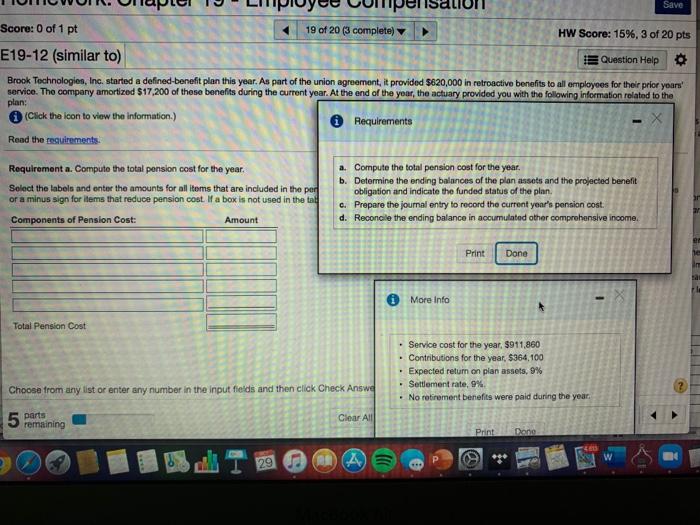

Save Score: 0 of 1 pt 19 of 20 (3 complete) HW Score: 15%, 3 of 20 pts E19-12 (similar to) Question Help Brook Technologies, Inc. started a defined benefit plan this year. As part of the union agreement, it provided $420,000 in retroactive benefits to all employees for their prior years' service. The company amortized $17,200 of these benefits during the current year. At the end of the year, the actuary provided you with the following information related to the plan: Click the icon to view the information.) Requirements Read the requirements: Requirement a. Compute the total pension cost for the year. a. Compute the total pension cost for the year. b. Determine the ending balances of the plan assets and the projected benefit Select the labels and enter the amounts for all items that are included in the per obligation and indicate the funded status of the plan or a minus sign for items that reduce pension cost. If a box is not used in the talk c. Prepare the journal entry to record the current year's pension cost. Components of Pension Cost: Amount d. Reconcile the ending balance in accumulated other comprehensive income. Print Done * More Info Total Pension Cost Service cost for the year. $911,860 Contributions for the year, $364 100 Expected return on plan assets, 9% Settlement rate, 9% No retirement benefits were paid during the year. Choose from any list or enter any number in the input fields and then click Check Answe 5 parts remaining Clear All Print Done -A *** Save Score: 0 of 1 pt 19 of 20 (3 complete) HW Score: 15%, 3 of 20 pts E19-12 (similar to) Question Help Brook Technologies, Inc. started a defined benefit plan this year. As part of the union agreement, it provided $420,000 in retroactive benefits to all employees for their prior years' service. The company amortized $17,200 of these benefits during the current year. At the end of the year, the actuary provided you with the following information related to the plan: Click the icon to view the information.) Requirements Read the requirements: Requirement a. Compute the total pension cost for the year. a. Compute the total pension cost for the year. b. Determine the ending balances of the plan assets and the projected benefit Select the labels and enter the amounts for all items that are included in the per obligation and indicate the funded status of the plan or a minus sign for items that reduce pension cost. If a box is not used in the talk c. Prepare the journal entry to record the current year's pension cost. Components of Pension Cost: Amount d. Reconcile the ending balance in accumulated other comprehensive income. Print Done * More Info Total Pension Cost Service cost for the year. $911,860 Contributions for the year, $364 100 Expected return on plan assets, 9% Settlement rate, 9% No retirement benefits were paid during the year. Choose from any list or enter any number in the input fields and then click Check Answe 5 parts remaining Clear All Print Done -A ***