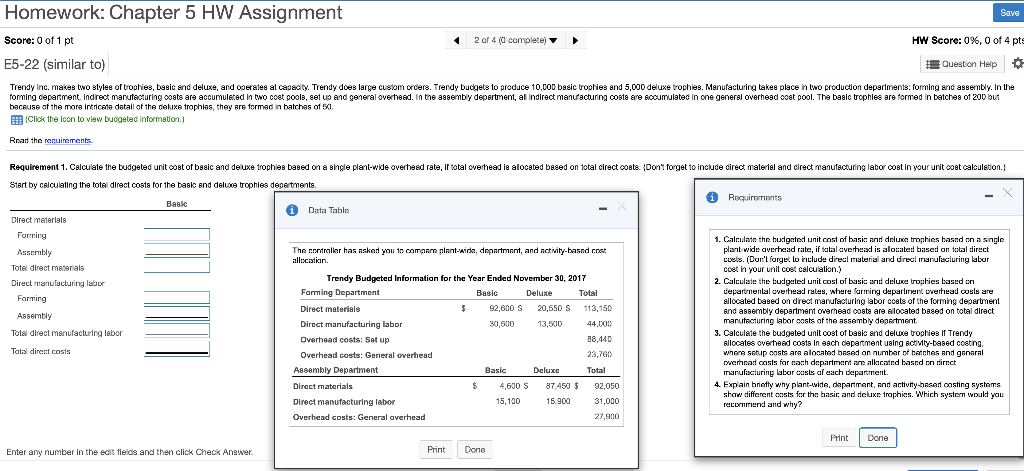

Save Homework: Chapter 5 HW Assignment Score: 0 of 1 pt E5-22 (similar to) 2 of 4 (0 complete) HW Score: 0%, 0 of 4 pts Question Help Trendy Inc. makes two slylee of trophies, basic and deluxe, and operatee al capacity. Trendy does large custom orders. Trendy budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing lakee place in two production departments: forming and assembly. In the foming department. Indirect manufacturing coats are accumulated in two cost pools, set up and general overhead. In the assembly department, al indirect manufacturing costs are socumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but bacause of the more intricata detail of the deluxe trophies, they are formad in batches of 50. Click the icon to view bucgeted information.) Road the requirements Requirement 1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead rate, if total overhead is alocated based on total direct costs. Don't forget to include direct material and cirect manufacturing labor cost in your unit cost calculation.) Start by calculating the total direct costs for the basic and deluxe trophies departments i Requirements Basic 1 Data Table Direct materials Forming 1. Calculate the budgeted unit cost of basic and deluxe tronhies based on a single Assembly The controllar has asked you to como plantida, department, and act Mity-based cost plant wide averhead rate, if salal avetthead is alocated based on total direct allocation. coets. (Don'forget lo include direcl material and direcliranufacluring labor Total direct materials cost in your unit cost calculation.) Trendy Budgeted Information for the Year Ended November 30, 2017 2. Calculate the budeated unit cost of basis and deluxe trophies based on Direct manufacturing labor Forming Department Basic Deluxe Total cepartmental overhead rales, where fortring deparliment overhead sls are Farming allocated based on direct manufacturing labor costs of the forming department Direct materials $ 92,600 S 20,550 S 113,150 and assembly department overhead coats are allocated based on total direct Assembly Direct manufacturing labor manufacturing labor costs of the assembly department 30,500 13,500 44.000 Total direct manufacturing Isbor 3. Calculate the budgeted unit cost of basis and deluxe trophies if Trendy Overhead costs: Set up a8.440 allocates overheed costa in each department using activity-based costing Tatal direct costs Overhead costs: General overhead 23,760 where setup costs are alocated based on number of batches and Anara overhead casts far cach department are allocated based on rirect Assembly Department Basic Deluxe Total manufacturing latar antes af each department. Direct materials $ 4,600 S 37,450 $ 92,050 4. Explain bretly why plant-wide, department, and activity-based costing systems show different costs for the basic and deluxe trophies. Which system would you Direct manufacturing labor 15,100 15.900 31,000 recommend and why? Overhead costs: General averhead 27,900 Print Done Enter any number in the edit fields and then click Check Answer. Print Done Save Homework: Chapter 5 HW Assignment Score: 0 of 1 pt E5-22 (similar to) 2 of 4 (0 complete) HW Score: 0%, 0 of 4 pts Question Help Trendy Inc. makes two slylee of trophies, basic and deluxe, and operatee al capacity. Trendy does large custom orders. Trendy budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing lakee place in two production departments: forming and assembly. In the foming department. Indirect manufacturing coats are accumulated in two cost pools, set up and general overhead. In the assembly department, al indirect manufacturing costs are socumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but bacause of the more intricata detail of the deluxe trophies, they are formad in batches of 50. Click the icon to view bucgeted information.) Road the requirements Requirement 1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead rate, if total overhead is alocated based on total direct costs. Don't forget to include direct material and cirect manufacturing labor cost in your unit cost calculation.) Start by calculating the total direct costs for the basic and deluxe trophies departments i Requirements Basic 1 Data Table Direct materials Forming 1. Calculate the budgeted unit cost of basic and deluxe tronhies based on a single Assembly The controllar has asked you to como plantida, department, and act Mity-based cost plant wide averhead rate, if salal avetthead is alocated based on total direct allocation. coets. (Don'forget lo include direcl material and direcliranufacluring labor Total direct materials cost in your unit cost calculation.) Trendy Budgeted Information for the Year Ended November 30, 2017 2. Calculate the budeated unit cost of basis and deluxe trophies based on Direct manufacturing labor Forming Department Basic Deluxe Total cepartmental overhead rales, where fortring deparliment overhead sls are Farming allocated based on direct manufacturing labor costs of the forming department Direct materials $ 92,600 S 20,550 S 113,150 and assembly department overhead coats are allocated based on total direct Assembly Direct manufacturing labor manufacturing labor costs of the assembly department 30,500 13,500 44.000 Total direct manufacturing Isbor 3. Calculate the budgeted unit cost of basis and deluxe trophies if Trendy Overhead costs: Set up a8.440 allocates overheed costa in each department using activity-based costing Tatal direct costs Overhead costs: General overhead 23,760 where setup costs are alocated based on number of batches and Anara overhead casts far cach department are allocated based on rirect Assembly Department Basic Deluxe Total manufacturing latar antes af each department. Direct materials $ 4,600 S 37,450 $ 92,050 4. Explain bretly why plant-wide, department, and activity-based costing systems show different costs for the basic and deluxe trophies. Which system would you Direct manufacturing labor 15,100 15.900 31,000 recommend and why? Overhead costs: General averhead 27,900 Print Done Enter any number in the edit fields and then click Check Answer. Print Done