Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saved Help Save & Exit Submit Check my work Problem 5-9 (Algo) Required: Using Table 5.3 as your guide, what is your estimate of

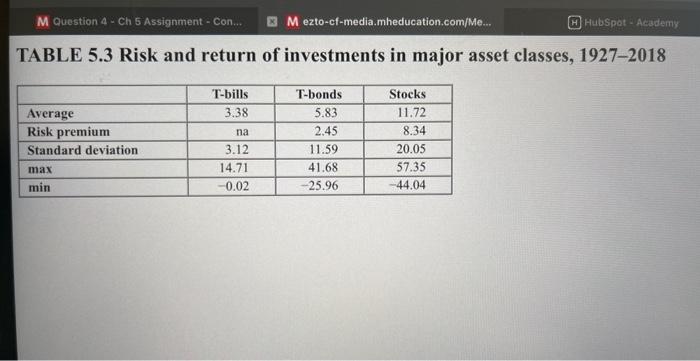

Saved Help Save & Exit Submit Check my work Problem 5-9 (Algo) Required: Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the market index stock portfolio if the current risk-free interest rate is 5.6 % ? (Round your answer to 2 decimal places.) ok Expected annual HPR t inces M Question 4 - Ch 5 Assignment - Con... M ezto-cf-media.mheducation.com/Me... HHubSpot Academy TABLE 5.3 Risk and return of investments in major asset classes, 1927-2018 Average T-bills 3.38 T-bonds Stocks 5.83 11.72 Risk premium na 2.45 8.34 Standard deviation. 3.12 11.59 20.05 max 14.71 41.68 57.35 min -0.02 -25.96 -44.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started