Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saved Help Save a tax imposed on the retail price of goods ( plus certain services ) . Retailers are responsible for collecting and remitting

Saved

Help

Save

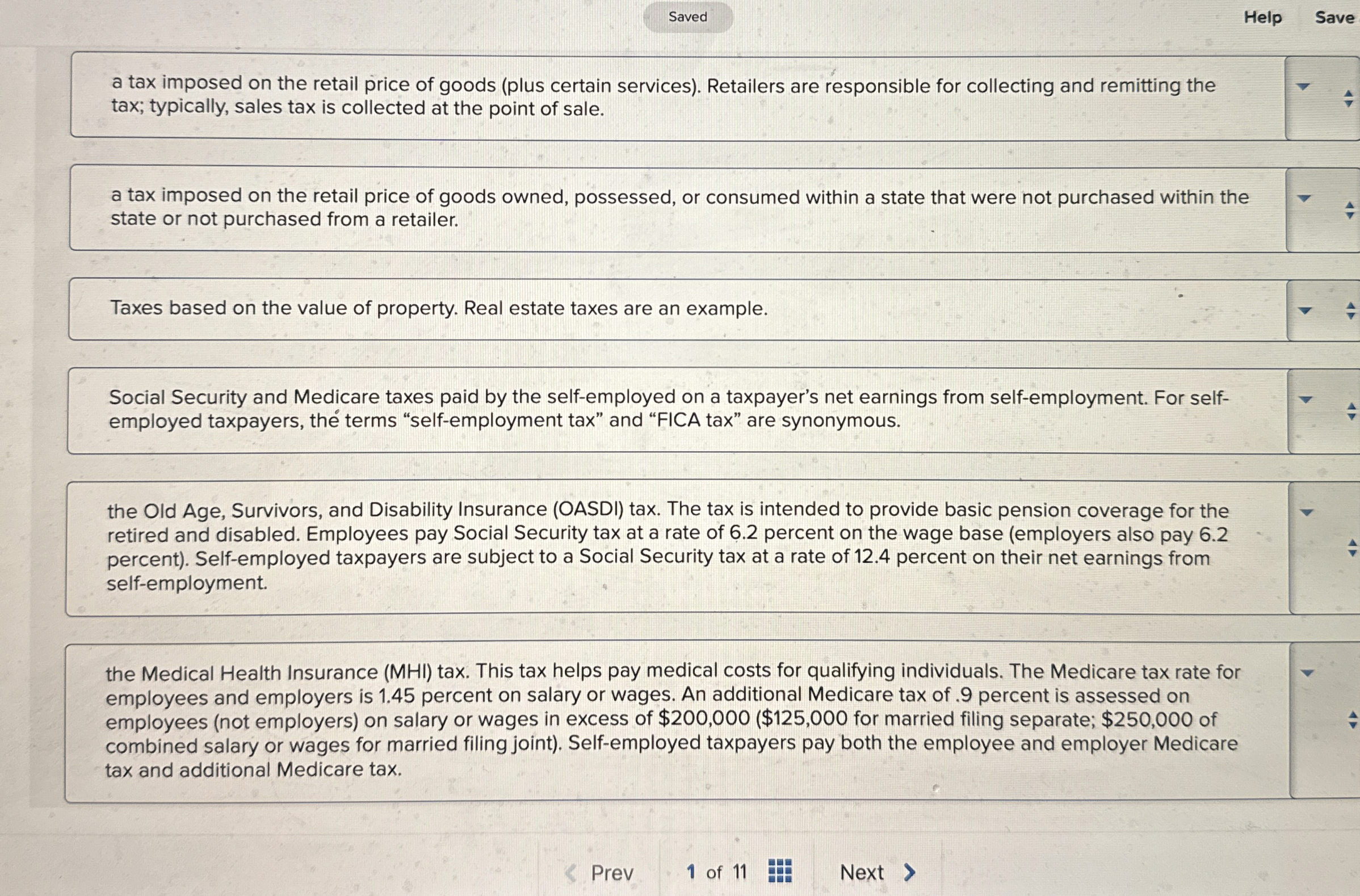

a tax imposed on the retail price of goods plus certain services Retailers are responsible for collecting and remitting the tax; typically, sales tax is collected at the point of sale.

a tax imposed on the retail price of goods owned, possessed, or consumed within a state that were not purchased within the state or not purchased from a retailer.

Taxes based on the value of property. Real estate taxes are an example.

Social Security and Medicare taxes paid by the selfemployed on a taxpayer's net earnings from selfemployment. For selfemployed taxpayers, the terms "selfemployment tax" and "FICA tax" are synonymous.

the Old Age, Survivors, and Disability Insurance OASDI tax. The tax is intended to provide basic pension coverage for the retired and disabled. Employees pay Social Security tax at a rate of percent on the wage base employers also pay percent Selfemployed taxpayers are subject to a Social Security tax at a rate of percent on their net earnings from selfemployment.

the Medical Health Insurance MHI tax. This tax helps pay medical costs for qualifying individuals. The Medicare tax rate for employees and employers is percent on salary or wages. An additional Medicare tax of percent is assessed on employees not employers on salary or wages in excess of $ $ for married filing separate; $ of combined salary or wages for married filing joint Selfemployed taxpayers pay both the employee and employer Medicare tax and additional Medicare tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started