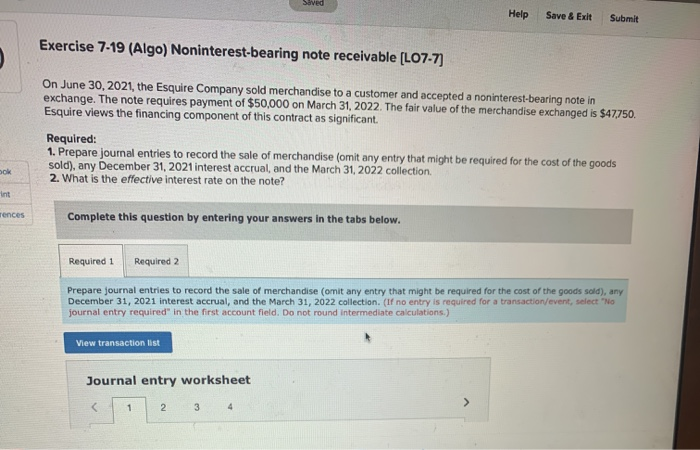

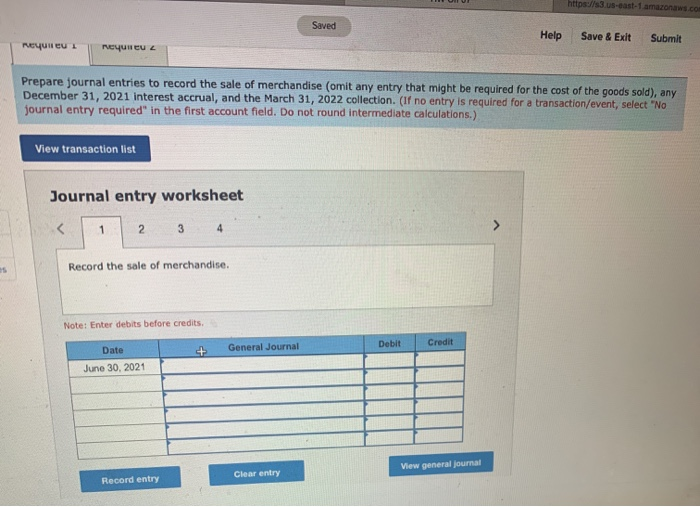

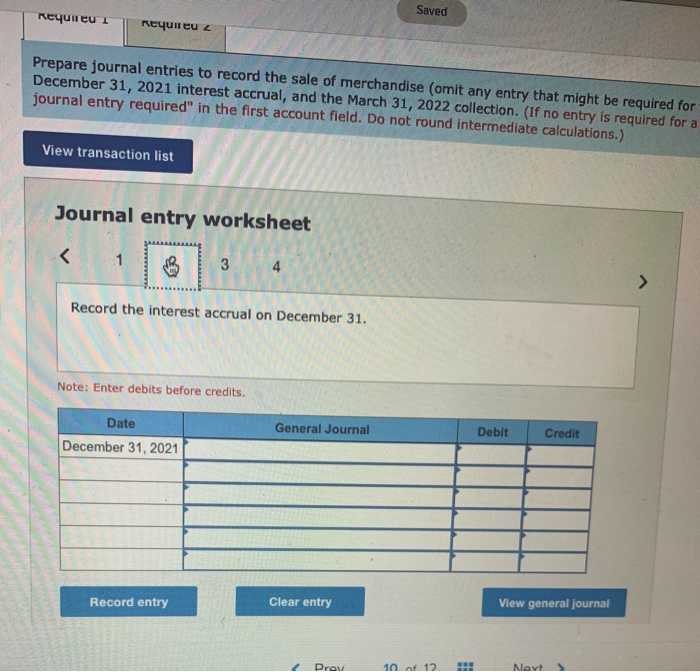

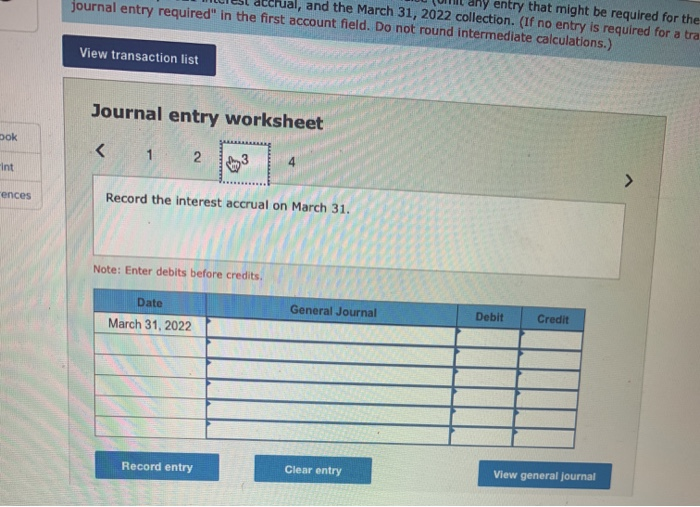

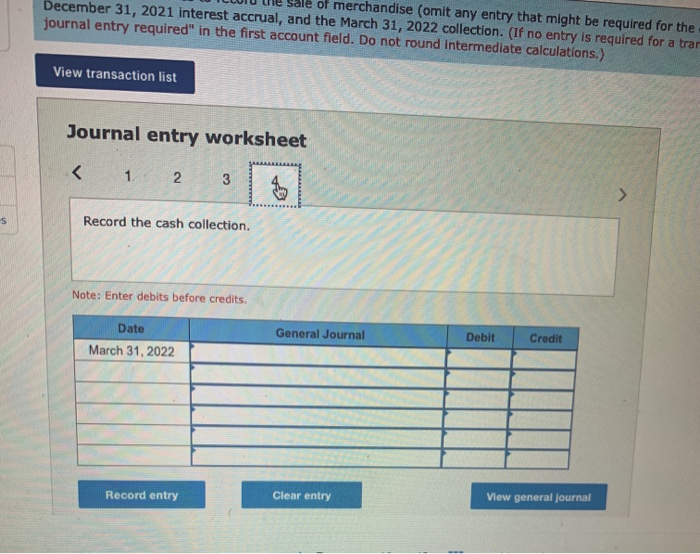

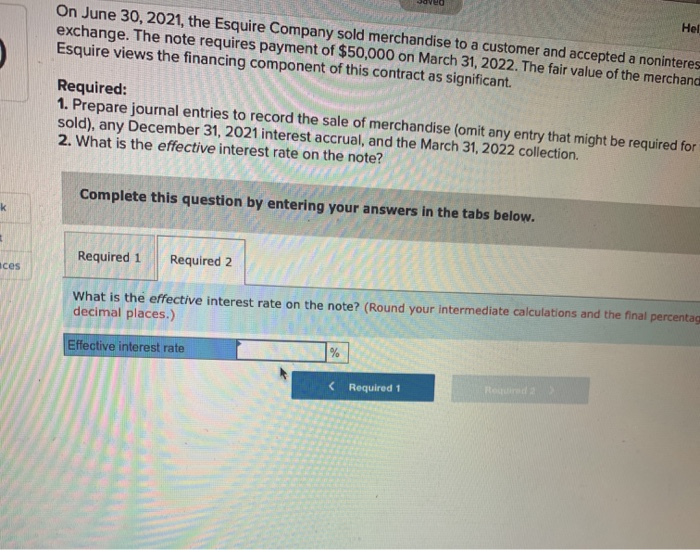

Saved Help Save & Exit Submit Exercise 7-19 (Algo) Noninterest-bearing note receivable [LO7-7) On June 30, 2021, the Esquire Company sold merchandise to a customer and accepted a noninterest-bearing note in exchange. The note requires payment of $50,000 on March 31, 2022. The fair value of the merchandise exchanged is $47750. Esquire views the financing component of this contract as significant Required: 1. Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), any December 31, 2021 interest accrual, and the March 31, 2022 collection. 2. What is the effective interest rate on the note? ook int rences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), any December 31, 2021 interest accrual, and the March 31, 2022 collection. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet 2 3 4 1 https://s3.us-east-1.amazonaws.com Saved Help Save & Exit Submit eyuileu i eyun euL Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), any December 31, 2021 interest accrual, and the March 31, 2022 collection. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the cash collection. Note: Enter debits before credits. Credit Debit General Journal Date March 31, 2022 View general journal Clear entry Record entry Hel On June 30, 2021, the Esquire Company sold merchandise toa customer and accepted a noninteres exchange. The note requires payment of $50,000 on March 31, 2022. The fair value of the merchand Esquire views the financing component of this contract as significant Required: 1. Prepare journal entries to record the sale of merchandise (omit any entry that might be required for sold), any December 31, 2021 interest accrual, and the March 31, 2022 collection. 2. What is the effective interest rate on the note? Complete this question by entering your answers in the tabs below. k Required 1 Required 2 ces What is the effective interest rate on the note? (Round your intermediate calculations and the final percentag decimal places.) % Effective interest rate Roquired 2