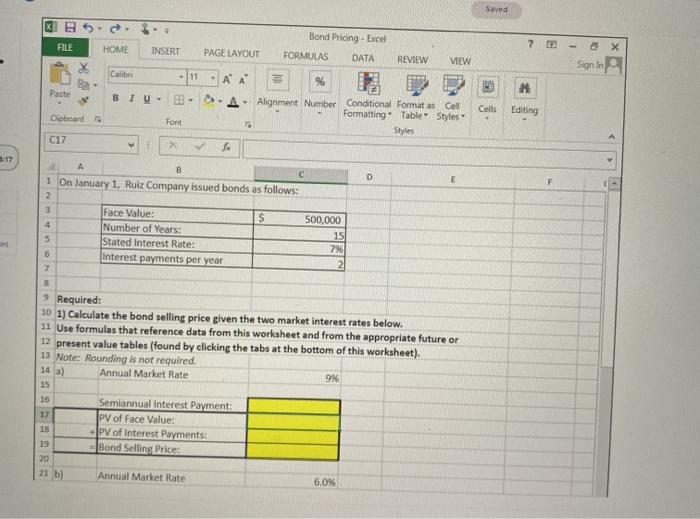

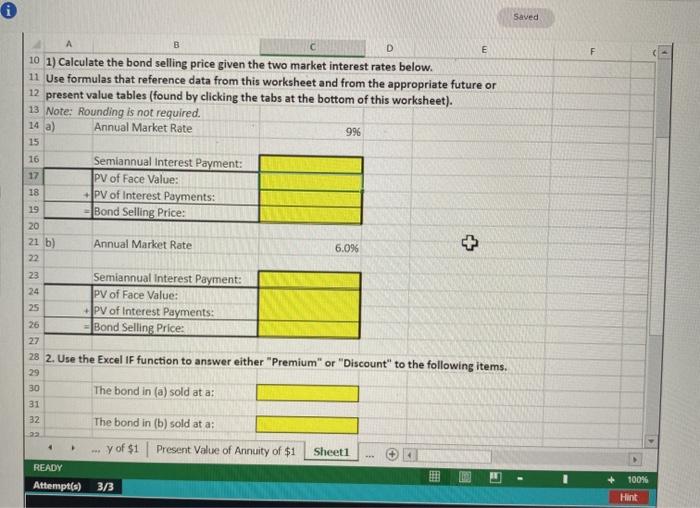

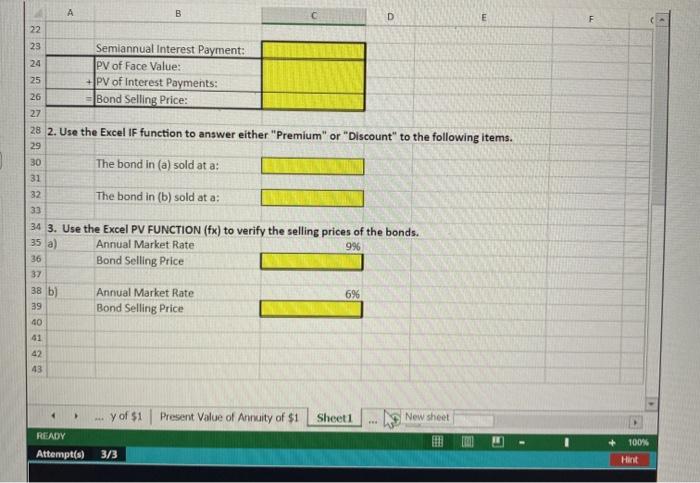

Saved BB FILE Bond Pricing - Excel FORMULAS DATA HOME ? 2 - INSERT PAGE LAYOUT REVIEW VIEW Sign in Calibri 11 AA % Paste BIU BB - Cells Editing Coboard Font A Alignment Number Conditional Format as Cell Formatting Table Styles Styles fo C17 3:17 D E - A B 1 On January 1, Ruiz Company issued bonds as follows: 2 3 Face Value: S Number of Years: 5 Stated Interest Rate: Interest payments per year 7 OUR 500,000 15 796 2 B 5 Required: 101) Calculate the bond selling price given the two market interest rates below. 11 Use formulas that reference data from this worksheet and from the appropriate future or 12 present value tables (found by clicking the tabs at the bottom of this worksheet). 11 Note: Rounding is not required. Annual Market Rate 9% 14 a) 10 15 19 20 21 b) Semiannual interest Payment: PV of Face Value: - PV of Interest Payments: Bond Selling Price: Annual Market Rate 6.0% 0 Saved A B E F D 10 1) Calculate the bond selling price given the two market interest rates below. 11 Use formulas that reference data from this worksheet and from the appropriate future or 12 present value tables (found by clicking the tabs at the bottom of this worksheet). 13 Note: Rounding is not required. 14 a) Annual Market Rate 996 15 16 Semiannual Interest Payment: PV of Face Value: PV of Interest Payments: - Bond Selling Price: 18 Annual Market Rate 6.0% 19 20 21 b) 22 23 24 25 26 Semiannual Interest Payment: PV of Face Value: PV of Interest Payments: Bond Selling Price: 27 28 2. Use the Excel IF function to answer either "Premium" or "Discount" to the following items. 29 30 The bond in (a) sold at a: 31 32 22 The bond in (b) sold at a: y of $1 Present Value of Annuity of $1 4 Sheet1 READY Attempt(s) 3/3 100% Hint A B D E F 22 24 23 Semiannual Interest Payment: PV of Face Value: 25 + PV of Interest Payments: 26 Bond Selling Price: 27 28 2. Use the Excel IF function to answer either "Premium" or "Discount" to the following items. 29 30 The bond in (a) sold at a: 31 32 The bond in (b) sold at a: 33 34 3. Use the Excel PV FUNCTION (fx) to verify the ling prices of the bonds. Annual Market Rate 996 36 Bond Selling Price 37 Annual Market Rate 39 Bond Selling Price 40 41 35 a) 38 b) 6% 42 43 y of S1 Present Value of Annuity of $1 Sheet1 New sheet READY Attempt(s) 3/3 100% Hint