Answered step by step

Verified Expert Solution

Question

1 Approved Answer

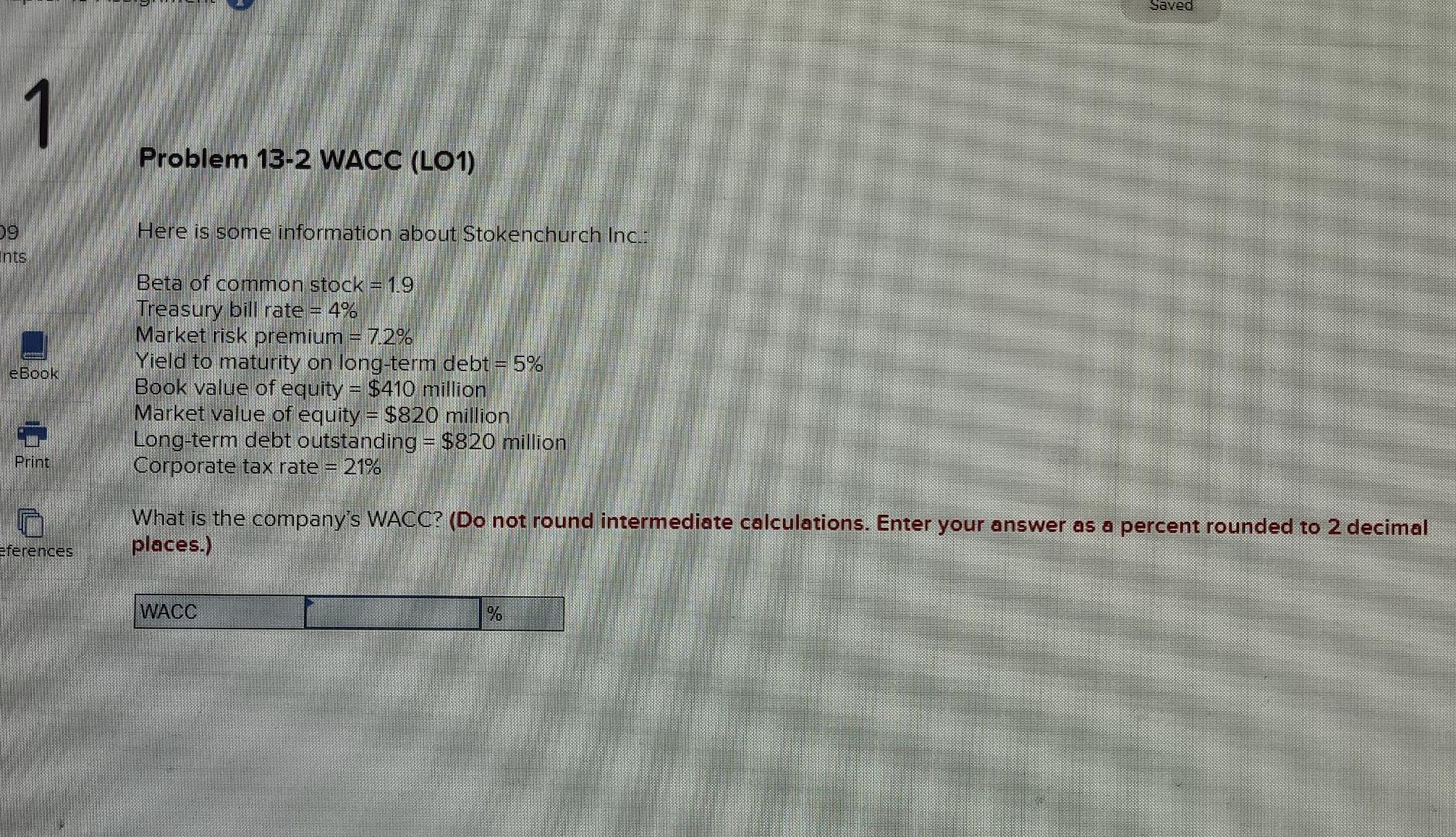

Saved 1 Problem 13-2 WACC (LO1) 29 Here is some information about Stokenchurch Inc.: Ints eBook Beta of common stock = 1.9 Treasury bill rate

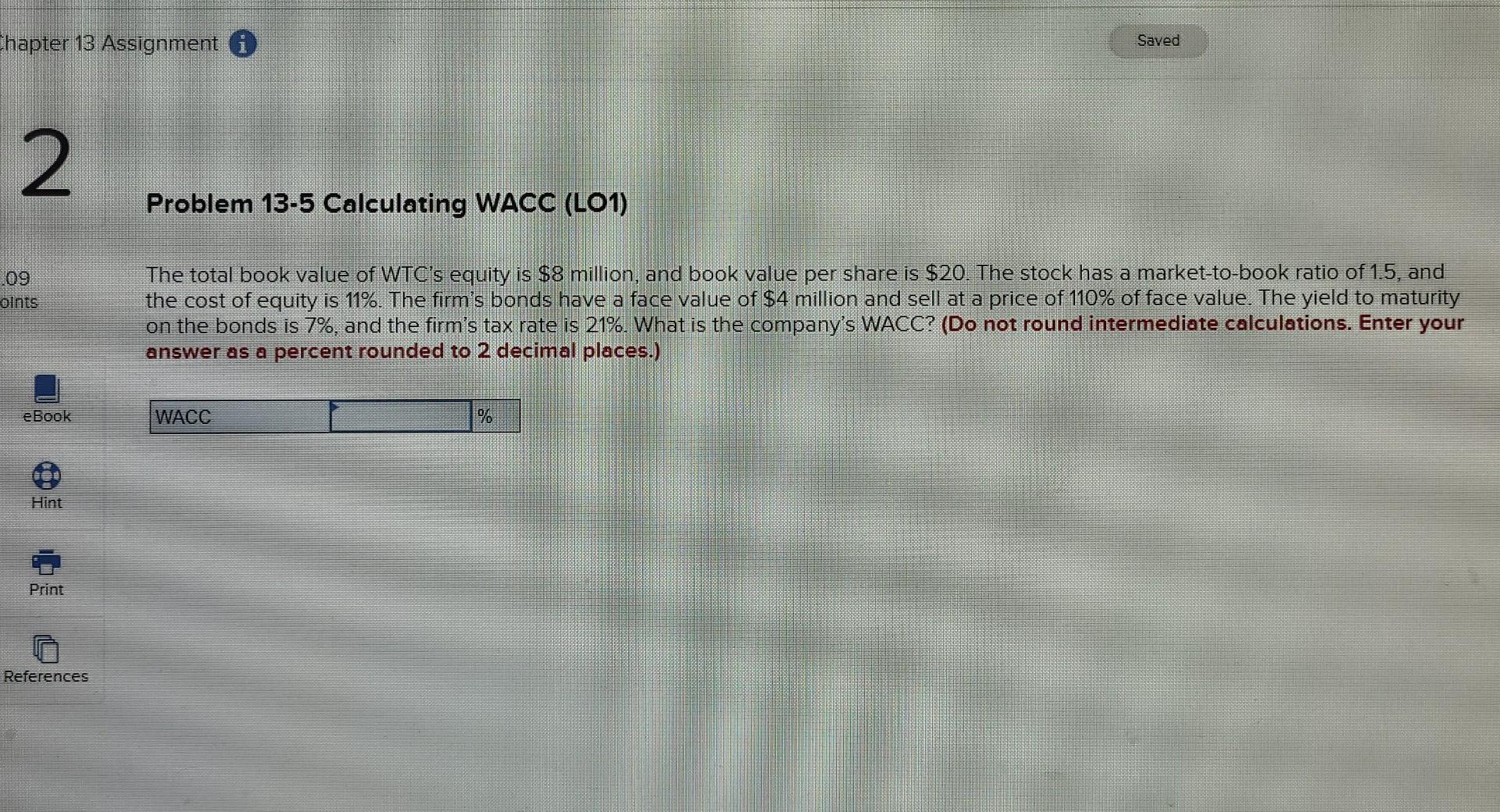

Saved 1 Problem 13-2 WACC (LO1) 29 Here is some information about Stokenchurch Inc.: Ints eBook Beta of common stock = 1.9 Treasury bill rate = 4% Market risk premium = 7.2% Yield to maturity on long-term debt = 5% Book value of equity = $410 million Market value of equity = $820 million Long-term debt outstanding = $820 million Corporate tax rate = 21% Print What is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) =ferences WACC % Chapter 13 Assignment & Saved 2 Problem 13-5 Calculating WACC (LO1) 09 olnts The total book value of WTC's equity is $8 million, and book value per share is $20. The stock has a market-to-book ratio of 1.5, and the cost of equity is 11%. The firm's bonds have a face value of $4 million and sell at a price of 110% of face value. The yield to maturity on the bonds is 7%, and the firm's tax rate is 21%. What is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) ebook WACC Print References

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started