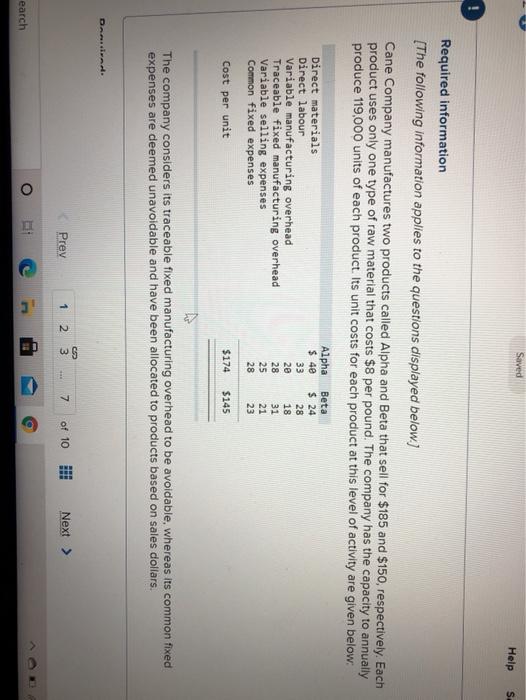

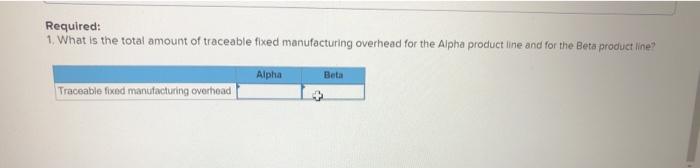

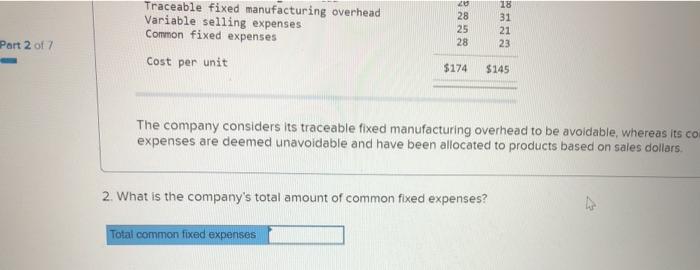

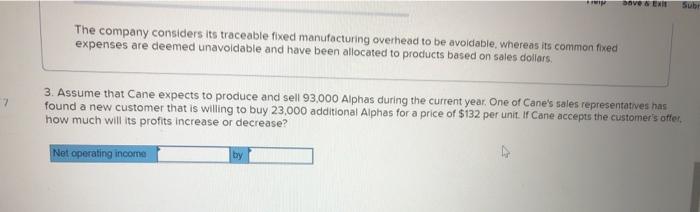

Saved Help S Required information [The following information applies to the questions displayed below.) Cane Company manufactures two products called Alpha and Beta that sell for $185 and $150, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 119,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Alpha $ 4e 33 20 28 25 28 Beta $ 24 28 18 31 21 23 Cost per unit $174 $145 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Prev 1 2 C92 3 7 of 10 Next > earch O Required: 1. What is the total amount of traceable fixed manufacturing overhead for the Alpha product line and for the Beta product line Alpha Beta Traceable fixed manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses 20 28 25 28 18 31 21 23 Part 2 of 7 Cost per unit $174 $145 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its co expenses are deemed unavoidable and have been allocated to products based on sales dollars 2. What is the company's total amount of common fixed expenses? Total common fixed expenses save & EN Sub The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. 2 3. Assume that Cane expects to produce and sell 93.000 Alphas during the current year . One of Cane's sales representatives has found a new customer that is wiling to buy 23,000 additional Alphas for a price of $132 per unit. If Cane accepts the customer's offer. how much will its profits increase or decrease? . Net operating income by Linha browserslaunchurl=http%253A%252F%252Fnewconnect.meducation.com/ Chapter 12 Saved Help Save & Exit Sub 7 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars 4017 4. Assume that Cane expects to produce and sell 103.000 Betas during the current year. One of Cane's sales representatives has found a new customer that is willing to buy 2,000 additional Betas for a price of $61 per unit. If Cane accepts the customer's affet how much will its profits increase or decrease? Net operating income by The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars 5 of 6 Assume that Cane normally produces and sells 103,000 Betas per year. If Cane discontinues the Beta product line, how much will profits increase or decrease? Profit by expenses are deemed unavoidable and have been allocated to products based on sales dollars. t 6 of 7 7. Assume that Cane normally produces and sells 53.000 Betas per year. If Cane discontinues the Beta product line, how much war profits increase or decrease? Pron by The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars of 7 8. Assume that Cane normally produces and sells 73,000 Betas and 93,000 Alphas per year if Cane discontinues the Beta product line. Its sales representatives could increase sales of Alpha by 13,000 units. If Cane discontinues the Beta product line, how much would profits increase or decrease? Profit by