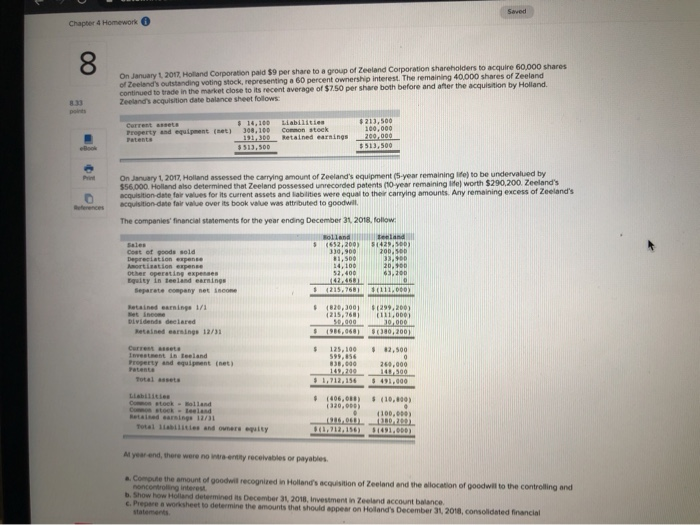

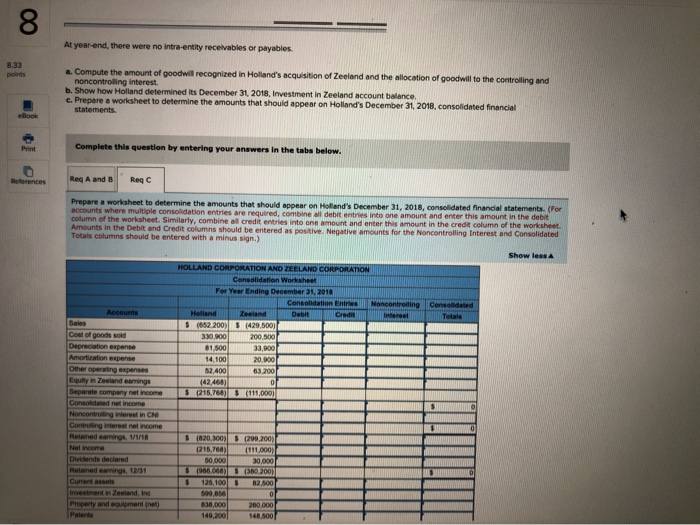

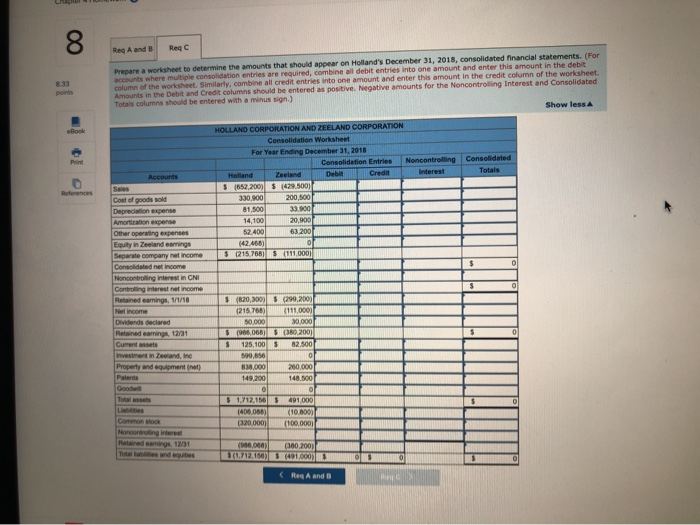

Saved Chapter 4 Homework 8. On January 1 2017, Holland Corporation paid $9 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $7.50 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current asset $ 14,100 Llabilities Property and equipment (net) 308,100 Common stock Patents 191,300 Retained earnings 5513,500 $213,500 100,000 200,000 5513,500 On January 1, 2017, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining to be undervalued by $56,000. Holland also determined that Zeeland possessed unrecorded patents (10 year remaining life worth $290,200. Zeeland's acquisition date for values for its current assets and liabilities were equal to the carrying amounts. Any remaining excess of Zeeland's acquisition date fair value over its book value was attributed to goodwil The companies' financial statements for the year ending December 31, 2018, follow Cost of goods sold Depreciation expense mortisation expense other operating expenses Equity in teeland earnings separate company net icon Holland 5 652,200) 330,900 #1,500 14,100 52.400 42.463 51423 200.50 3.100 20.00 63,200 (111.000) Betained earnings 1/1 et income Dividends declared Retained earnings 12/31 . 1820,3001 (215,7681 50.000 $ (986.060) (299,200) (111,0001 10,000 380, 2001 Current sta Investment in teeland Property and equipment (net) Patenta Total assets 125,100 599,856 838.000 $ 12,500 0 260,000 148,500 $ 491.000 $ 1,712,156 Otok Holland Leeland Retained earnings 12/31 Total llities and owners wity # 606,088) (320,000) . 0905.00 302.712,156) (10.1103 100,000) 31491.000) Al year-end, there were no ently receivables or payables Compute the amount of goodwill recognized in Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest b. Show how Holland determined its December 31, 2018, Investment in Zeeland account balance c. Prepare a worksheet to determine the amounts that should appear on Holland's December 31, 2018, consolidated financial 8 At year-end, there were no intra-entity receivables or payables. 8.33 points a. Compute the amount of goodwill recognized in Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest. b. Show how Holland determined its December 31, 2018, Investment in Zeeland account balance c. Prepare a worksheet to determine the amounts that should appear on Holland's December 31, 2018, consolidated financial statements. eflock Print Complete this question by entering your answers in the tabs below. fo Beerences Req A and B Regc Prepare a worksheet to determine the amounts that should appear on Holland's December 31, 2018, consolidated financial statements. (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Amounts in the Debit and Credit columns should be entered as positive. Negative amounts for the Noncontrolling Interest and Consolidated Totals columns should be entered with a minus sign.) Show less C HOLLAND CORPORATION AND ZEELAND CORPORATION Consolidation Worksheet For Year Ending December 31, 2018 Consolidation Entre Noncontrolling Comodated Holland Zeeland Debit Interest Totals $ 652,200) 5 (429,500) 3.90.800 200.500 81 500 33,000 14,100 20.000 52.400 03 200 (42.464) 0 $ 215,764) (111,000) Accounts Sales Cost of goods sold Depreciation expense Amortization expense Other operating expenses Equity in Zeeland earnings Beparate company net income Considered net income Noncontraming terest in CN Controlling interest net income Retained earnings, 1/1/18 Net income Dividends declared Retained earnings, 12/31 Current Investment in Zeeland, Inc Property and equipment nee $ 820,300 $ 299,200) (215,760) (111.000) 50.000 30,000 (906) (300 2001 $ 126,1005 82.500 699,856 0 8.38.000 200.000 149,200 148.500 8. Reg A and B Print be References Reqc Prepare a worksheet to determine the amounts that should appear on Holland's December 31, 2018, consolidated financial statements. (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Amounts in the Debit and Credit columns should be entered as positive. Negative amounts for the Noncontrolling Interest and Consolidated Totals columns should be entered with a minus sign.) Show less HOLLAND CORPORATION AND ZEELAND CORPORATION Consolidation Worksheet For Year Ending December 31, 2018 Consolidation Entries Noncontrolling Consolidated Accounts Holland Debit Credit Interest Totals Sales $ 1652,200 S (429,500) Cost of goods sold 330 000 200,000 Depreciation expense 81,500 33.900 Amortization expense 14,100 20,900 Other operating expenses 52.400 63.20 Equity in Zeeland earnings (42.400) 0 Separate company income $ 215.768) 5 (111,0001 Consolidated net income 0 Noncontrolling interest in GNI Controlling restreincome Retained earnings, 1/1/18 $ 820,000 $200,2001 income 1215.766 (111.000 Dividends declared 50.000 30.000 Retained earrings 12/31 $ 966,060 $ (380.2001 Current assets $ 125,100 $ 82.500 Investment in Zeeland, in 599,856 0 Property and mental) 838,000 200.000 Patent 149,200 148.500 Good O Total $ 1.712,150 $ 491,000 (400066) (10.000 Commons (320.000) (100.000 Noncorrong interes Retained Gamings, 12/31 (186.000) (360.2001 1.712,150 $ 1491.000