Answered step by step

Verified Expert Solution

Question

1 Approved Answer

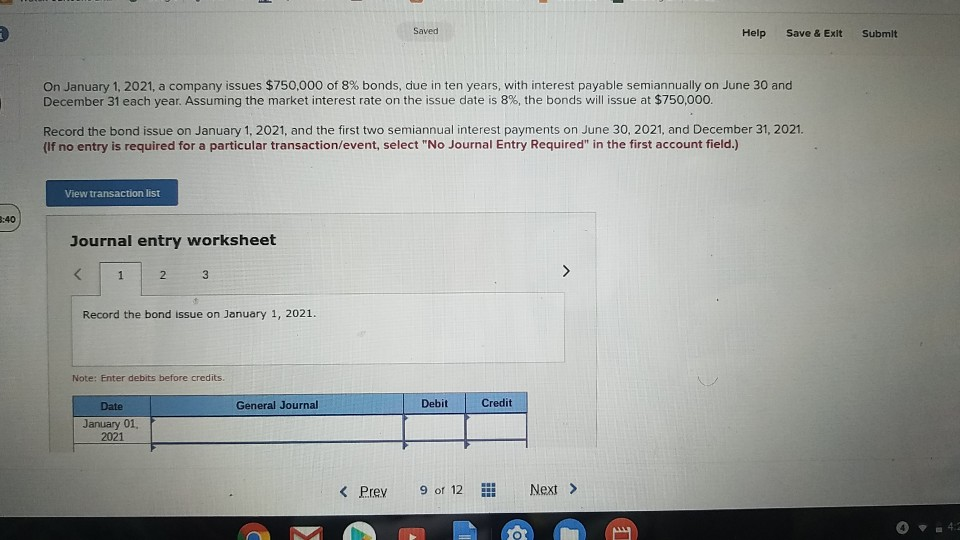

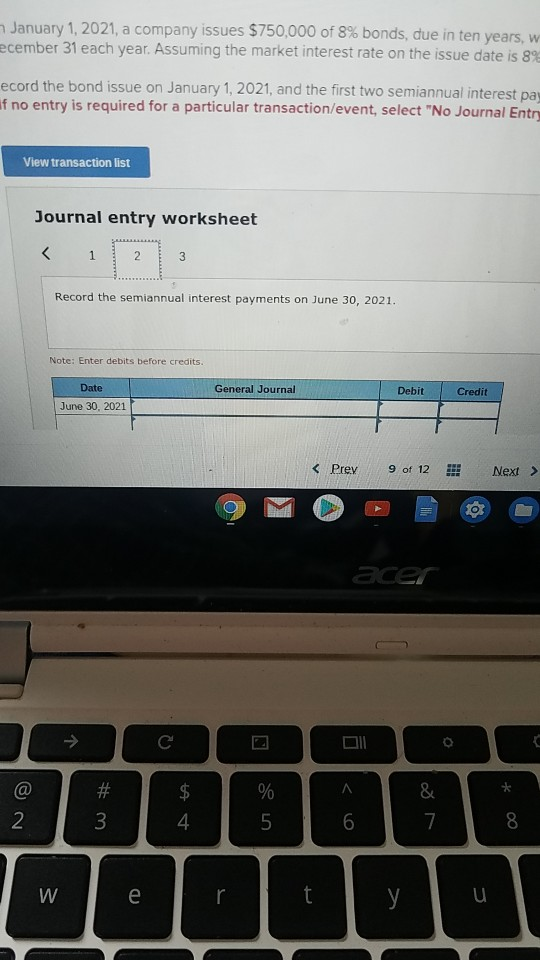

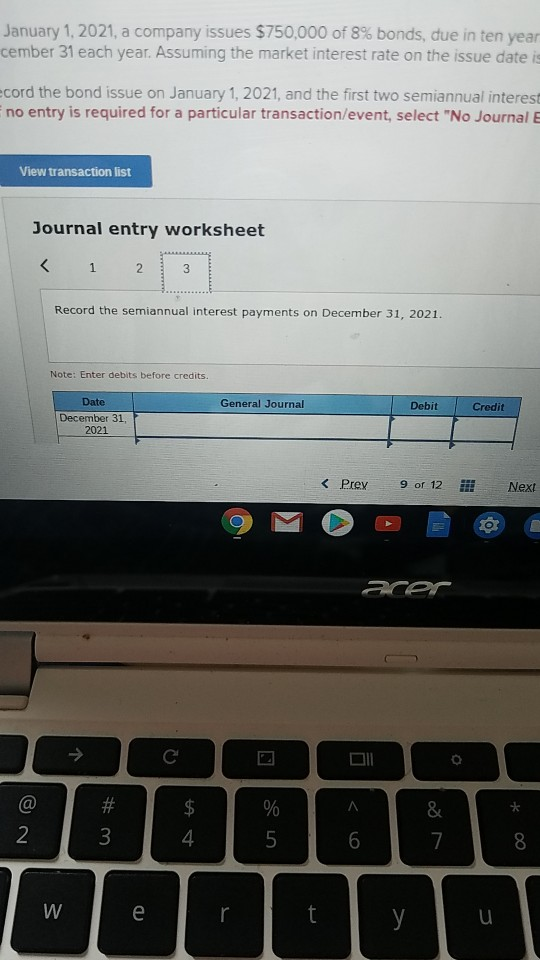

Saved Help Save & Exit Submit On January 1, 2021, a company issues $750,000 of 8% bonds, due in ten years, with interest payable semiannually

Saved Help Save & Exit Submit On January 1, 2021, a company issues $750,000 of 8% bonds, due in ten years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $750,000. Record the bond issue on January 1, 2021, and the first two semiannual interest payments on June 30, 2021, and December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet January 1, 2021, a company issues $750,000 of 8% bonds, due in ten years, w ecember 31 each year. Assuming the market interest rate on the issue date is 89 ecord the bond issue on January 1, 2021, and the first two semiannual interest pa if no entry is required for a particular transaction/event, select "No Journal Entr View transaction list Journal entry worksheet acer A * & A 4. 5 6 7 00 January 1, 2021, a company issues $750,000 of 8% bonds, due in ten year cember 31 each year. Assuming the market interest rate on the issue date cord the bond issue on January 1, 2021, and the first two semiannual interest no entry is required for a particular transaction/event, select "No Journal E View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started