Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Save Homework: Chapter 18 Homework Assignment Score: 0 of 1 pt 1 of 1 (0 complete) P18-36A (similar to) HW Score: 0%, 0 of 1

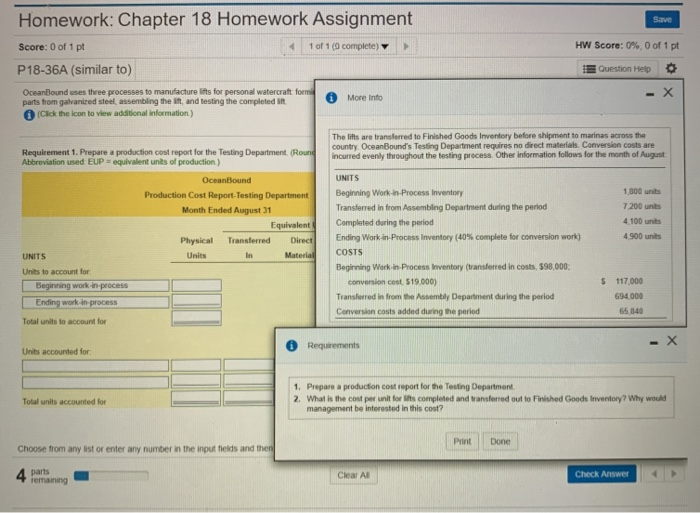

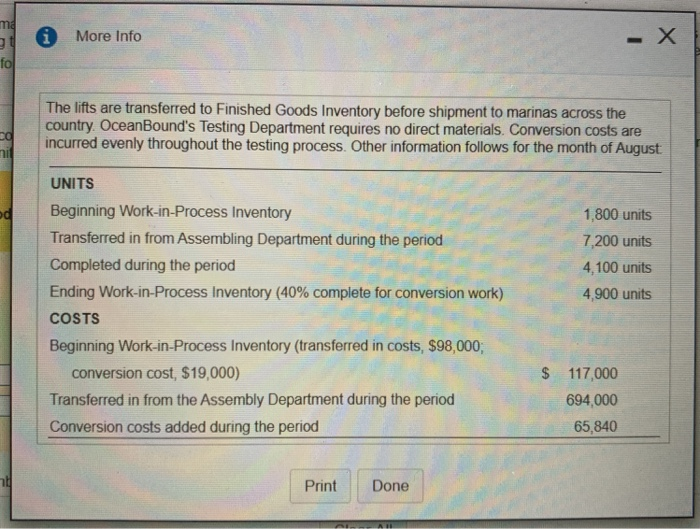

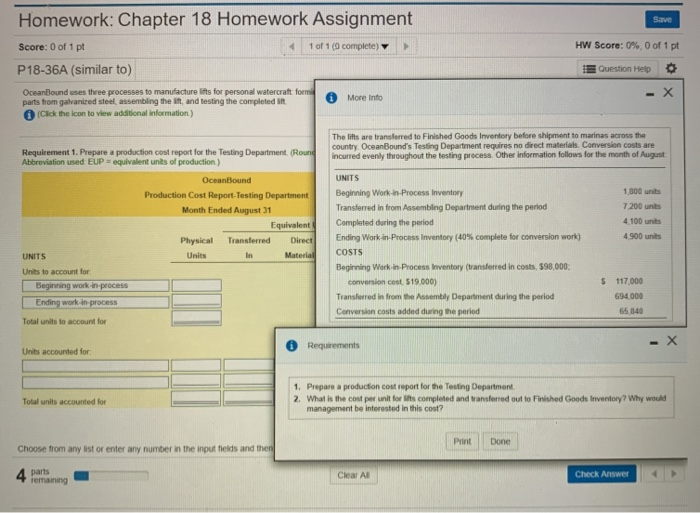

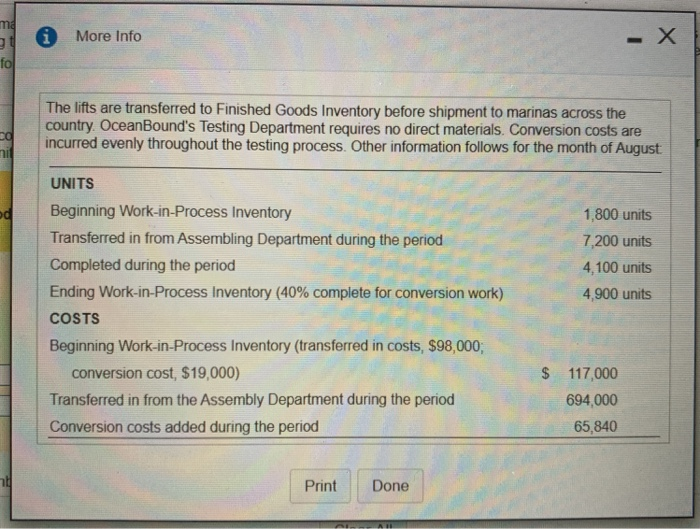

Save Homework: Chapter 18 Homework Assignment Score: 0 of 1 pt 1 of 1 (0 complete) P18-36A (similar to) HW Score: 0%, 0 of 1 pt Question Help * More Info - X OceanBound uses three processes to manufactures for personal watercraft form parts from galvanized steel, assembling the in, and testing the completed in (Click the icon to view additional information) The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country. OceanBound's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August Requirement 1. Prepare a production cost report for the Testing Department. Round Abbreviation used EUP = equivalent units of production) OceanBound Production Cost Report-Testing Department Month Ended August 31 Equivalent Physical Transferred Direct Units in Material 1 800 units 7 200 units 4 100 units 4.500 units UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work in Process Inventory (40% complete for conversion work) COSTS Beginning Work in Process Inventory (transferred in costs, 598,000; conversion cost 519000) Transferred in from the Assembly Department during the period Conversion costs added during the period UNITS Units to account for Beginning work in process Ending work in process $ 117,000 694.000 65 840 Total units to account for 0 Requirements Units accounted for Total units accounted for 1. Prepare a production cost report for the Testing Department 2. What is the cost per unit for its completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost? Print Done Choose from any list or enter any number in the input fields and then 4 parts 4 remaining Clear Al Check Answer ma * More Info The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country, OceanBound's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August 1,800 units 7,200 units 4,100 units 4,900 units UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work-in-Process Inventory (40% complete for conversion work) COSTS Beginning Work-in-Process Inventory (transferred in costs, $98,000; conversion cost, $19,000) Transferred in from the Assembly Department during the period Conversion costs added during the period $ 117,000 694,000 65,840 Print Done * Requirements 1. Prepare a production cost report for the Testing Department 2. What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost? Print Done

Save Homework: Chapter 18 Homework Assignment Score: 0 of 1 pt 1 of 1 (0 complete) P18-36A (similar to) HW Score: 0%, 0 of 1 pt Question Help * More Info - X OceanBound uses three processes to manufactures for personal watercraft form parts from galvanized steel, assembling the in, and testing the completed in (Click the icon to view additional information) The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country. OceanBound's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August Requirement 1. Prepare a production cost report for the Testing Department. Round Abbreviation used EUP = equivalent units of production) OceanBound Production Cost Report-Testing Department Month Ended August 31 Equivalent Physical Transferred Direct Units in Material 1 800 units 7 200 units 4 100 units 4.500 units UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work in Process Inventory (40% complete for conversion work) COSTS Beginning Work in Process Inventory (transferred in costs, 598,000; conversion cost 519000) Transferred in from the Assembly Department during the period Conversion costs added during the period UNITS Units to account for Beginning work in process Ending work in process $ 117,000 694.000 65 840 Total units to account for 0 Requirements Units accounted for Total units accounted for 1. Prepare a production cost report for the Testing Department 2. What is the cost per unit for its completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost? Print Done Choose from any list or enter any number in the input fields and then 4 parts 4 remaining Clear Al Check Answer ma * More Info The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country, OceanBound's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August 1,800 units 7,200 units 4,100 units 4,900 units UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work-in-Process Inventory (40% complete for conversion work) COSTS Beginning Work-in-Process Inventory (transferred in costs, $98,000; conversion cost, $19,000) Transferred in from the Assembly Department during the period Conversion costs added during the period $ 117,000 694,000 65,840 Print Done * Requirements 1. Prepare a production cost report for the Testing Department 2. What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost? Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started