Answered step by step

Verified Expert Solution

Question

1 Approved Answer

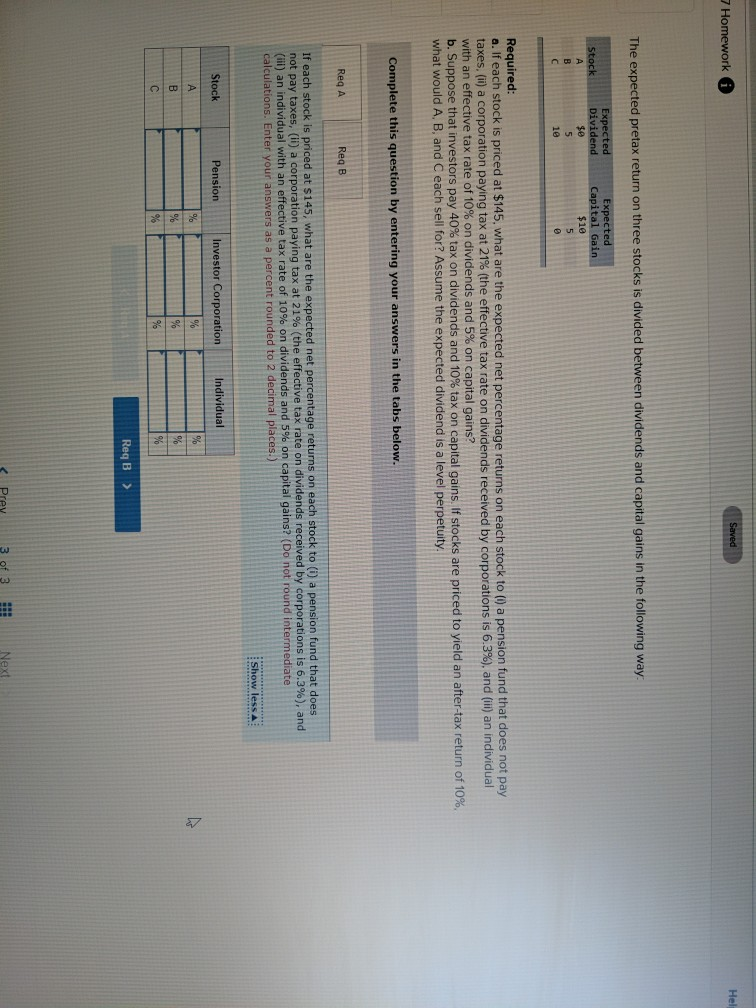

Saved 7 Homework Hall The expected pretax return on three stocks is divided between dividends and capital gains in the following way Stock B Expected

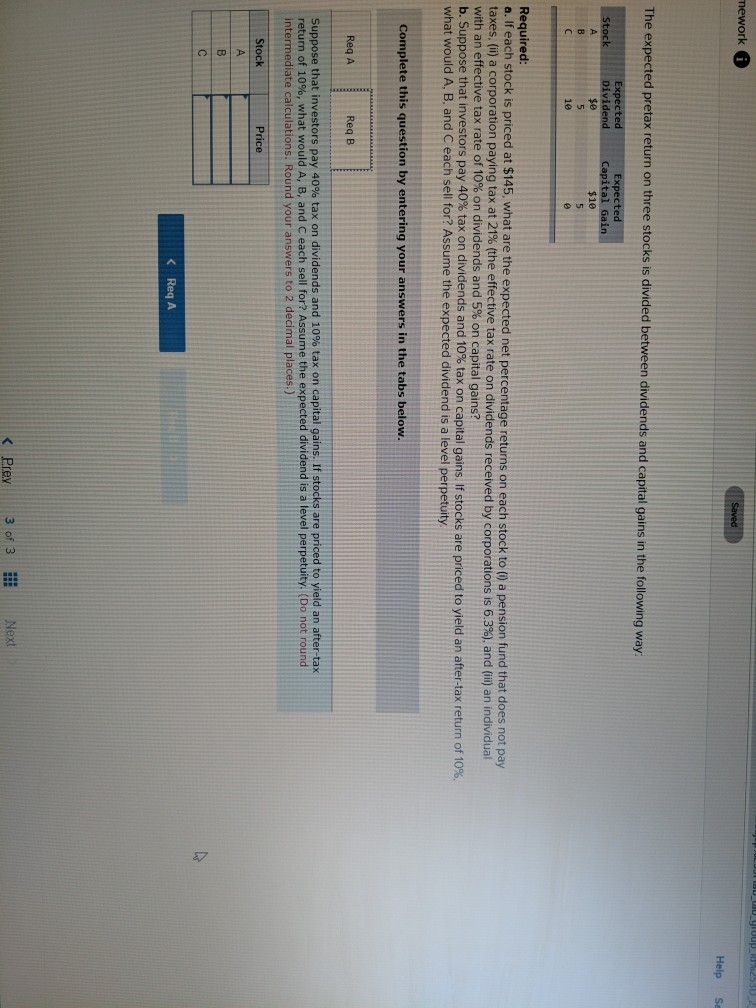

Saved 7 Homework Hall The expected pretax return on three stocks is divided between dividends and capital gains in the following way Stock B Expected Dividend se 5 10 Expected Capital Gain $10 5 0 Required: a. If each stock is priced at $145, what are the expected net percentage returns on each stock to (1) a pension fund that does not pay taxes. () a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ill) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Req A Reg B If each stock is priced at $145, what are the expected net percentage returns on each stock to a pension fund that does not pay taxes, (i) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ill) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Show less Stock Pension Investor Corporation Individual A % % % % B % 96 ReqB> mework Saved Help S The expected pretax return on three stocks is divided between dividends and capital gains in the following way Stock B Expected Dividend $0 5 10 Expected Capital Gain $10 5 Required: a. If each stock is priced at $145, what are the expected net percentage returns on each stock to (1) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity Complete this question by entering your answers in the tabs below. Req A ReqB Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock Price A B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started