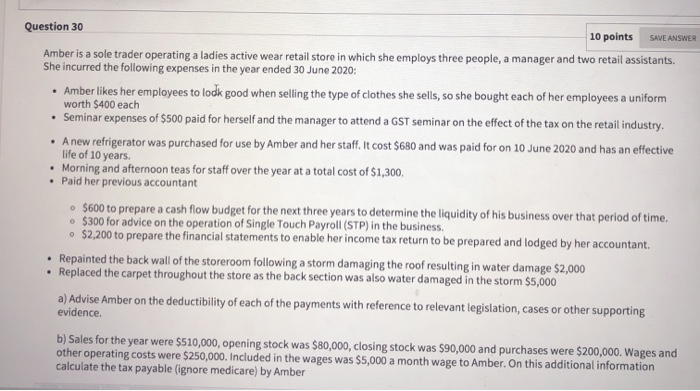

SAVE ANSWER Question 30 10 points Amber is a sole trader operating a ladies active wear retail store in which she employs three people, a manager and two retail assistants. She incurred the following expenses in the year ended 30 June 2020: Amber likes her employees to lodk good when selling the type of clothes she sells, so she bought each of her employees a uniform worth $400 each Seminar expenses of $500 paid for herself and the manager to attend a GST seminar on the effect of the tax on the retail industry. A new refrigerator was purchased for use by Amber and her staff. It cost $680 and was paid for on 10 June 2020 and has an effective life of 10 years. Morning and afternoon teas for staff over the year at a total cost of $1,300 Paid her previous accountant $600 to prepare a cash flow budget for the next three years to determine the liquidity of his business over that period of time. o $300 for advice on the operation of Single Touch Payroll (STP) in the business. $2,200 to prepare the financial statements to enable her income tax return to be prepared and lodged by her accountant. Repainted the back wall of the storeroom following a storm damaging the roof resulting in water damage $2,000 Replaced the carpet throughout the store as the back section was also water damaged in the storm $5,000 a) Advise Amber on the deductibility of each of the payments with reference to relevant legislation, cases or other supporting evidence b) Sales for the year were $510,000, opening stock was $80,000, closing stock was $90,000 and purchases were $200,000. Wages and other operating costs were $250,000. Included in the wages was $5,000 a month wage to Amber. On this additional information calculate the tax payable (ignore medicare) by Amber SAVE ANSWER Question 30 10 points Amber is a sole trader operating a ladies active wear retail store in which she employs three people, a manager and two retail assistants. She incurred the following expenses in the year ended 30 June 2020: Amber likes her employees to lodk good when selling the type of clothes she sells, so she bought each of her employees a uniform worth $400 each Seminar expenses of $500 paid for herself and the manager to attend a GST seminar on the effect of the tax on the retail industry. A new refrigerator was purchased for use by Amber and her staff. It cost $680 and was paid for on 10 June 2020 and has an effective life of 10 years. Morning and afternoon teas for staff over the year at a total cost of $1,300 Paid her previous accountant $600 to prepare a cash flow budget for the next three years to determine the liquidity of his business over that period of time. o $300 for advice on the operation of Single Touch Payroll (STP) in the business. $2,200 to prepare the financial statements to enable her income tax return to be prepared and lodged by her accountant. Repainted the back wall of the storeroom following a storm damaging the roof resulting in water damage $2,000 Replaced the carpet throughout the store as the back section was also water damaged in the storm $5,000 a) Advise Amber on the deductibility of each of the payments with reference to relevant legislation, cases or other supporting evidence b) Sales for the year were $510,000, opening stock was $80,000, closing stock was $90,000 and purchases were $200,000. Wages and other operating costs were $250,000. Included in the wages was $5,000 a month wage to Amber. On this additional information calculate the tax payable (ignore medicare) by Amber